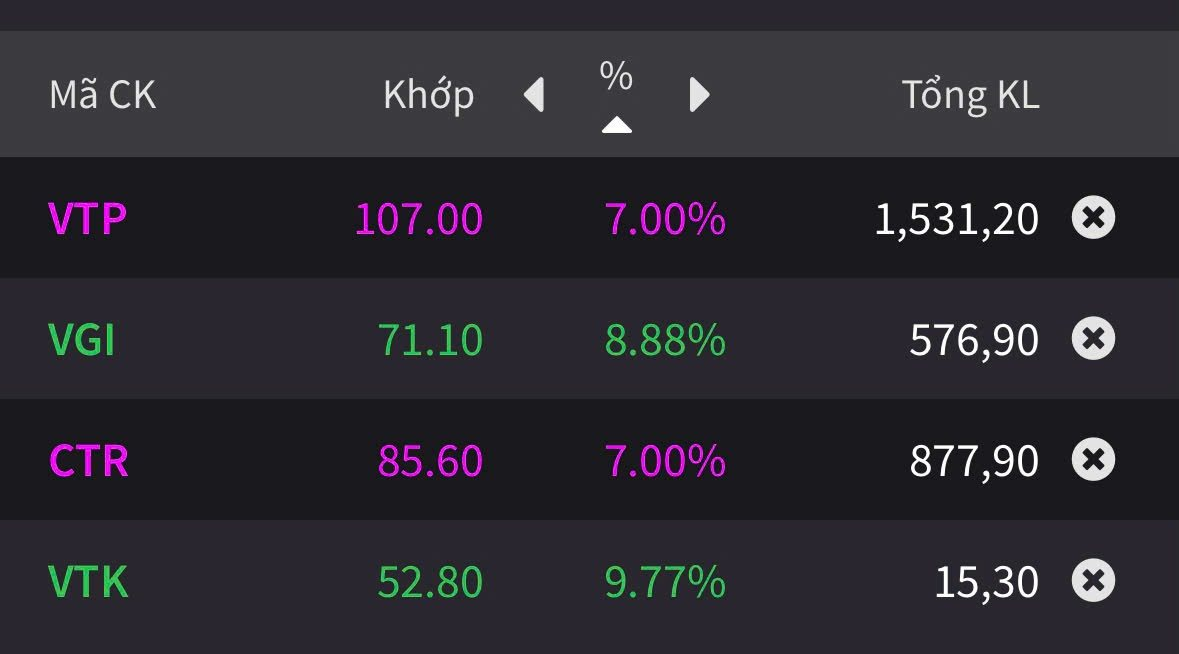

On October 20th, Viettel-affiliated stocks surged during the trading session. By the end of the morning session, CTR shares of Viettel Construction (Viettel Construction JSC) hit the ceiling, rising 7% to 85,600 VND per share. Similarly, VTP shares of Viettel Post (Viettel Post JSC) also reached their upper limit, closing at 107,000 VND per share.

Additionally, VGI shares of Viettel Global (Viettel Global Investment JSC) climbed 8.9%, ending the morning session at 71,100 VND per share, while VTK shares of Viettel Design Consulting JSC increased by 9.8%, reaching 52,800 VND per share.

Trading volumes for these stocks were also significantly higher compared to previous sessions. By the end of the morning, over 1.5 million VTP shares, 576,900 VGI shares, 877,900 CTR shares, and 15,300 VTK shares had been traded.

On October 15th, Viettel Telecom, Viettel’s flagship company and Vietnam’s largest telecom operator, celebrated its 25th anniversary. The company set an ambitious goal to become a world-class technology firm, targeting 115 trillion VND in revenue by 2030, with non-telecom revenue accounting for over 20%.

On the same day, at the international Open RAN Connect 2025 event, technology analyst firm Gartner recognized Viettel as a global provider of 5G Radio Access Network (RAN) infrastructure. This milestone lays the foundation for the company’s further expansion and development of a global technology ecosystem.

According to a VISecurities report, Viettel Post currently dominates Vietnam’s logistics sector with a market share of approximately 17%.

In December last year, Viettel Post inaugurated Vietnam’s largest logistics industrial park, spanning nearly 144 hectares with an investment of 130 million USD.

The company is also establishing a subsidiary in Guangxi Province, China, to expand its cross-border logistics network.

In terms of business performance, according to the reviewed consolidated financial report for the first half of 2025, Viettel Post generated net revenue of nearly 10,023 billion VND, a slight increase of 4.2% compared to the same period in 2024. After deducting costs, gross profit reached nearly 541.6 billion VND, up 38.4%.

After taxes and fees, Viettel Post reported a net profit of over 166.3 billion VND, a 14.3% increase year-on-year.

VTP is investing in infrastructure for new segments and deepening its logistics presence in emerging areas such as airports. These initiatives are expected to enhance the company’s profit margins, complementing its traditional B2C services.

Viettel Global has emerged as one of the world’s top 11 foreign telecom investors in terms of markets with over 49% equity ownership and ranks among the top 25 global telecom companies by subscriber count.

In Q2/2025, sales and service revenue reached 10,514 billion VND, a 21% increase compared to the same period in 2024. This marks the 7th consecutive quarter of over 20% revenue growth and extends the growth streak to 11 quarters since Q4/2022. Net profit attributable to the parent company’s shareholders (net profit) surged 185% to 2,389 billion VND.

For the first six months of the year, Viettel Global achieved 20,171 billion VND in net revenue, up 21.6% year-on-year, nearly five times the global telecom growth rate of 4.7% (according to GSMA). Net profit reached 2,357 billion VND, a 10% increase.

Viettel Construction owns 8,447 BTS stations (mobile base transceiver stations), 2.45 million m² of DAS, 2,716 km of transmission lines, and 16.92 MWp of solar energy as of September. Notably, 230 BTS stations are shared by two or more operators, with a sharing ratio of 1.03. The company aims to increase its BTS stations to 30,000 by 2030.

Moving forward, Viettel Construction plans to expand its operations, offering residential construction services, installation and integration of electronic and refrigeration equipment, technology solutions, and maintenance services.

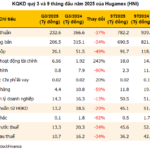

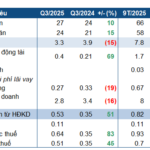

May Hữu Nghị Surpasses Profit Targets Despite Two-Year Low in Gross Margin

Despite facing significant challenges due to adverse U.S. tariff policies, which led to a sharp decline in gross profit margins in Q3, Huu Nghi Garment Corporation (Hugamex, UPCoM: HNI) has successfully surpassed its 2025 profit targets. This achievement is attributed to a substantial increase in financial revenue and the company’s ability to maintain a debt-free status.

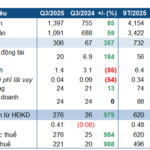

Record-Breaking Profits for DDV, Surpassing Annual Targets

DAP – VINACHEM Corporation (UPCoM: DDV) soared to new heights in Q3 2025, achieving a record-breaking quarterly profit. This remarkable performance was driven by a significant surge in both revenue and selling prices of its flagship product, DAP, compared to the same period last year.