Update

Chairman of the Board of Directors BCR Tan Bo Quan, Andy makes the opening speech of the 2024 annual General Meeting of Shareholders. Screen capture

|

At the opening of the General Meeting, the Chairman of the Board of Directors of BCR, Mr. Tan Bo Quan, Andy shared: “The economic recession in 2022 and its impact in 2023, in the context of continuous negative developments in the global economy, has severely affected many aspects of the Vietnamese economy, and the domestic real estate market has faced serious challenges, continuing to suffer from declining purchase power and liquidity. Nevertheless, the market showed signs of a slight recovery in early Q4/2023 as the government made efforts to revive it by issuing a series of policies, while the banks also assisted in mitigating difficulties, improving access to credit capital for the market. Nonetheless, many businesses still face the risk of bankruptcy or are forced to increase their debt to maintain operations, while interest rate and financial expenses eat away at profits.

Not exempt from the general fluctuations, BCR‘s business results are also being directly impacted as economic growth slows. Based on the Board of Directors’ strategies, BCR is gradually adapting to the new situation so as to overcome this difficult period. Specifically, key projects such as Malibu Hoi An and Hoian d’Or are starting to enter the phase of handover to customers, recognizing revenue and profit, marking an important turning point for BCR in its formation and development.“.

Earnings tripled in 2024

Commenting on the macroeconomic situation, BCR forecasts that in Q2-Q3/2024, the real estate market will start to recover, with a clearer growth trend starting from 2025. The recovery will start with the real estate market in large cities such as Hanoi, Ho Chi Minh City, Binh Duong, Can Tho, and then gradually spread to neighboring satellite cities.

Based on the general market situation and 2023 results, BCR set a target for 2024 to achieve a net revenue of nearly VND 2,190 billion and a post-tax profit of over VND 424 billion, respectively 2.3 times and 3 times higher than the actual results of 2023.

The revenue target is based on the expectation that the company will hand over all products at the Malibu Hoi An and Hoian d’Or projects in 2024.

Regarding profit distribution, BCR proposes a 2023 dividend payment of 3% and will increase it to 5% in 2024.

In terms of capital increase plans, BCR expects to increase its capital by approximately VND 2,938 billion in 2024, to VND 7,538 billion, through the issuance of 13.8 million shares to pay dividends; and issue 280 million shares privately to professional securities investors with an expected offering price of VND 10,000/share.

With the VND 2.8 trillion raised through the private issuance of shares, BCR plans to use VND 2.65 trillion to restructure its operating capital, while the remaining VND 100 billion will be used to pay for the transfer of shares to increase its ownership interest in Sao Sang Joint Stock Company.

In addition to the above two share issuance methods, BCR also plans to issue ESOP shares subject to its 2024 business results. Specifically, if the 2024 result exceeds the target stated above, the bonus will be equal to 5% of post-tax profit, plus 30% of the profit exceeding the target.

Target to reach VND 16 trillion in charter capital by 2028

For the development strategy for the period 2024-2028, BCR stated that with its portfolio of projects that have been and are being in progress, total land area in the next 5 years is expected to increase by about 5,080 hectares, of which residential real estate accounts for 10%, resort and vacation real estate accounts for 20%, and satellite urban areas account for 70%.

In addition, by 2028, BCR set a target to increase its charter capital to VND 16,000 billion, its equity to VND 26,000 billion and its total assets to VND 57,000 billion. The financial scale will be increased to meet the investment needs of BCR‘s projects.

In order to increase its capital raising capacity, the Company plans to list its shares on the HOSE within the next two years.

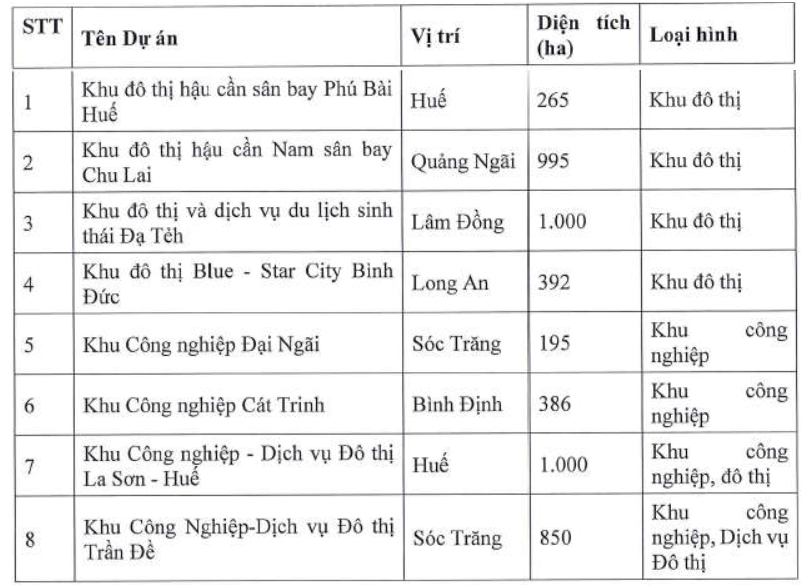

With the above scale, BCR aims to become one of the 5 largest real estate development companies in Vietnam. The company’s medium-term project development portfolio includes:

Source: BCR

|

At this General Meeting, BCR dismissed Mr. Bui Thien Dong from the position of member of the Board of Directors for the term 2022-2027. In addition to electing a replacement for Mr. Dong, BCR also approved an increase in the total number of members of the Board of Directors from 8 to 10.

Accordingly, the 3 individuals elected to the Board of Directors of BCR include: Mr. Vu Xuan Chien, currently an independent member of the Board of Directors of BCR‘s parent company, Bamboo Capital Group Corporation (HOSE: BCG); Mr. Nguyen Thanh Hung, current General Director of BCR; and Mr. Pham Dai Nghia, Deputy CEO of BCR.

Discussion:

Seeking partners to enter the industrial real estate market

When does BCR estimate the real estate market will recover?

General Director Nguyen Thanh Hung: BCR expects the real estate market to recover in the 2025-2026 period. Accordingly, the company will focus on four major priorities during the period 2024-2026 in order to capture the moment when the market recovers, including: completing unfinished construction projects for handover to customers, generating cash flow for the company; focusing on large projects that are currently in the planning phase; seeking potential projects through M&A; and taking advantage of opportunities to attract foreign partners between now and 2025.

By 2028, in addition to its existing real estate orientation, BCR will seek partners to enter the industrial real estate market, as it highly appreciates Vietnam’s FDI attraction potential, and this market is expected to be a great opportunity for BCR in the next 5 years.

Legal progress of BCR‘s projects after the new law is passed?

Vice Chairman of the Board of Directors Nguyen Tung Lam: The new law is a positive signal for the real estate market and real estate businesses. Some of the benefits include: supplementing regulations on foreign-invested economic organizations being able to acquire project transfers, thus creating favorable conditions for foreign-invested enterprises to invest in Vietnam; adding provisions on annual land rent payments instead of one-time payments, which will help reduce pressure on real estate projects, especially industrial parks, in the early stages; specifying cases of land allocation through bidding and non-bidding, helping to resolve issues for projects facing legal obstacles, as this is a very pressing issue in the provinces; and