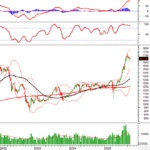

Technical Signals of VN-Index

During the morning trading session on October 6, 2025, the VN-Index experienced a robust recovery, forming a Long Lower Shadow candlestick pattern. This pattern typically signals a potential price increase when it appears near support levels.

The Stochastic Oscillator has reversed, providing a buy signal, which suggests a reduction in short-term risks.

Technical Signals of HNX-Index

In the morning session on October 6, 2025, the HNX-Index found strong support at the previous low from August 2025 (around 265-270 points).

The short-term outlook for the index is expected to improve further if the MACD and Stochastic Oscillator indicators generate buy signals in the upcoming sessions.

ANV – Nam Viet Corporation

During the morning session on October 6, 2025, ANV shares surged for the second consecutive day, forming a Rising Window candlestick pattern. The stock continues to trade near the upper band of the Bollinger Bands, indicating increased investor optimism.

The stock has reached a new 52-week high, supported by the MACD indicator, which continues to rise after generating a buy signal. This suggests a positive medium-term outlook remains intact.

HPG – Hoa Phat Group Corporation

In the morning session on October 6, 2025, HPG shares rebounded strongly after testing the 50-day SMA, accompanied by a projected trading volume exceeding the average. This indicates a resurgence in investor activity.

Currently, HPG has broken above the upper boundary of a Falling Wedge pattern, while the Stochastic Oscillator has entered the oversold territory. If the indicator generates a buy signal and moves out of this region, the recovery momentum of HPG is likely to strengthen.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:33 October 6, 2025

Vietstock Weekly 06-10/10/2025: Is the Market Still Hesitant?

The VN-Index extended its decline for the fourth consecutive week, accompanied by a drop in trading volume. Recent weeks have seen the index consistently forming long-shadowed candlesticks, signaling investor hesitation and uncertainty. With the Stochastic Oscillator weakening further following a sell signal in overbought territory, short-term volatility risks remain elevated.

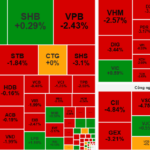

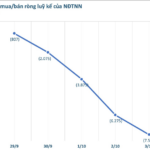

Massive $7 Billion Buying Spree: Mystery Force Scoops Up Vietnamese Stocks in Friday’s Trading Frenzy

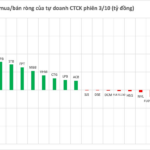

Proprietary trading firms continued their buying spree on the Ho Chi Minh City Stock Exchange (HOSE), netting a substantial VND 638 billion in purchases.