Launch Ceremony of VN100 Futures Contracts

|

In his opening remarks, Mr. Le Xuan Hai, CEO of the Vietnam Stock Exchange, stated that the VN100 Futures Contract (VN100 FC) is a successful follow-up to the VN30 Futures Contract. It is designed to broaden the representation of constituent stocks in the listed equity market, better meeting the investment and risk management needs of both institutions and individuals. This new product is expected to diversify investment tools, enhance liquidity, and contribute to the efficiency and transparency of Vietnam’s derivatives market.

Addressing the ceremony, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that the introduction of the VN100 FC aligns with the Securities Market Development Strategy by 2030 and reflects global trends in derivatives product development.

The Vice Chairman acknowledged the efforts of stock exchanges, VSDC, and related units in product development, technical infrastructure preparation, and operational process refinement, ensuring timely, safe, and effective implementation. Mr. Bui Hoang Hai affirmed that the SSC will continue to collaborate with stock exchanges to promote research and development of new products, such as options contracts and structured products, to enhance the derivatives ecosystem, better serve investor needs, and support Vietnam’s securities market upgrade.

Mr. Luong Hai Sinh, Chairman of the Vietnam Stock Exchange’s Board of Directors, expressed gratitude for the close guidance of the Ministry of Finance and SSC, as well as the support from market participants. He reaffirmed the exchange’s commitment to innovation, technology infrastructure upgrades, product diversification, and effective initiatives to foster sustainable, transparent, and integrated growth in Vietnam’s securities market.

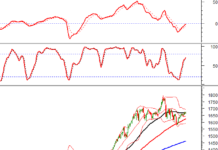

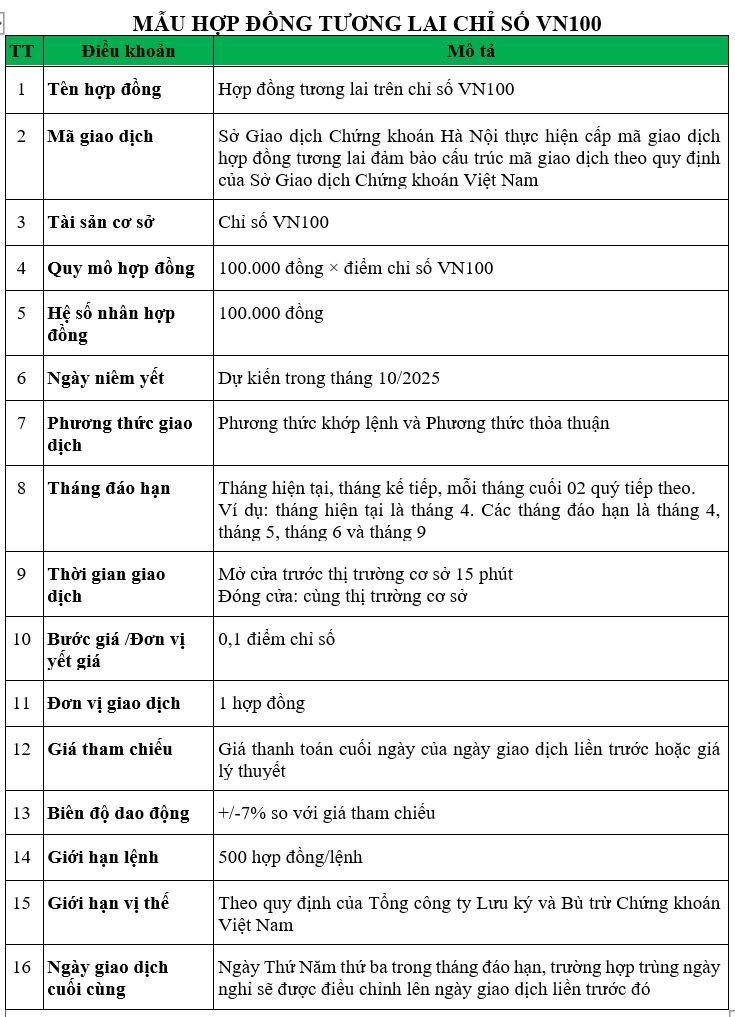

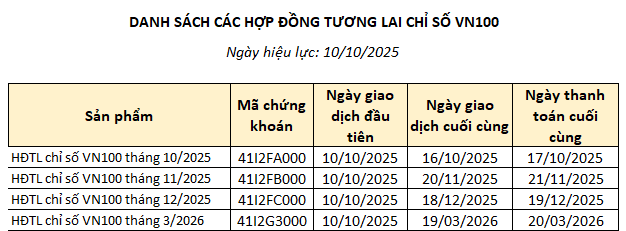

The VN100 Futures Contract is the second equity index-based product in Vietnam’s derivatives market. It shares similar trading and settlement characteristics with the VN30 Futures Contract, which has been operational for eight years, ensuring ease of access for investors.

The key difference between the two products lies in their underlying assets. The VN30 index, selected as the underlying asset in 2017, was suitable for market conditions at that time. Given the current development of Vietnam’s securities market, expanding derivatives products to larger indices is essential and aligns with the planned roadmap for derivatives market development.

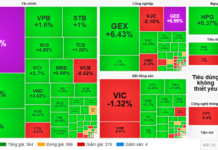

The VN100 index is highly representative of the market, accounting for over 95% of the VNAllshare basket’s market capitalization, with no single stock dominating (top 10 stocks represent only 47.62% of the basket). The VN100 constituents are selected by combining the VN30 index with top stocks from the VNMidcap index, blending their strengths: strong growth, high representativeness, liquidity, and diversification. This aligns with international recommendations for index construction.

Source: VSD

|

– 3:13 PM, October 10, 2025

Launch of VN100 Index Futures Trading: A Milestone for Vietnam’s Derivatives Market

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that the introduction of the VN100 Futures Contract (HĐTL VN100) into trading aligns with the roadmap of the Securities Market Development Strategy by 2030. This move also reflects the global trend of developing derivative products in international markets.

VN100 Futures Contracts: Enhanced Risk Hedging for Investors

In addition to offering a broader range of investment products, the VN100 Futures Contract (HĐTL VN100) is poised to significantly enhance portfolio risk management for investors. Its heightened market representation and alignment ensure more effective risk mitigation strategies.

Over 15 Million Shares Suddenly Halted from Trading, Prices Plummet to Floor After Three Consecutive Limit-Up Sessions

Negative news instantly triggered a sell-off in this stock, driving its price to the daily limit down after three consecutive sessions of hitting the upper limit.