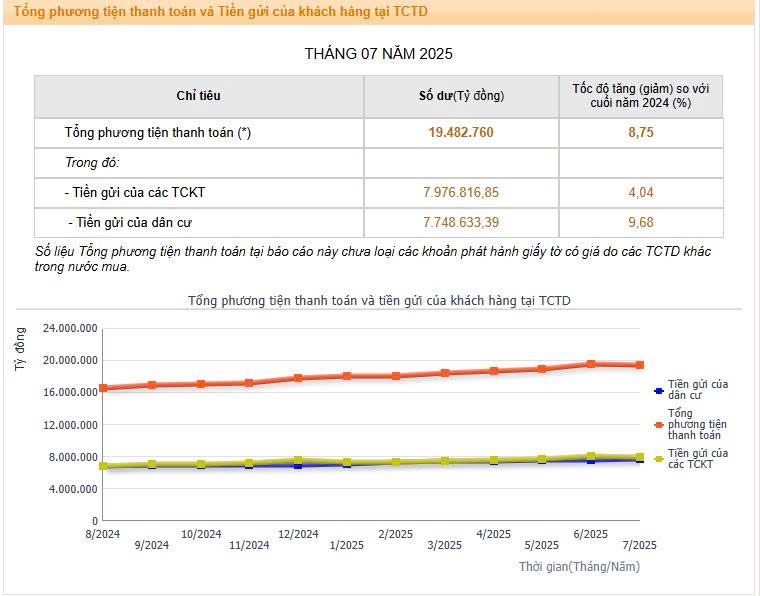

According to the latest data released by the State Bank of Vietnam (SBV), total deposits from individuals and businesses in credit institutions reached nearly VND 15,730 trillion by the end of July, marking a decrease of over VND 73.4 trillion (0.47%) compared to the previous month.

Specifically, corporate deposits amounted to more than VND 7,978 trillion, reflecting a 4.04% increase from the end of 2024 but a decline of VND 127.5 trillion (1.57%) from the end of June. This marks the first drop in corporate deposits after five consecutive months of growth since February 2025.

In contrast, household deposits continued to set new records, reaching nearly VND 7,750 trillion, a 9.68% increase since the beginning of the year. In July alone, household deposits rose by over VND 54 trillion (0.7%).

Source: SBV

The SBV also reported that the total means of payment by the end of July reached nearly VND 19,500 trillion, an 8.75% increase year-to-date. However, in July, the total means of payment decreased by VND 101.7 trillion (0.5%). This figure does not exclude securities issued by domestic credit institutions.

Vietnam Ranks 14th in Asia and 50th Globally in SWIFT Message Traffic, Says Deputy Governor of the State Bank of Vietnam

As of now, Vietnam’s SWIFT network boasts 86 members, encompassing commercial banks, joint-venture banks, and branches of foreign banks.

Central Bank Approves HDBank’s Charter Capital Increase to VND 38,594 Billion

On October 10th, the State Bank of Vietnam (SBV) approved an increase in HDBank’s chartered capital by a maximum of nearly VND 3.493 trillion.