What Defines a Developed Market?

A developed market is not solely determined by the strength of its economy but also by its large capital size, liquidity, accessibility to international investors, and adherence to the highest operational and legal standards.

Specifically, according to MSCI, a country must meet the requirements of three sets of criteria to be classified as a developed market:

First, economic development, requiring the country to have a Gross National Income (GNI) per capita higher than 25% above the World Bank’s high-income threshold for three consecutive years.

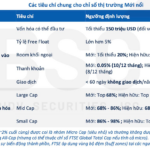

Simultaneously, market size and liquidity must meet the standard of at least 5 companies satisfying the criteria of the Standard Index in the last 8 assessment periods. These criteria include: a minimum market capitalization of 5.9 billion USD; a minimum free-float market capitalization of 2.9 billion USD; and an Annual Traded Value Ratio (ATVR) of 20%.

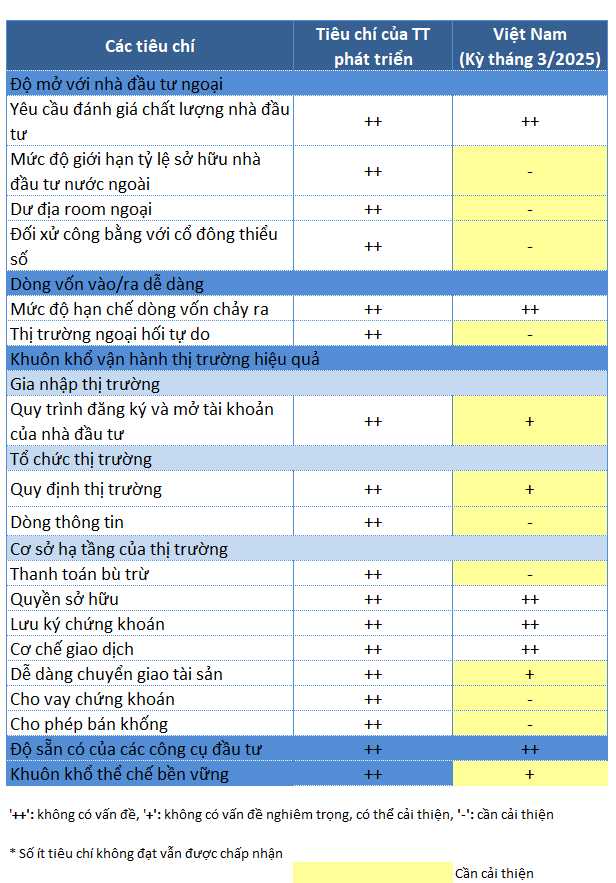

These markets must also score highly on market accessibility criteria, which reflect the experience of international institutional investors when investing in a particular market.

|

MSCI’s Market Accessibility Criteria

|

According to FTSE Russell’s Country Classification Process, a market considered for an upgrade from Advanced Emerging to Developed must meet the following requirements:

GNI per capita must be classified as ‘High’ by the World Bank using the Atlas method. Additionally, the market must have an investment-grade credit rating.

In terms of market size and number of securities, a country must meet the minimum thresholds for investable market capitalization and number of securities in at least 2 review periods. The entry requirement includes a minimum of 5 securities meeting the screening criteria of the FTSE Developed All Cap Index.

The total investable market capitalization (from 5 or more eligible stocks, adjusted for free-float and foreign ownership limits) must exceed 0.05% of the FTSE Developed All Cap Index (equivalent to 42.25 billion USD as of June 30, 2025).

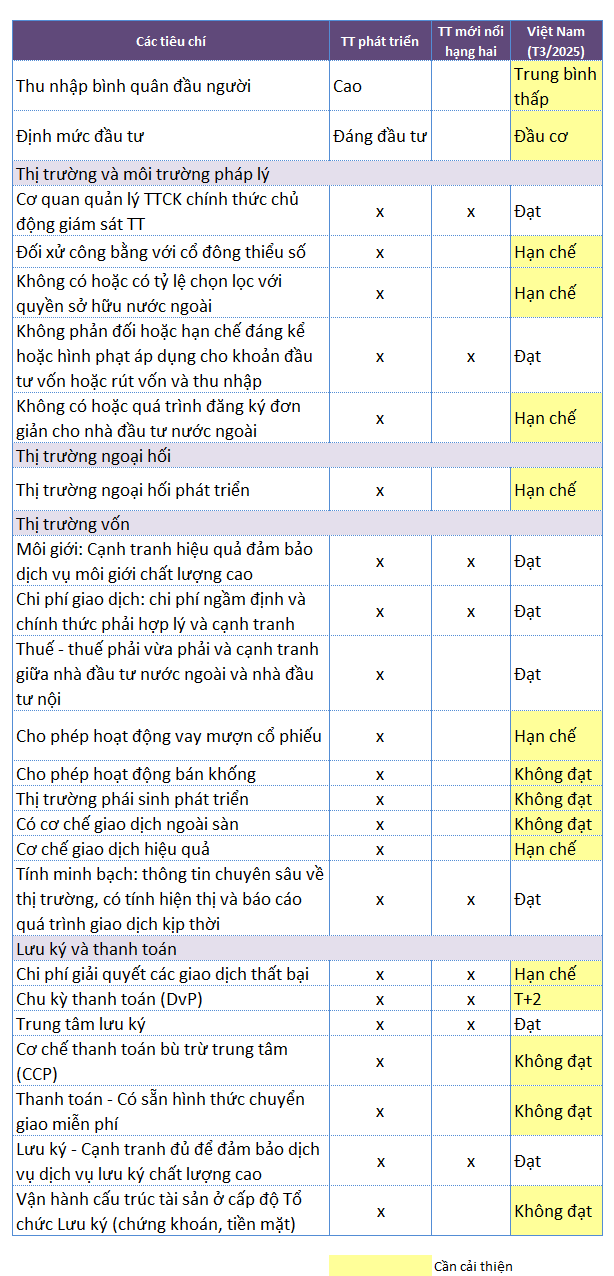

The quantitative criteria will be placed by FTSE Russell into the Market Quality Matrix. Developed markets must not have any criteria rated as ‘Not Met’; however, a very small number of ‘Restricted’ ratings are acceptable.

|

FTSE’s Market Quality Criteria

|

Exemplary Developed Markets

In the rankings of both FTSE and MSCI, developed markets are primarily located in Europe. The number of developed markets in Asia-Pacific is more limited. In the Americas, only the United States and Canada meet the developed market criteria.

For example, the U.S. market stands out with two exchanges: NYSE and NASDAQ. The system operates on a multi-center model, including both centralized exchanges and decentralized trading systems (ECN, Dark Pool, and OTC markets). The centralized custody and settlement system (via DTC – Depository Trust Company) facilitates global investors.

The trading platform is advanced, with transaction processing standards at T+1.

Regarding legal frameworks for investor protection, there are requirements for transparency and market fraud prevention. Accounting standards follow GAAP, and foreign companies can apply IFRS for listing on the U.S. market.

This is a highly open capital market, with no restrictions on foreign ownership of listed securities. Stable tax and legal policies make the U.S. a top destination for international capital.

Similarly, developed markets in Europe and Asia-Pacific share these characteristics.

In the UK, the London Stock Exchange (LSE) is one of the world’s oldest exchanges (established in 1801). The trading system is modern, applying a T+2 settlement standard and will officially adopt T+1 in October 2027.

LSE has strict listing requirements, mandating transparent information disclosure and applying IFRS as the accounting standard. It has a robust legal system to protect shareholders and combat market manipulation, regularly updated after financial crises. Additionally, many IR and ESG standards are integrated into disclosure laws.

The UK market uses an international custody and settlement system (Euroclear, CREST) closely connected to global capital flows.

The UK stock market does not restrict foreign ownership ratios. With an open-door policy attracting global companies to list, many non-EU firms choose LSE as their destination (Russia, India, China).

In Asia, Japan’s market is prominent. The Tokyo Stock Exchange (TSE) is Asia’s largest center, part of the Japan Exchange Group (JPX) after merging with Osaka in 2013. Its market capitalization ranks third globally, after the U.S. and China. The electronic trading system is modern and high-speed, with a T+1 standard. It has an advanced custody and settlement system (JASDEC).

TSE has strict listing rules, focusing on corporate governance, transparency, and protection of minority shareholders. It applies J-GAAP accounting standards and allows IFRS to enhance international comparability.

Japan is open to foreign investors (no ownership restrictions in most sectors, except sensitive areas like defense and telecommunications).

In Southeast Asia, Singapore is the only market classified as developed. Since FTSE and MSCI began market classifications, Singapore has consistently been in the developed market group. It serves as Southeast Asia’s financial gateway, strongly attracting multinational listings and foreign funds. The CDP custody and settlement system acts as a central counterparty (CCP), providing secure account and settlement services globally. Singapore’s market has a modern trading system, international standards, and a T+2 settlement time.

Institutionally, listed companies must comply with strict corporate governance rules regarding shareholder protection, corporate governance, and information disclosure. Singapore allows the use of IFRS to enhance comparability and global transparency.

Singapore is open to foreign investors, with no ownership limits, except in strategic sectors (media, real estate, legal services).

How Far is Vietnam from Becoming a Developed Market?

Market upgrading is a frequently discussed topic recently, especially with FTSE’s upcoming review and decision on October 7. For FTSE’s Emerging Market criteria, Vietnam has met 9 out of the required criteria. The next upgrade is within reach.

According to the Vietnam Stock Market Upgrade Plan (signed on September 12, 2025) by the government, by 2030, Vietnam aims to meet the criteria for an upgrade to Emerging Market status by MSCI and Advanced Emerging status by FTSE Russell by 2030.

The journey to becoming a developed market is even longer, as Vietnam still needs to improve 14 out of 22 criteria according to FTSE standards. For MSCI, 12 out of 18 market accessibility criteria require improvement.

Additionally, Vietnam needs to strive to become a high-income economy and expand its stock market size to meet the economic scale requirements of a developed market. The profiles of the developed markets mentioned above will serve as benchmarks for Vietnam to learn from.

– 12:00 07/10/2025

Vietnam’s Stock Market Surges Among World’s Top Performers Ahead of Historic Milestone

The buoyant performance of the stock market underscores an atmosphere of heightened investor optimism, particularly as the anticipated announcement of an upgraded rating draws near.