On the afternoon of October 16, Vietcombank Securities Investment Fund Management LLC (VCBF) hosted an event themed “Q3/2025 Open-Ended Fund Performance Report and Stock Market Outlook.” During the event, VCBF experts assessed the investment performance of the funds and shared updates on upcoming plans.

Underperformance Due to Lack of “Star” Holdings

In Q3/2025, the VN-Index surged by 20.8%, bringing year-to-date returns to 31.2%. Large-cap stocks outperformed, while liquidity was a highlight with an average daily trading value of 1.7 billion USD, up 79% from the previous quarter and 125% year-over-year. Foreign investors’ net selling was another notable factor.

Amid this context, VCBF-managed open-ended funds recorded growth in Q3 and the first nine months, but their performance lagged behind benchmark indices.

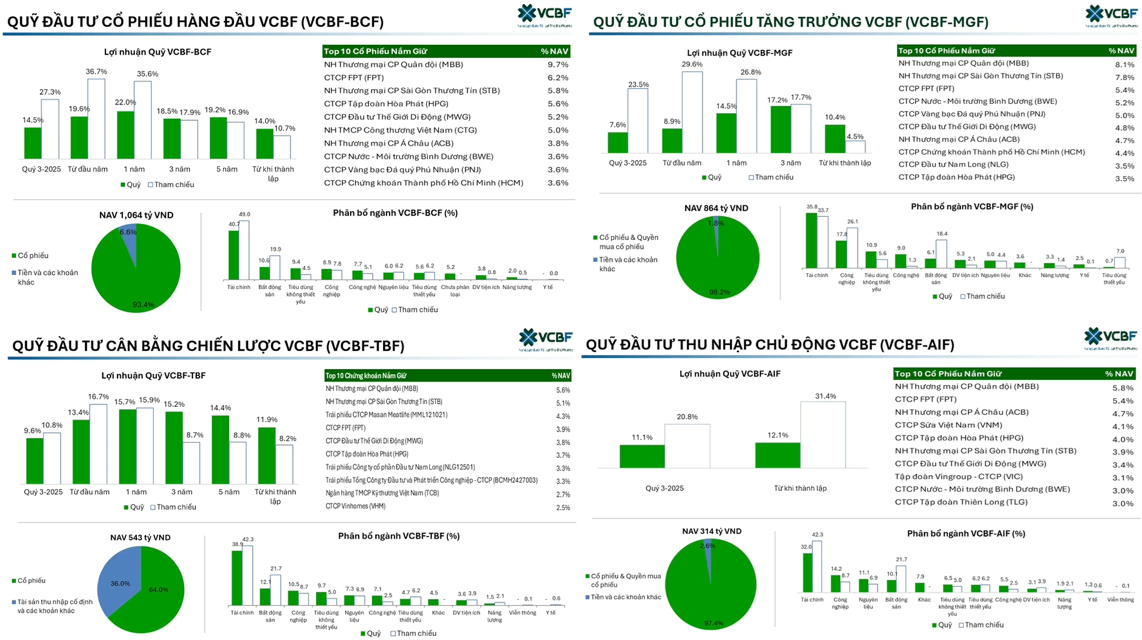

Specifically, the VCBF Leading Stocks Fund (VCBF-BCF) achieved 14.5% in Q3 and approximately 20% in nine months, underperforming the VN100-Index benchmark. The VCBF Growth Stocks Fund (VCBF-MGF) posted 7.6% in Q3 and 8.9% in nine months, below the VN70-Index benchmark. The VCBF Strategic Balanced Fund (VCBF-TBF) recorded 9.6% in Q3 and 13.4% in nine months, slightly lower than its benchmark. The VCBF Active Investment Fund (VCBF-AIF), launched in February 2025, achieved 11.1% in Q3 and 12.1% since inception, underperforming the VN-Index benchmark.

|

Performance of VCBF equity and balanced funds lagged benchmark indices

Source: VCBF

|

Explaining the underperformance, Mr. Phạm Lê Duy Nhân, Director of Investment Portfolio Management at VCBF, attributed it primarily to low or no holdings in top performers like VIC, VHM, VIX, SHB, LPB, and GEX. Conversely, selected stocks such as PNJ, BWE, ACV, FPT, CTR, TLG, and LHG underperformed the broader market.

“The market’s strong performance in the first nine months was driven by a few leading stocks, making VCBF‘s underperformance relative to benchmarks understandable,” Mr. Nhân commented.

As of September 2025, VCBF-BCF’s total assets reached 1,064 billion VND. Cash holdings increased from nearly 0% at the end of Q2 to 6.6% at the end of Q3, as large-cap stocks—the fund’s target—rose sharply, prompting cautious new investments. Inflows also contributed to higher cash levels.

VCBF-MGF’s total assets stood at 864 billion VND, maintaining a 1.8% cash ratio. Inflows were weaker than VCBF-BCF due to lower performance, but most mid-cap stocks in the portfolio still had significant upside potential, leading the fund to maintain high equity exposure.

VCBF-TBF’s total assets reached 543 billion VND, with 64% allocated to equities and the remainder to fixed-income assets and cash.

VCBF-AIF’s total assets were 314 billion VND, with 97.4% invested in equities. Focused on dividend income, the portfolio’s average dividend yield was 2.7%, higher than the VN-Index‘s 1.4%.

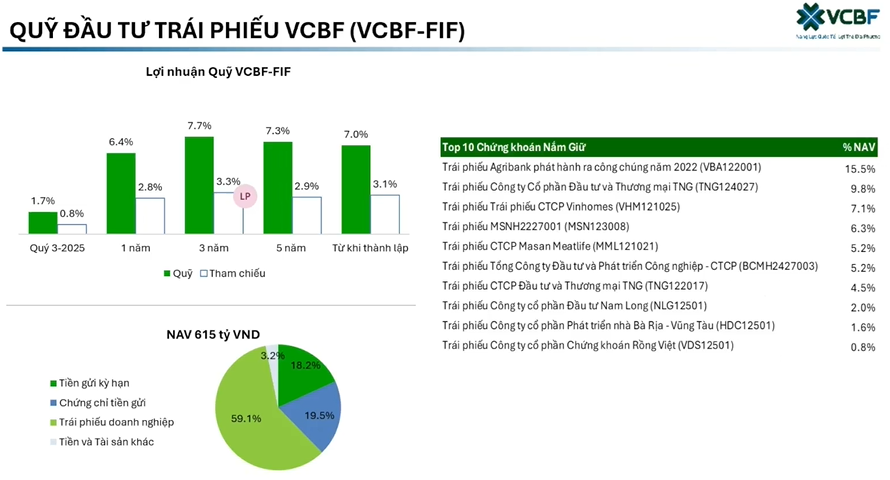

In the bond segment, the VCBF Bond Fund (VCBF-FIF) achieved 1.7% in Q3 and a 12-month average of 6.4%. As of September, VCBF-FIF’s total assets were 615 billion VND, with bond holdings increasing from 54% at the end of Q2 to 59% at the end of Q3.

Source: VCBF

|

Continued Confidence in FPT

Addressing investor queries about the high allocation to FPT despite its price correction, Mr. Nguyễn Triệu Vinh, Deputy Director of the Investment Division and Equity Investment Director at VCBF, cited FPT‘s position as a leading Vietnamese company with sustainable growth. Despite expected profit growth of only 15-18% this year due to challenges in the US and Asia-Pacific markets, FPT secured positive developments, including a 100 million USD software contract and a 250 million USD project in these regions. With a P/E ratio of 16-17, FPT remains attractive, offering long-term growth potential of 18-20% annually.

Regarding BWE, another stock VCBF is optimistic about, Mr. Vinh highlighted its monopoly in water supply in Binh Duong, generating stable cash flow and expanding to other localities. With a capital-intensive but long-term revenue model, low financing costs, and strong credibility, BWE is positioned for sustainable cash flow and 5-10 year growth potential.

Increased Equity Fund Trading Frequency from Late 2025

Another key topic discussed was the plan to increase open-ended fund trading frequency from the current Tuesday and Thursday schedule.

According to Ms. Dương Kim Anh, Director of the Investment Division at VCBF, the company has been working with stakeholders since the beginning of the year to implement this change. Starting November-December 2025, equity funds are expected to trade daily (5 days/week).

However, the VCBF-FIF bond fund will maintain its twice-weekly trading schedule due to its small size and low profits. Increasing frequency would raise operational costs (custody, bank supervision, account management), impacting investor returns.

– 16:05 17/10/2025

Real Estate Stocks on Fire: Unlocking Explosive Growth Opportunities

Selling pressure intensified in the afternoon session on October 17th, particularly among large-cap stocks, driving the VN-Index sharply lower to close the session down nearly 36 points. Blue-chip stocks, especially those in the Vingroup family, saw significant declines across the board.