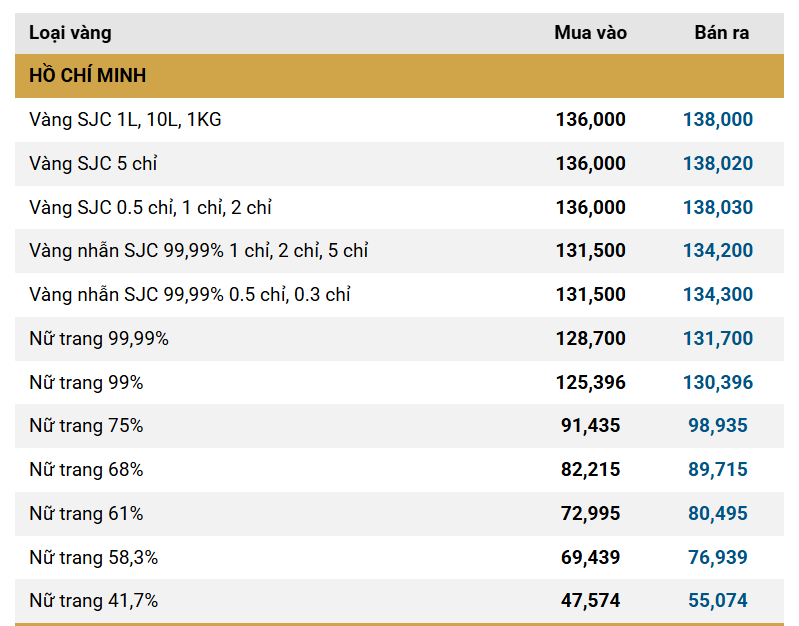

As of the afternoon update on October 2nd, SJC gold prices have dropped by approximately 400,000 VND per tael compared to this morning. Consequently, the price of SJC gold bars now ranges between 136.0 and 138.0 million VND per tael.

Ring gold prices in the market have adjusted downward by around 200,000 to 300,000 VND per tael. Bao Tin Minh Chau lists this type of gold at 132.8 to 135.8 million VND per tael, a decrease of 200,000 VND per tael. Sai Gon Jewelry Company prices it at 131.5 to 134.2 million VND per tael, down by 300,000 VND per tael.

Ring gold prices at PNJ and DOJI remain unchanged at 132.0 to 135.0 million VND per tael.

Price board at SJC Company

In the international market, spot gold is trading at $3,880 per ounce. Earlier, spot gold reached $3,896 per ounce, the highest level ever recorded.

The precious yellow metal has surged by over 48% since the beginning of the year, heading toward its strongest annual gain since 1979. According to expert forecasts, gold is on track to hit the historic milestone of $4,000 per ounce.

Kitco News reports that gold set a new record today as concerns over a potential U.S. government shutdown boosted demand for safe-haven assets. The possibility of a U.S. government shutdown has become a key driver, attracting additional capital into the already vibrant precious metals market throughout 2025. Investors are increasingly betting on this scenario amid the current administration’s apparent “calm” stance on the budget impasse.

This political uncertainty has put downward pressure on the U.S. dollar, causing the USD Index to drop by 0.15% to 97.79 points on Tuesday, marking its third consecutive decline.

Additionally, a prolonged government shutdown could delay the release of critical employment data, leaving the Federal Reserve without key economic indicators ahead of its October policy meeting. Paradoxically, this development is viewed positively by the market, as it increases the likelihood of the Fed cutting interest rates sooner.

According to the CME FedWatch tool, the probability of the Fed reducing interest rates in October has skyrocketed from 89.8% to 96.7% in just the past 24 hours.

The combination of political instability, a weakening U.S. dollar, and expectations of Fed policy easing continues to fuel gold’s historic rally, indicating that this precious metal still has room to rise as these factors persist.

Bitcoin, Ethereum Lead Crypto Surge as Global Market Cap Tops $4 Trillion

Compared to just one week ago, the global market capitalization has surged by over $330 billion, representing a remarkable increase of nearly 9%.

Bitcoin Surges Amid US Government Shutdown Concerns

The Bitcoin surge has sparked a rally across major altcoins, with Ethereum (ETH), Solana (SOL), and XRP leading the charge, each recording impressive gains of 4–6% in the past 24 hours.