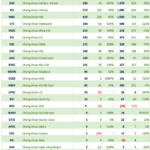

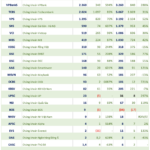

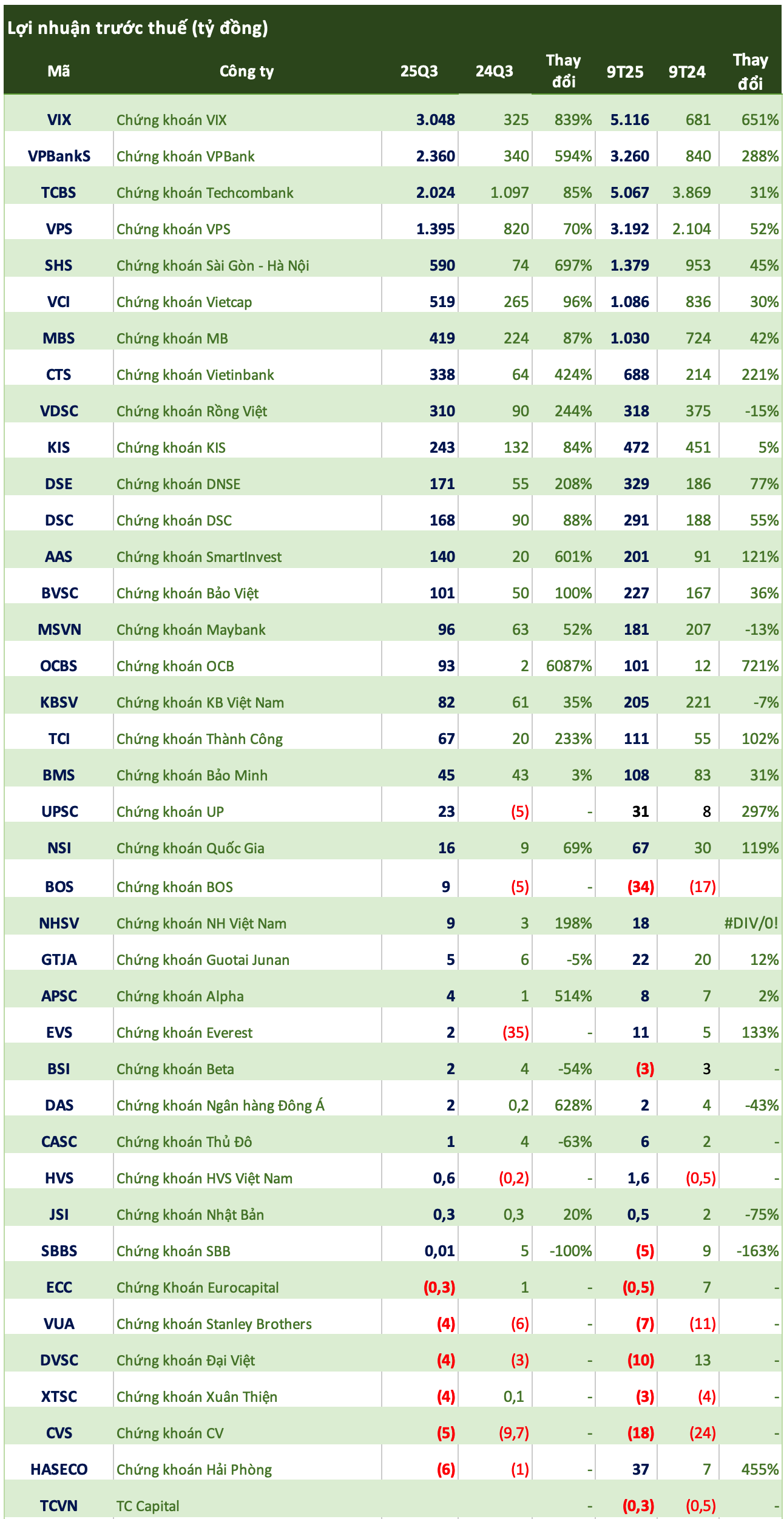

As of the morning of October 19th, 39 securities companies have released their Q3 2025 financial reports.

Xuan Thien Securities recorded over VND 536 million in operating revenue, a 31% decrease compared to the same period last year. The entire revenue stems from interest earned on held-to-maturity investments (HTM). Operating expenses amounted to nearly VND 754 million, with an additional VND 3.6 billion in securities company management costs.

As a result, Xuan Thien Securities reported a loss of over VND 4 billion in Q3, compared to a profit of VND 134 million in the same period last year. Previously, the company had returned to profitability in Q2 but has since reverted to a loss in this quarter. Accumulated losses for the first nine months of the year exceed VND 2.6 billion.

Xuan Thien Securities, formerly known as Sen Vang Securities, officially changed its name this year to align with its brand-building, promotional, and operational development strategies. Currently, Mr. Nguyen Van Thien, Chairman of Xuan Thien Group, is a major shareholder of the company.

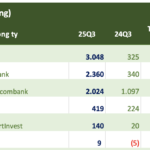

Bao Minh Securities reported Q3 operating revenue of over VND 137 billion, a 69% increase year-over-year. This includes nearly VND 124 billion in fair value through profit or loss (FVTPL) gains, double the amount from the same period last year. The company also recorded VND 2 billion in brokerage revenue, down 66%.

Operating expenses surged by over 310%, from nearly VND 17 billion in Q3 last year to more than VND 70 billion. After deducting expenses, BMSC reported pre-tax profit of nearly VND 45 billion for Q3, a modest 3% increase year-over-year, bringing the nine-month pre-tax profit to VND 108 billion.

Thanh Cong Securities achieved Q3 operating revenue of over VND 106 billion, including nearly VND 57 billion from FVTPL gains and nearly VND 24 billion from lending and receivables. After deducting expenses, TCI’s Q3 pre-tax profit reached VND 67 billion, a robust 233% increase year-over-year.

For the first nine months of the year, the company reported pre-tax profit of VND 111 billion, doubling compared to the same period last year.

Q3 Earnings Surge: Vietcap, SHS, OCBS Report Significant Profits, While One Firm Extends 13-Quarter Loss Streak

Another corporate giant has unveiled its financial performance, joining the wave of third-quarter earnings reports from the securities sector.