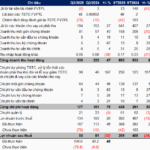

In Q3, VCF’s net revenue reached nearly VND 546 billion, a 10% decrease year-over-year. Simultaneously, the cost of goods sold dropped by 15% to VND 421 billion, resulting in a 12% increase in gross profit to over VND 125 billion. The gross margin improved from 18.45% in the same period last year to 22.94%.

Financial revenue increased by 3% to VND 26 billion. Financial expenses amounted to VND 3.7 billion, with interest expenses accounting for VND 2.9 billion. Other expenses, such as selling expenses, decreased by 21% to VND 1.2 billion, while administrative expenses rose by 12% to VND 5.6 billion.

Consequently, VCF reported a 12% year-over-year increase in after-tax profit, reaching over VND 112 billion.

For the first nine months of the year, VCF generated VND 1,855 billion in net revenue and VND 362 billion in after-tax profit, marking an 11% and 26% increase, respectively, compared to the same period last year.

For 2025, VCF has set two business scenarios: a low scenario with VND 2,700 billion in net revenue and VND 470 billion in after-tax profit, and a high scenario with VND 2,950 billion in net revenue and VND 516 billion in after-tax profit. After nine months, the company has achieved 69% of its revenue target and 77% of its profit target for the low scenario.

As of September 30, 2025, VCF’s total assets grew by 16% since the beginning of the year, reaching VND 2,898 billion. Cash and cash equivalents surged to VND 1,422 billion, 13 times higher than at the start of the year. Short-term financial investments increased from VND 400 million to VND 2 billion, and inventory rose by 46% to VND 409 billion.

|

VCF’s Q3 and 9-month business results for 2025. Unit: Billion VND

Source: VietstockFinance

|

Masan initiated its acquisition of VCF in 2010 by purchasing shares from major funds like VinaCapital, VF1, Vietcombank Fund, and Vietnam Holding, securing approximately 20% of the charter capital before listing on HOSE in January 2011. In September 2011, Masan, through Masan Consumer (UPCoM: MCH), publicly offered to buy 13.32 million VCF shares, equivalent to 50.11% of the capital, at VND 80,000 per share, valuing the deal at over VND 1,069 billion.

By August 2025, Masan Beverage, VCF’s parent company, increased its ownership to 98.79%, nearing its goal of full ownership.

VCF recently paid a 2024 cash dividend on October 8, with an impressive rate of 480%, equivalent to VND 48,000 per share. With over 265.7 million shares outstanding, this dividend payment totaled nearly VND 1,276 billion.

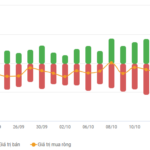

On the HOSE, despite low liquidity of around 1,000 shares per day, VCF’s stock price has surged by nearly 53% since the beginning of the year, trading at around VND 280,000 per share as of the morning of October 21.

| VCF’s stock price performance since the beginning of the year |

– 09:58 21/10/2025

FPTS Reports Q3 Profit of Over VND 55 Billion, Highlighting Continued Success of MSH Investment

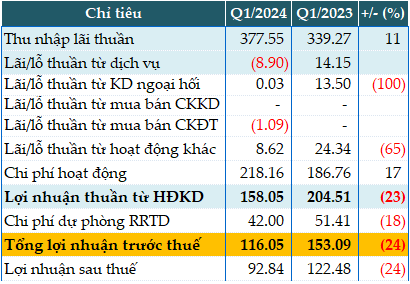

In Q3/2025, FPT Securities Corporation (FPTS, HOSE: FTS) reported post-tax profits exceeding 55 billion VND, marking a 32% decline compared to the same period last year. Notably, the realized profit segment exhibited a contrasting trend.

Long Hậu Surpasses 70% of Annual Profit Target in Just 9 Months

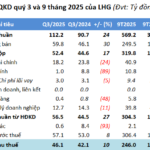

In Q3, Long Hau Corporation (HOSE: LHG) reported net revenue exceeding VND 112 billion, a 24% year-on-year increase, with nearly half attributed to a 19% rise in leasing revenue from industrial workshops, accommodation areas, and commercial centers. Net profit reached over VND 46 billion, marking a 10% growth.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.