NCB’s Q3 and 9-month 2025 business results showcase an impressive growth trajectory, surpassing the annual targets set at the shareholders’ meeting in late March. This success can be attributed to the bank’s nearly 5-year commitment to a comprehensive restructuring process and the implementation of a new strategy, supported by a leading global consulting firm.

Business Surges Ahead, Exceeding Annual Plan in Just 9 Months

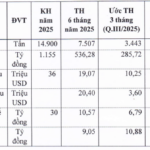

According to NCB, the bank’s Q3 2025 performance remained robust, with net interest income estimated at over VND 685 billion, a 150% increase, and service income at more than VND 62 billion, soaring 370% compared to Q3 2024. The bank’s Q3 after-tax profit reached nearly VND 190 billion.

For the first 9 months of 2025, NCB’s after-tax profit surpassed VND 652 billion, marking a significant turnaround from the previous year’s negative results. Core business activities drove this growth, with net interest income totaling VND 1,947.7 billion (up 153%) and service income reaching VND 160.4 billion (up 155%) compared to the same period in 2024.

NCB Achieves and Surpasses 2025 Business Targets Ahead of Schedule

|

As of September 30, 2025, NCB’s total assets reached VND 154,100 billion, a 30% increase from 2024 and 14% above the annual plan. Deposits (excluding securities issuance) and customer loans grew by 24% and 33% respectively, exceeding the 2025 targets by 1% and 3%.

These achievements highlight NCB’s successful restructuring efforts and validate the effectiveness of its strategic choices and solutions.

Since 2021, with a new management team, NCB has strengthened its internal capabilities, addressed legacy issues, and improved operational efficiency. As a result, the bank’s 2025 performance excelled, with non-performing loans well-managed according to the restructuring plan.

Ambitious Goals, Accelerating Growth in the New Phase

NCB’s consistent progress has propelled it into a new growth phase, aligning with its vision to redefine banking experiences through innovation. The bank aims to lead financial service innovation, develop cutting-edge technology-based products, and become a socially responsible institution contributing to sustainable community development.

NCB Accelerates Restructuring for New Growth Trajectory

|

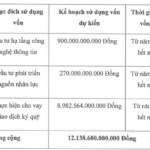

NCB is expediting its restructuring by increasing its charter capital by VND 7,500 billion to VND 19,280 billion in 2025, ahead of schedule. This third consecutive capital increase (2022–2025) demonstrates NCB’s commitment to strengthening its financial foundation for sustainable growth.

The bank is also optimizing its investment portfolio, focusing on profitable assets and capital efficiency. NCB prioritizes credit quality, targeting financially transparent and efficient customers, and leveraging digitalization for safe and sustainable credit growth. These measures have effectively controlled non-performing loans, with new loan NPLs below 1%, improved credit quality, and a significantly expanded profitable asset portfolio.

Surpassing 2025 targets ahead of schedule marks a pivotal moment in NCB’s restructuring journey, launching a new acceleration phase. NCB is poised to become a leading bank, offering innovative financial solutions and driving transformative change in Vietnam’s financial landscape.

– 6:58 PM, October 17, 2025

VPS Announces Minimum IPO Price of VND 60,000 per Share

Late in the afternoon on October 13th, the Board of Directors of VPS Securities JSC (VCK) passed a resolution approving changes to their previously announced IPO plan. Notably, the minimum offering price was set at 60,000 VND per share, aiming to raise over 12.1 trillion VND.

Phú Bài Fiber’s Pre-Tax Profit Surges 72% in 9 Months

On September 24, 2025, the Board of Directors of Phu Bai Fiber Joint Stock Company (UPCoM: SPB) approved the estimated business results for the first nine months of 2025. The company reported net revenue of VND 822 billion and pre-tax profit exceeding VND 17 billion. While revenue decreased by 12%, profit surged by nearly 72% compared to the same period last year.