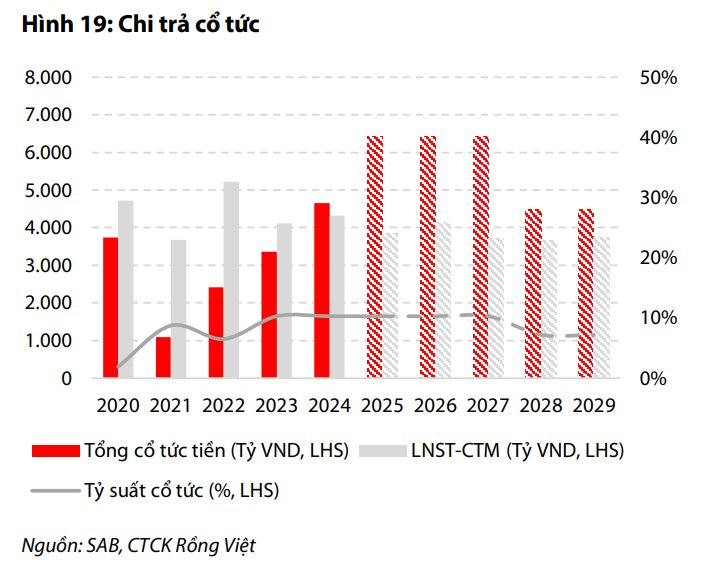

Since 2017, following the acquisition of Saigon Beer-Alcohol-Beverage Corporation (Sabeco, stock code: SAB) by Thai Beverage—a member of billionaire Charoen Sirivadhanabhakdi’s ecosystem—Sabeco has consistently paid cash dividends at a rate of 35%. Notably, in 2018 and 2022, the company increased cash dividends to 50%.

In 2023, after issuing shares to existing shareholders at a 1:1 ratio from equity (a 100% stock bonus) and doubling its charter capital, Sabeco continued to pay a 35% cash dividend.

In 2024, Sabeco paid a 50% cash dividend.

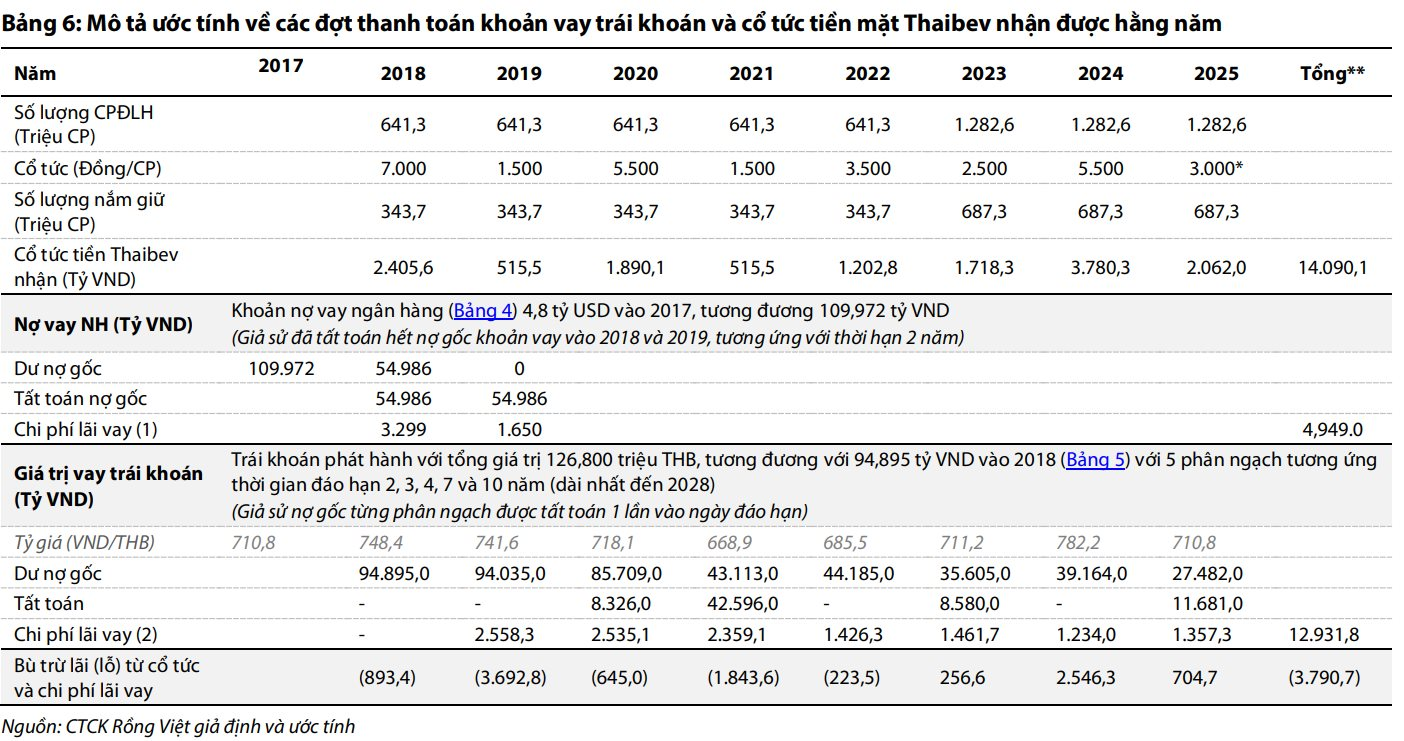

In total, over the eight years since Thai Beverage’s acquisition, the company has received over VND 14,000 billion in dividends from Sabeco.

A recent report by Rong Viet Securities (VDSC) predicts that Sabeco will maintain its high dividend payout policy, ranging from 35% to 50% in the coming years, due to: (1) no significant new investment plans; and (2) increased dividends to offset interest expenses of 2.4–3% on a USD 4.8 billion loan used to finance ThaiBev’s 2017 acquisition of Sabeco.

VDSC estimates that the total dividends received by ThaiBev from 2018 to present are insufficient to cover the total interest costs of the acquisition loan. This highlights ThaiBev’s ongoing debt burden, including principal and interest repayments from 2017 to 2028, as a key driver for Sabeco’s sustained high dividend policy.

Specifically, on December 29, 2017, Vietnam Beverage (49% owned by ThaiBev) paid VND 110,000 billion (USD 4.84 billion) to the Ministry of Industry and Trade to acquire 53.6% of Sabeco’s shares, becoming the controlling parent company.

To finance this acquisition, ThaiBev and its wholly-owned subsidiary, BeerCo, secured multiple loans totaling nearly USD 5 billion at an average interest rate of 2.5–3% per year.

However, with a two-year term for the USD 4.8 billion loan, ThaiBev refinanced in 2018 by issuing bonds valued at 83% of the acquisition cost. These bonds had terms ranging from 2 to 10 years and average interest rates between 1.76% and 3.6%.

According to VDSC’s estimates, from 2018 to 2025, ThaiBev received approximately VND 14,090 billion in cash dividends from Sabeco.

In contrast, the total interest expense on the acquisition loan is estimated at VND 17,881 billion by 2025, exceeding the dividends received by ThaiBev by nearly VND 3,791 billion.

VDSC notes that the consistent high dividend payouts have reduced Sabeco’s asset scale, with a projected CAGR of -7.2% per year (2024–2029), primarily driving the increase in asset turnover.

MG Vehicle Distributor Seeks to Acquire Showroom Leasing Business

PTM Corporation (UPCoM: PTM), the exclusive distributor of MG vehicles within the Haxaco ecosystem, is set to seek shareholder approval for the acquisition of all shares in Dat Viet Construction and Trading JSC. Dat Viet currently leases its Hai Duong City premises to PTM.

Ministry of Education Tightens Control on Illicit Fees, Prepares to Restructure University Network by 2026

The Ministry of Education and Training is not only tackling prolonged overcharging issues but also preparing a comprehensive plan to restructure the network of higher education and vocational institutions. This initiative aims to create a transparent, efficient system that is closely aligned with the practical needs of the economy.

Song Da Corporation Declares 10% Dividend Payout, SCIC Set to Reap Over VND 448 Billion

Song Da Corporation is set to distribute over VND 449.5 billion in dividends for 2024, at a rate of 10%. Notably, SCIC is expected to receive nearly VND 448.6 billion from this payout.