| VIX Sets Profit Record |

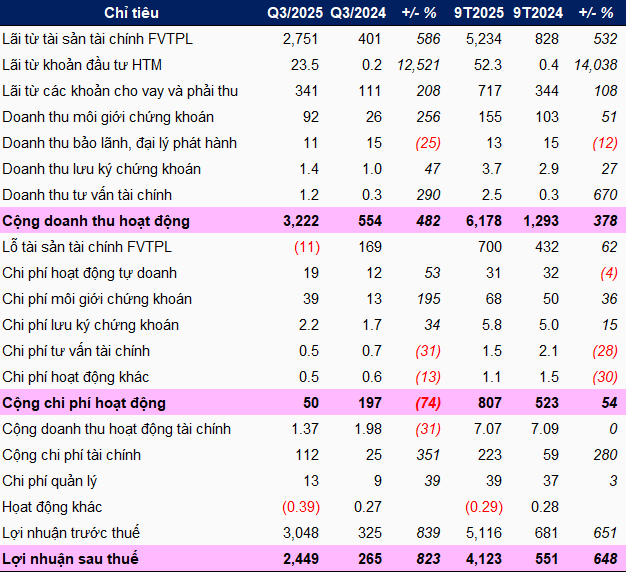

In its profit fluctuation explanation, VIX cited two main reasons for this outstanding performance: a booming stock market driving proprietary trading profits and a surge in margin lending activity, significantly boosting revenue from this segment.

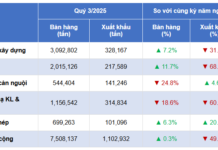

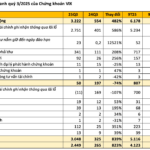

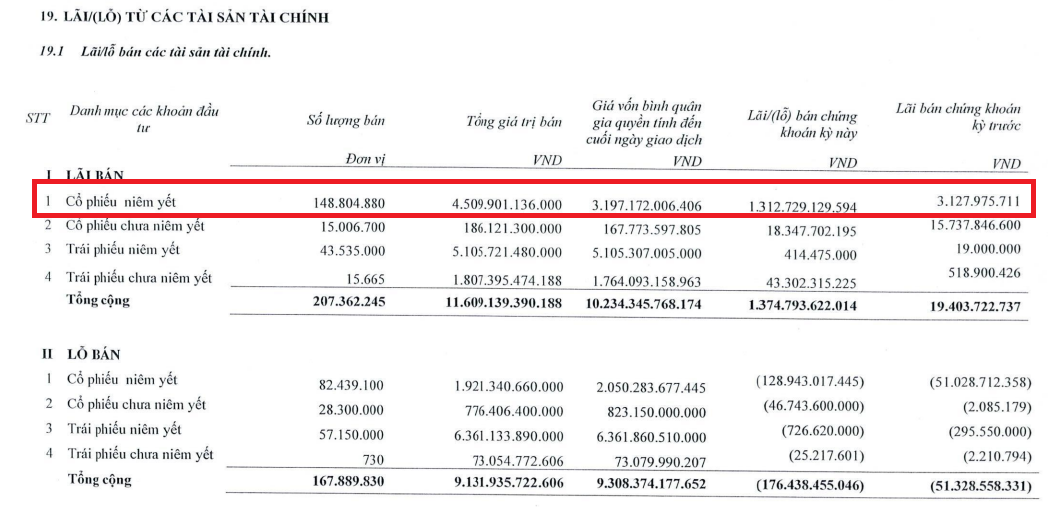

According to the financial statements, VIX generated over 2.7 trillion VND in proprietary trading profits in Q3, a 12-fold increase year-on-year. This was driven by strong gains in both the sale of financial assets measured at fair value through profit or loss (FVTPL), primarily listed stocks and bonds, and the revaluation of FVTPL financial assets, mainly listed stocks.

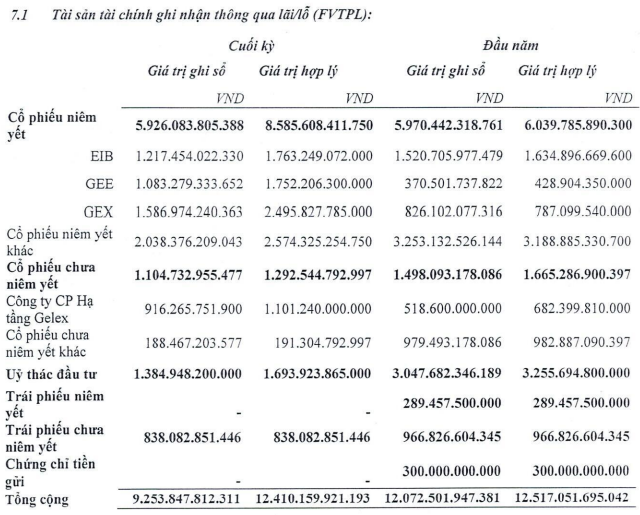

Within its FVTPL financial asset portfolio at the end of Q3, VIX held three significant investments in listed stocks: EIB (over 1.2 trillion VND), GEE (nearly 1.1 trillion VND), and GEX (nearly 1.6 trillion VND). These investments saw fair values increase by 47%, 62%, and 57% respectively compared to book values, also showing substantial growth since the beginning of the year.

In the case of EIB, despite the stock’s continuous rise, the book value decreased, indicating a clear “profit-taking” strategy by VIX. Conversely, the book values of GEE and GEX increased significantly.

Another notable point is that VIX no longer holds investments in listed bonds and certificates of deposit, while the scale of unlisted bonds and investment trusts has also decreased sharply.

Source: Q3/2025 Financial Statements of VIX

|

Source: Q3/2025 Financial Statements of VIX

|

In lending activities, the company generated over 341 billion VND in revenue, three times higher than the same period last year. By the end of Q3, VIX‘s margin loan balance reached over 16 trillion VND, nearly three times higher than the beginning of the year.

Beyond these two segments, another core activity, brokerage, also saw profit growth, reaching over 52 billion VND, more than four times higher than the same period last year.

VIX faced some pressure in financial activities, incurring a loss of over 110 billion VND, compared to a loss of less than 23 billion VND in the same period last year. VIX significantly increased its borrowing scale, from over 2.8 trillion VND at the beginning of the year to nearly 10.3 trillion VND by the end of Q3, all in short-term loans.

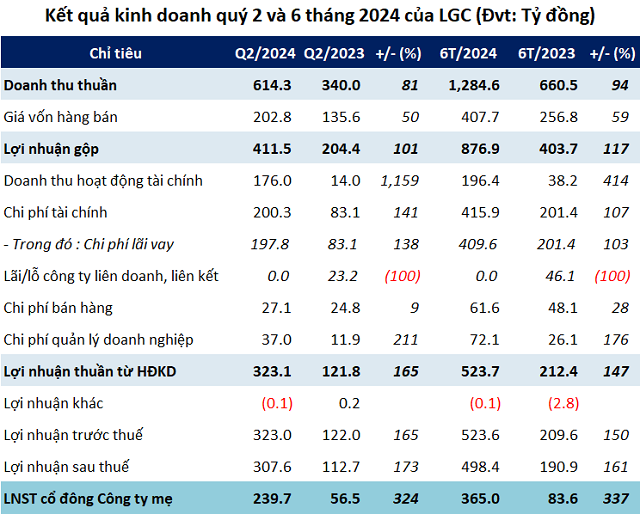

The positive results in Q3 brought the cumulative profit for the first nine months to over 4.1 trillion VND, more than seven times higher than the same period last year and far exceeding the annual plan of 1.2 trillion VND.

|

Q3 and 9-Month 2025 Business Results of VIX

Unit: Billion VND

Source: VietstockFinance

|

Note that VIX plans to hold an extraordinary shareholders’ meeting to approve a new business plan with pre-tax profit of 5 trillion VND and post-tax profit of 4 trillion VND, both more than three times the original plan. If approved, VIX will soon exceed the plan.

As of the end of Q3/2025, VIX‘s total assets reached over 31.5 trillion VND, a 61% increase from the beginning of the year, primarily driven by the aforementioned margin loan growth. Asset funding remains largely from equity of nearly 20.2 trillion VND, with the remaining 11.4 trillion VND from debt, mainly short-term loans.

– 13:59 10/10/2025

Revealed: Vietnam’s Top Profit-Generating Company – Just 80+ Employees, Each Averaging Over VND 60 Billion in Profit Since Year-Start

VIX’s revenue and profits are primarily driven by proprietary trading activities, which require minimal staffing.

Vietnamese Securities Firm Partners with Nasdaq

On the afternoon of October 8, 2025, in Hanoi, SSI Securities Corporation (HOSE: SSI) signed a Memorandum of Understanding (MoU) with Nasdaq, marking the beginning of a collaboration across three key areas: sharing expertise on international listing standards, organizing training programs for Vietnamese enterprises, and exploring the application of technology to serve the capital market.

DNSE Offers 1 Trillion VND in Public Corporate Bonds

DNSE Securities Corporation (HOSE: DSE) has officially launched a VND 1,000 billion bond issuance to bolster its capital for margin trading and securities advance payment activities.