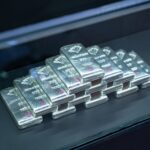

According to Phú Quý Group, the company has announced a temporary halt on accepting new orders for silver bars and ingots starting October 10th, until further notice.

Many investors have shifted to buying silver in recent times.

A representative from Phú Quý explained that due to the high volume of orders causing extended delivery schedules, the company has paused new orders to focus on enhancing production and expediting the fulfillment of existing orders.

While the exact number of orders was not disclosed, the representative confirmed that the overwhelming demand prompted this decision.

“Our supply chain remains robust, as we rely on imported raw materials,” the Phú Quý representative assured.

Following Phú Quý’s lead, other domestic silver brands such as Ancarat and Kim Ngân Phúc also announced a halt on new orders starting October 10th.

This news has left investors disappointed, as they are unable to purchase silver during this period of surging prices.

Surprising Collaboration Between Two Market Leaders in Gold and Silver

Another notable development in the gold and silver market has captured investors’ attention: Bảo Tín Minh Châu, a long-standing gold brand in Hanoi, has partnered with Phú Quý to distribute silver bullion.

Recently, the silver market has become increasingly dynamic, with prices continuously rising to new highs. The price of silver ingots has surpassed 52,000 million VND/kg. On October 11th, Phú Quý listed the price of silver ingots at 52,453 million VND/kg, a historic record.

According to Giabac.vn, over the past week, silver bullion prices have increased by approximately 6.3%, 23% over the past month, 35.5% over the past three months, and a staggering 76.6% over the past year.

Global analysts predict that silver prices could reach $50/ounce due to increased demand for safe-haven investments and industrial production.

Silver Prices Hold Steady Above 51 Million VND per Kilogram

Silver prices today remain elevated both domestically and globally, reflecting sustained market strength.