| Hugamex’s Quarterly Business Results for 2023-2025 |

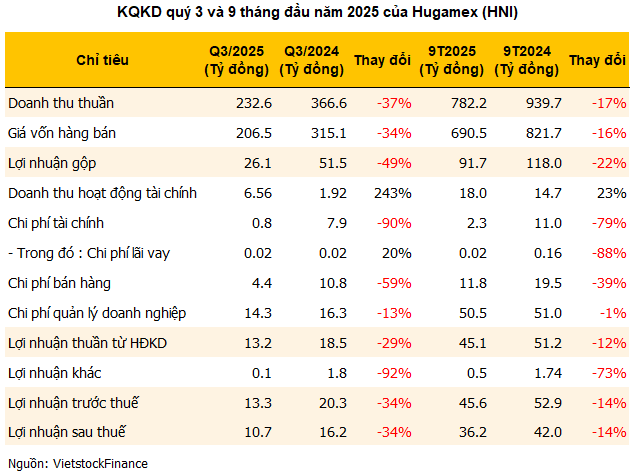

In Q3 2025, Hugamex reported net revenue of nearly VND 233 billion and a net profit of under VND 11 billion, marking a 37% and 34% decline year-over-year, respectively. The gross profit margin hit a two-year low of 11.2%, down from over 14% in the same period in 2024.

The company attributed these declines to the trade policies implemented by U.S. President Donald Trump, which disrupted exports to the U.S. market, impacting both revenue and profit in Q3.

|

However, financial activities were a bright spot during the period, with financial revenue surging 243% to nearly VND 6.6 billion, while financial expenses plummeted 90% to less than VND 800 million. As of September 2025, Hugamex held nearly VND 352 billion in bank deposits, a slight increase from the beginning of the year, and remained debt-free.

Nine-Month Results Exceed Annual Profit Targets

For the first nine months of the year, Hugamex’s revenue reached over VND 782 billion, a 17% decrease, with a net profit of over VND 36 billion, down 14% year-over-year. Despite this, the company achieved 82% of its annual revenue target and surpassed its profit goal by nearly 13%.

On the UPCoM market, HNI shares have shown low liquidity, trading sideways at VND 26,500 per share for nearly two weeks without any matched orders. Over the past year, the stock has seen a modest 11% increase, with average daily trading volume below 1,700 shares.

| HNI Stock Price Performance Over the Past Year |

– 09:13 21/10/2025

Record-Breaking Profits for DDV, Surpassing Annual Targets

DAP – VINACHEM Corporation (UPCoM: DDV) soared to new heights in Q3 2025, achieving a record-breaking quarterly profit. This remarkable performance was driven by a significant surge in both revenue and selling prices of its flagship product, DAP, compared to the same period last year.