Vocarimex’s Journey: From Public to Private Entity

In a significant move, Vietnam Vegetable Oils Industry Corporation (Vocarimex, UPCoM: VOC) has received near-unanimous approval from its shareholders to revoke its public company status and delist from the UPCoM trading system. This decision, as per the 2025 Extraordinary Shareholders’ Meeting resolution, marks a new chapter for the company, which has been trading on UPCoM since 2016.

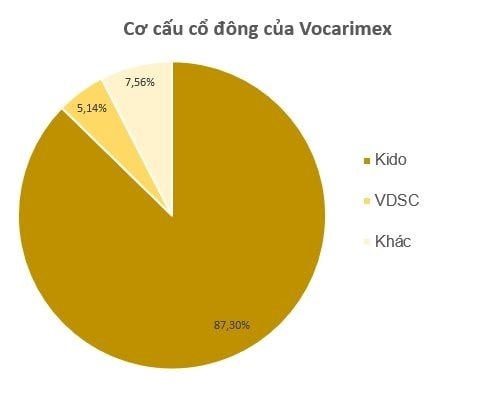

Currently, Vocarimex boasts 1,099 shareholders, with two major stakeholders holding 92.99% of the charter capital (equivalent to over 113 million shares). The remaining 1,097 minority shareholders hold 7.01%. This structure no longer meets the criteria for the minimum percentage of minority shareholders as stipulated in point d, clause 1, Article 11 of Law No. 56/2024/QH15.

Vocarimex has proposed and received approval from the shareholders to voluntarily delist before January 1, 2026. This plan was initially presented at the Extraordinary Shareholders’ Meeting on December 12, 2023, where it garnered 100% approval, and is now being implemented.

To safeguard shareholder interests, Vocarimex has requested that KIDO Group (HoSE: KDC), its largest shareholder with an 87.3% stake, acquire all shares from other shareholders wishing to sell post-delisting. KIDO has agreed to consider this proposal, potentially increasing its ownership to 100% and fully integrating the cooking oil segment into the parent company.

KIDO’s Strategic Acquisitions and Divestments

Established in 1976 as the Southern Vegetable Oil Company, Vocarimex transitioned to a joint-stock company in 2015. KIDO gained control in 2017 after acquiring shares from VPS Securities and divesting state capital from SCIC in 2020. KIDO invested over 1.255 trillion VND to acquire an additional 44.2 million shares, increasing its stake to 87.29%.

KIDO’s involvement began in 2014 with a 24% stake acquisition, becoming a strategic shareholder. It also acquired Tuong An Vegetable Oil (TAC), a former subsidiary of Vocarimex, and initiated TAC’s merger into KIDO.

Simultaneously, Vocarimex divested its entire stake in Calofic, owner of brands like Neptune, Simply, and Meizan, to Siteki Investment Pte Ltd (Wilmar International, Singapore) in March 2023, generating nearly 2.158 trillion VND.

.png)

Consistent Dividend Policy and Market Performance

Since 2016, Vocarimex has maintained a consistent cash dividend policy, ranging from 10% to 30% (peaking at 30% in 2022). This has yielded KIDO hundreds of billions of VND annually, with nearly 1 trillion VND in a single dividend distribution.

.png)

Stock Market Performance

As of October 17, VOC shares closed at 11,900 VND, down 14% since the month’s start and 28% year-on-year.

Vocarimex Prepares to Delist from the Stock Exchange

Vocarimex has decided to relinquish its public company status and delist from the Hanoi Stock Exchange (HNX) due to its failure to meet the required threshold of minority shareholders.

Kido Seeks Partner to Acquire 49% Stake in KDF

Kido Group (KDC) has announced its resolution to seek a partner for the transfer of its entire 49% stake in Kido Frozen Foods JSC (KDF), the company formerly managing renowned ice cream brands such as Celano and Merino.