Mapletree’s New 13,600m² Plot in West Tay Ho: Unveiling Strategic Moves (Part 1)

Pioneering Leadership

Mapletree Investments Pte Ltd (Mapletree) began its Vietnam journey in 2005 with its first project in the former Binh Duong province, later expanding to Bac Ninh and other key industrial hubs. At a time when the logistics market was still nascent, this early move granted the group a “first-mover” advantage, swiftly establishing a robust network.

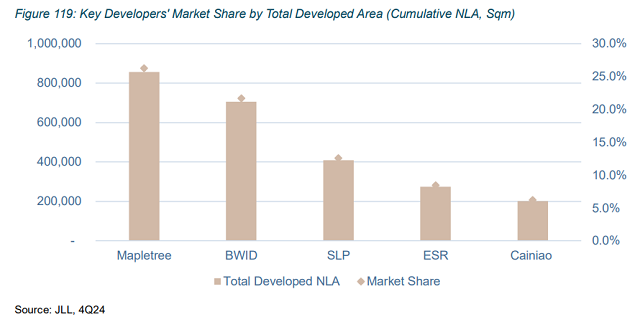

According to JLL statistics, by the end of 2024, Mapletree held a 26.3% market share in Grade A built-to-suit warehouses, surpassing many international competitors. This achievement is particularly notable as more global conglomerates enter Vietnam, where demand for modern warehouses is surging due to manufacturing, e-commerce, and export-import activities.

Mapletree leads Vietnam’s Grade A built-to-suit warehouse market share as of 2024. Source: JLL

|

Mapletree’s report also highlights that Vietnam’s average warehouse space per capita is only 0.03m², significantly lower than regional peers. This indicates vast growth potential in this segment. CEO Hiew Yoon Khong asserts that Vietnam and India are Asia’s most promising logistics markets due to limited supply and rapidly rising demand.

“We are deploying the Mapletree Emerging Growth Asia Logistics Development Fund (MEGA) with SGD 2.4 billion, focusing on Vietnam, Malaysia, and India—markets lacking international-standard logistics facilities,” said Hiew Yoon Khong, emphasizing the segment’s potential for superior returns and Mapletree’s goal to lead in setting industry benchmarks.

Mr. Hiew Yoon Khong – CEO of Mapletree

|

High Occupancy Rates

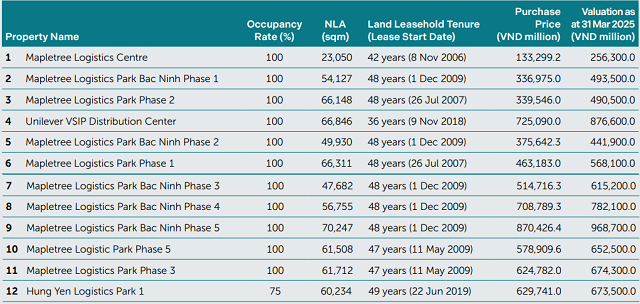

In Vietnam, Mapletree Logistics Trust (MLT), the group’s logistics asset management arm, reports rapid high occupancy across projects. Notably, Mapletree Logistics Park Phase 3 and Hung Yen Logistics Park I—acquired by MLT from Mapletree in 2024—achieved 95-100% occupancy by July 2025, with initial yields of 7.5%, outpacing Malaysia’s 5.7%.

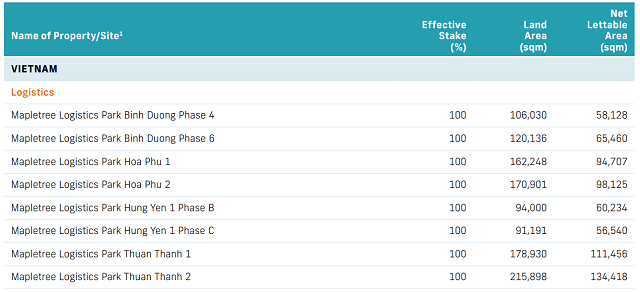

In former Binh Duong, Phases 4 and 6 of Mapletree Logistics Park are fully occupied. Bac Giang shows promising progress with Hoa Phu Logistics Park, while the largest project, Thuan Thanh 1 in Bac Ninh, is underway with SGD 158 million investment, adding 245,874 m² upon completion.

Currently, MLT owns 12 built-to-suit warehouses in Vietnam, totaling nearly 700,000m² of leasable space. Concurrently, the parent group is developing an additional 700,000m². Mapletree’s Vietnam logistics portfolio boasts near-full occupancy at 97.8%.

Looking ahead, the Singaporean real estate giant plans to expand into Dong Nai and explore opportunities in Vinh Phuc and Long An, where land availability and infrastructure investments are robust.

MLT’s 12 warehouses with nearly 100% occupancy. Source: MLT’s 2024/2025 Annual Report

|

Mapletree to add nearly 700,000m² of leasable space in Vietnam. Source: Mapletree’s 2024/2025 Annual Report

|

Capital Recycling Model Yields Positive Results

Mapletree’s unique “hybrid” model—combining development and asset management via funds and REITs—sets it apart. This approach allows the group to profit from selling stabilized assets while generating long-term management fee income.

This “capital recycling” strategy is evident in recent transactions. In FY 2024/2025, Mapletree transferred three Grade A warehouses in Vietnam and Malaysia to MLT for SGD 227 million, boosting immediate profits and fund scale. Previously, in 2020, the group sold Mapletree Business City in Binh Duong for ~SGD 140 million and later transferred three logistics hubs worth SGD 96 million to MLT.

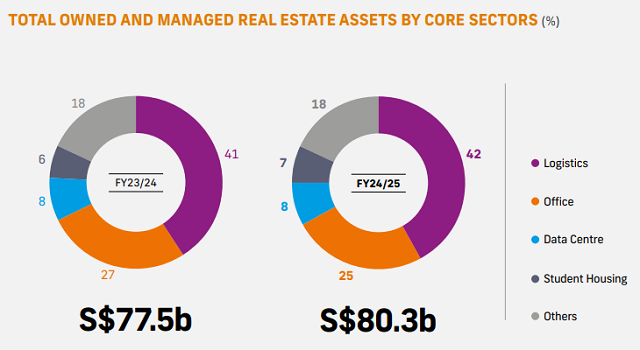

The strategy’s impact is clear in financial results. After a year of losses, Mapletree posted SGD 227 million in net profit for FY 2024/2025, reversing a SGD 577 million loss. Revenue dropped to SGD 2.23 billion due to MLT deconsolidation, but recurring profit remained stable at SGD 637 million. Total assets under management (AUM) reached SGD 80.3 billion, with logistics accounting for 42%.

Logistics dominates Mapletree’s AUM. Source: Mapletree’s 2024/2025 Annual Report

|

China+1 Wave Presents Opportunities

JLL reports Vietnam’s total warehouse space reached 7 million m² by 2024, projected to hit 9.7 million m² by 2027—a 1.4x increase in three years. Modern warehouses now account for over 46% of supply, reflecting a rapid shift from traditional models.

Demand stems from diverse clients: northern manufacturing giants like Samsung, Foxconn, and Luxshare, and southern e-commerce platforms such as Shopee, Lazada, and Tiki. The entry of Temu and Shein is expected to further boost demand, especially near ports and urban centers.

The China+1 trend offers significant opportunities as tenants relocate from China to Southeast Asia. Vietnam’s modern warehouse growth outpaces Thailand and Malaysia, second only to India. Rental prices are expected to rise, though yields may slightly adjust from 8-8.2% to 7.2-7.5% by 2027.

Mapletree’s warehouse system in Hung Yen. Photo: Mapletree

|

Alongside growth, Mapletree pursues sustainability. New projects target EDGE certification and green leases, reducing operational costs, enhancing energy efficiency, and increasing asset value.

With its pioneering edge, extensive network, stable clientele, and effective capital recycling, Mapletree is realizing its ambition to lead in shaping modern warehouse standards in Vietnam. As logistics enters a boom phase, the Singaporean group’s role is increasingly pivotal—not just as a developer, but as a rule-maker in the built-to-suit warehouse segment.

– 10:00 11/10/2025

$1 Billion EVN Hydropower Project Gets €430 Million Boost from Europe

Vietnam’s Bac Ai Pumped Storage Hydropower Project has officially secured a €430 million funding commitment from European partners. This substantial support will significantly enhance the project’s role in stabilizing the national power grid, aligning with the Just Energy Transition Partnership (JETP) commitments.

Dutch Billionaire’s Company Unveils Massive Vietnam Expansion Plan, Targeting New Billion-Dollar “Goldmine”

This enterprise is strategically targeting multiple high-potential regions across Vietnam for expansion.