HSBC’s latest report forecasts gold prices soaring to an unprecedented $5,000 per ounce by 2026, fueled by escalating global risks and a surge of new investor interest in the market.

Spot gold has already breached the $4,300 mark this week, poised for its most significant weekly gain since December 2008.

This rally is attributed to geopolitical tensions, robust central bank purchases, inflows into gold ETFs, expectations of Federal Reserve rate cuts, and economic uncertainties surrounding tariffs.

“The bullish momentum is likely to persist through the first half of 2026, potentially pushing prices to $5,000 per ounce during this period,” HSBC noted in its research report.

The bank has revised its average gold price forecast for 2025 upward to $3,455 per ounce (from $3,355 previously) and for 2026 to $4,600 per ounce (compared to $3,950 earlier).

HSBC identifies key price drivers as geopolitical risks, economic policy uncertainties, and rising global public debt levels.

The bank suggests that the strong upward trend in late 2025, coupled with inflows from new investors, could sustain high prices and even propel them higher in early 2026.

However, HSBC cautions about significant volatility and potential price corrections in the latter half of 2026.

“Unlike previous rallies, we believe many new investors will remain in the gold market even after the uptrend subsides—not solely for price appreciation, but for gold’s diversification benefits and safe-haven status,” HSBC added.

With this projection, HSBC joins major financial institutions like Bank of America and Société Générale, which have also predicted gold reaching $5,000 per ounce in 2026.

Source: Reuters

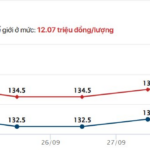

Gold Ring and SJC Gold Prices Continue to Decline on the Afternoon of October 2nd

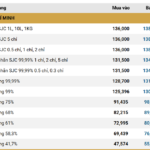

The current market price for SJC gold is set at 138 million VND per tael, while gold rings are trading at 135 million VND per tael.

The Soaring Price of Gold: An Unexpected Turn of Events

“The SJC gold bar prices soar to new heights as small gold shops push the price to a record high of VND 139 million. This surge has caught the attention of experts, who now warn of potential risks associated with the SJC gold market. With the prices skyrocketing, investors and buyers must stay vigilant and informed to navigate this volatile market.”