Hanoi Beer – Hong Ha, originally known as Hong Ha Beer Enterprise, was established under the Song Lo Trading Company, managed by the Finance Board of the Vinh Phu Provincial Party Committee. The first brewery commenced operations in 1994 with an annual capacity of 2.5 million liters. Following the dissolution of the provincial Finance Board in 2001, the enterprise was transferred to the management of the Phu Tho Provincial People’s Committee and underwent corporatization in 2003.

By 2007, Habeco officially invested in the company, introducing the brand name “Hanoi Beer – Hong Ha” and upgrading the production line. The capacity expanded from 10 million liters per year to 50 million liters, with distribution extending to northern provinces such as Vinh Phuc, Yen Bai, Lao Cai, and Tuyen Quang.

As of August 2025, HHB has 108 shareholders, with Habeco holding 53.9% of the capital, Mr. Dinh Van Thuan (HHB Board Member) owning 13.5%, and Mr. Nguyen Doan Khanh holding 8%. HHB’s chartered capital stands at 100 billion VND, maintained since the private placement in 2014, partially used to offset debts with Habeco.

Headquarters of Hanoi Beer – Hong Ha. Photo: Habeco

|

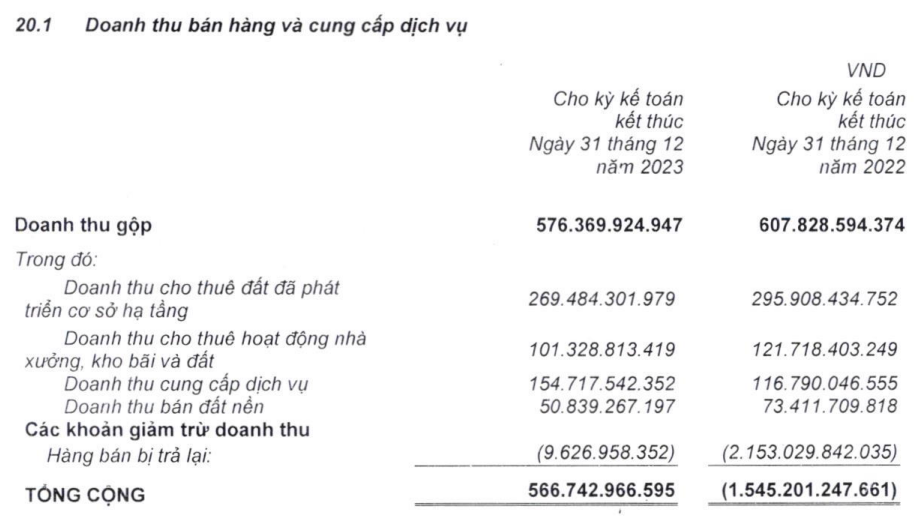

HHB’s core business involves producing and distributing Habeco-branded beer products, including Hanoi Beer 450ml bottles and Hanoi Draft Beer in 30-50 liter kegs. In the first half of 2025, the company reported revenue of nearly 100 billion VND, a 9% increase year-on-year, with a net profit of 6.8 billion VND. Gross profit margin stood at 42%. By the end of Q2, equity reached over 116 billion VND, including 6.8 billion VND in undistributed profits.

Over the past two years, HHB achieved revenues of 175-179 billion VND and post-tax profits of 17 billion VND and 13 billion VND, respectively, with a gross margin of approximately 36%. The company paid dividends of 8.3-10% of its chartered capital, with 9.5% distributed in the first half of 2025. This year, HHB targets 187 billion VND in revenue and nearly 11 billion VND in post-tax profit, having already surpassed half of its goals.

At the end of Q2, HHB’s total assets were 193 billion VND, including 70 billion VND in bank deposits and 19 billion VND in inventory. Fixed assets at original cost totaled 326 billion VND, with accumulated depreciation reducing this to 66 billion VND. The company operates debt-free, with total liabilities of 77 billion VND.

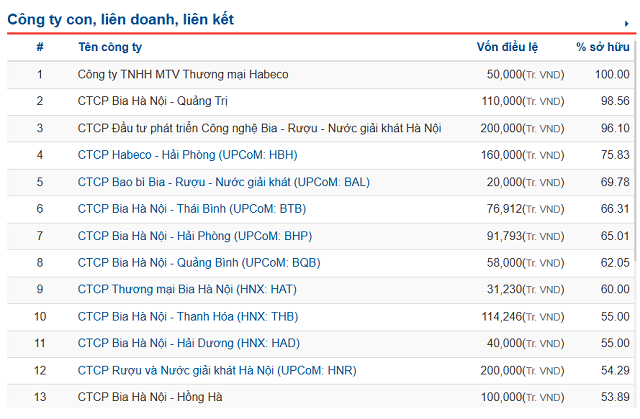

Hanoi Beer – Hong Ha is one of Habeco’s 16 subsidiaries, a state-owned enterprise under the Ministry of Industry and Trade, holding 81.7% of Habeco’s capital. Over half of these subsidiaries are listed on UPCoM or HNX, including Habeco – Hai Phong (HBH), Hanoi Liquor and Beverages (HNR), Hanoi Beer – Hai Phong (BHP), and Hanoi Beer – Thanh Hoa (THB). HHB ranks among Habeco’s most profitable subsidiaries, second only to Hanoi Beer Trading (HAT).

Many Habeco subsidiaries are now publicly traded. Source: VietstockFinance

|

– 15:58 07/10/2025

Masan Consumer Set to List on HoSE

Masan Consumer is poised to list on the Ho Chi Minh Stock Exchange (HoSE) in Q4 2025 or the first half of 2026.

Cà Mau Province Authorities to Auction Shares of Local Environmental Enterprise

On September 30th, the Ho Chi Minh City Stock Exchange (HOSE) announced the opening of registration for auction agents to participate in the sale of nearly 536,000 shares held by the People’s Committee of Ca Mau Province in Ca Mau Environment and Urban Joint Stock Company (Camenco). The expected scale of this auction is over 10 billion VND.