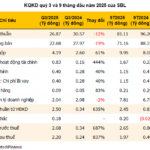

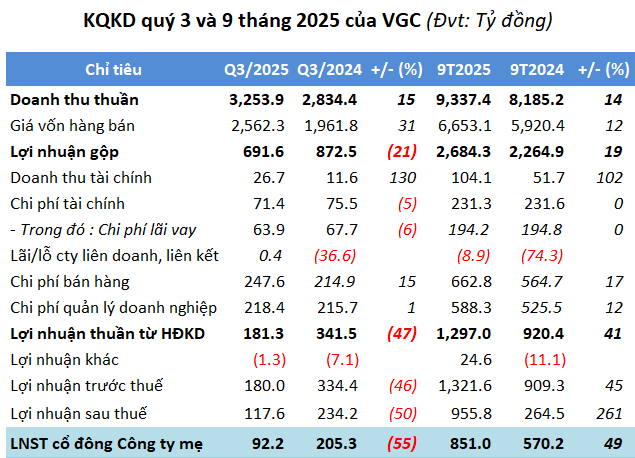

In Q3, Viglacera Corporation (HOSE: VGC) reported net revenue of nearly VND 3,254 billion, a 15% increase year-over-year. However, the cost of goods sold rose faster than revenue growth, causing gross profit to decline by 21% to approximately VND 692 billion. Consequently, the gross profit margin narrowed from 31% to 21%.

Financial, selling, and administrative expenses also rose by 6% to VND 537 billion, resulting in a net profit of just over VND 92 billion, a 55% drop compared to the same period last year.

Viglacera attributed the decline in Q3 profits to seasonal business fluctuations and adverse weather conditions, including heavy rainfall and storms.

| VGC Business Results from Q1/2019 to Q3/2025 |

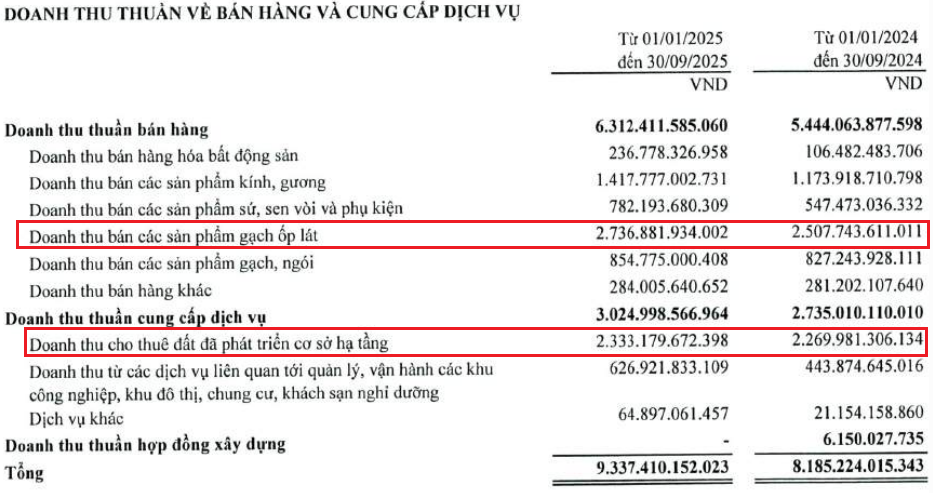

Despite Q3 challenges, Viglacera’s nine-month performance remains robust. Net revenue exceeded VND 9,337 billion, up 14% year-over-year. Key contributors included ceramic tiles (VND 2,737 billion, +9%), industrial land leasing (VND 2,333 billion, +3%), and real estate (nearly VND 237 billion, 2.2x higher than last year).

|

Revenue Structure of VGC in 9M/2025

Source: VGC

|

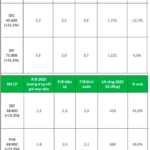

Pre-tax profit reached nearly VND 1,322 billion, and net profit hit VND 851 billion, rising 45% and 49%, respectively. Against the 2025 targets of VND 14,437 billion in consolidated revenue and VND 1,743 billion in pre-tax profit, Viglacera achieved 65% and 76% of these goals in the first three quarters.

Source: VietstockFinance

|

As of September 30, 2025, VGC’s total assets stood at over VND 25,624 billion, a 3% increase year-to-date. Cash and cash equivalents totaled VND 2,541 billion, down 11%; inventory remained at VND 4,321 billion, with over half comprising finished glass, ceramics, and sanitary ware. Work-in-progress construction costs reached VND 5,777 billion, down 5%, primarily allocated to Phase 1 of the Thuan Thanh Industrial Park (VND 1,720 billion).

Total liabilities were VND 14,751 billion, slightly down 1%; financial debt increased 2% to nearly VND 4,921 billion, accounting for 33% of total liabilities.

– 11:00 16/10/2025

Unlocking Advantages with Comprehensive Glass Solutions

Amidst the rebounding construction materials market, which is increasingly pivoting toward premium products and embracing green, energy-efficient standards, Viglacera stands out with its comprehensive, self-sustained glass supply chain strategy.

Building a Solid Foundation for Long-Term Growth: Phát Đạt’s Strategic Priority

Anticipated Q3/2025 business results indicate that Phat Dat Real Estate Development Corporation (HOSE: PDR) is beginning to accelerate. While the pace isn’t as rapid as market pressures or Phat Dat’s own expectations demand, it clearly reflects the sustainability of the company’s long-term strategic plan.