|

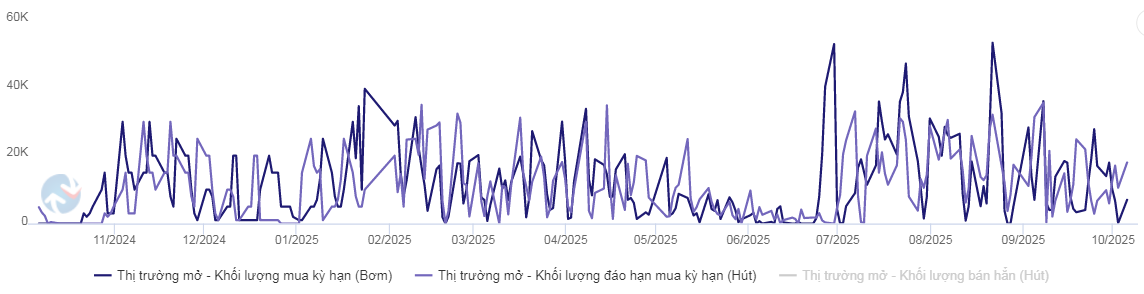

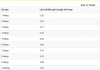

Trends in Net OMO Operations Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

Specifically, during the last two sessions of September (29-30/9), the State Bank of Vietnam (SBV) issued 31.962 trillion VND in new term purchases, exceeding the 15.782 trillion VND in maturities. However, in the early sessions of October, the regulator shifted to reducing liquidity, issuing only 24.020 trillion VND, significantly lower than the 58.073 trillion VND in maturities at a 4%/year interest rate.

Overall, the SBV net absorbed 17.873 trillion VND for the week, reducing the outstanding volume in term purchases to 187.228 trillion VND.

|

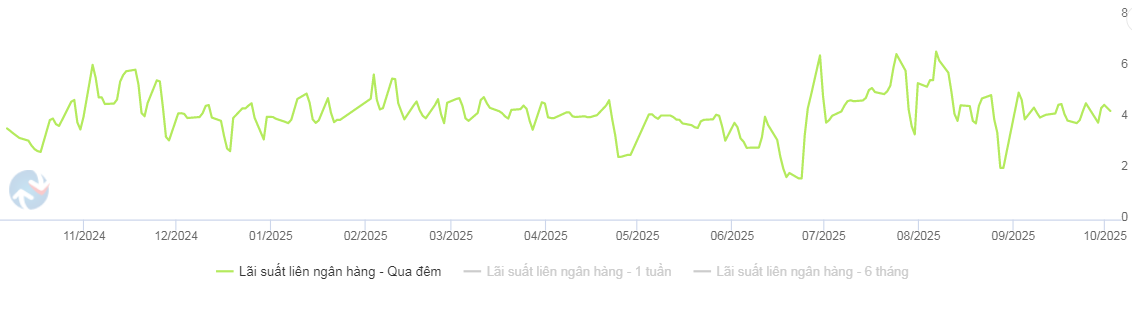

Overnight Interbank Interest Rate Trends from the Beginning of 2025 to October 3

Source: VietstockFinance

|

In the interbank market, the overnight interest rate closed at 4.27%/year on October 3, down 11 basis points from the previous week. Trading volume also decreased by 2%, averaging approximately 565 trillion VND per day.

|

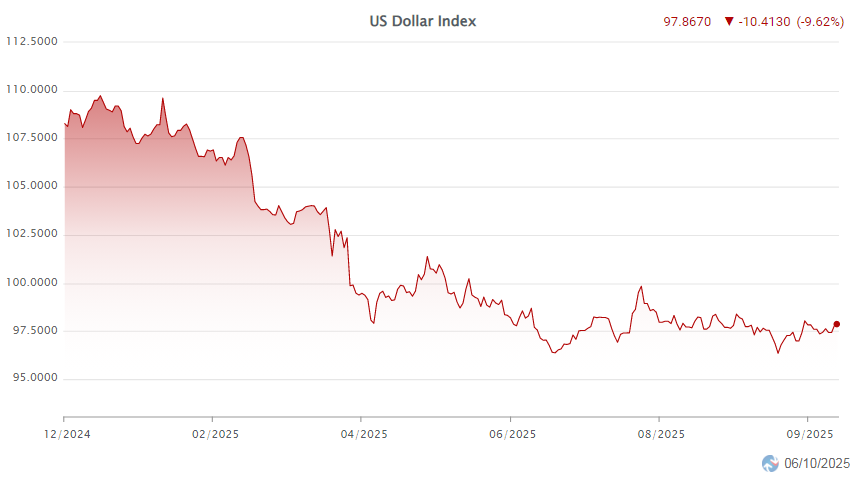

DXY Index Trends from the Beginning of 2025 to October 3

Source: VietstockFinance

|

In the international market, the USD Index (DXY), which measures the greenback’s strength against a basket of six major currencies, closed the week of October 3 at 97.71 points, down 0.47 points from the previous week.

The USD weakened as the U.S. entered a new phase of uncertainty, with President Donald Trump and Congress failing to reach a budget agreement by the October 1 deadline, leading to a government shutdown and the suspension of many public services and agencies.

This paralysis raised expectations that the Federal Reserve would continue cutting interest rates, as the release of critical economic data—essential for monetary policy planning—was delayed. This development diminished the appeal of the greenback.

Domestically, Vietcombank’s USD/VND exchange rate closed the week of October 3 at 26,170 – 26,420 VND/USD (buy – sell), down 13 and 33 VND, respectively, from the previous week.

– 10:56 07/10/2025

USD Price Retreats

During the week of September 29 – October 3, 2025, the US dollar weakened as the nation entered a new period of uncertainty. This followed the failure of President Donald Trump and Congress to reach a budget agreement by the October 1 deadline, resulting in a government shutdown and the suspension of numerous programs and services.

USD Rates Plummet at Major Banks

Compared to its peak over a month ago, the USD price at banks has unexpectedly dropped by more than 100 VND, falling to 26,435 VND per USD.

USD Free Market Rates Experience Significant Fluctuations

Over the past two months, the free USD rate has consistently declined in the open market, moving further away from its peak of 27,000 VND.