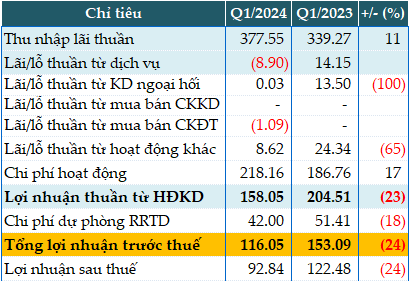

In Q1, net interest income was the only growing business activity of PGB, increasing by 30% year-on-year to nearly 378 billion VND.

Meanwhile, non-interest income declined. Service activities (loss of nearly 9 billion VND) and trading of invested securities (loss of more than 1 billion VND) were both in the red, while the same period last year recorded a profit.

PGB’s operating expenses increased by 17% to 158 billion VND. Despite the fact that the bank reduced its credit risk provision by 24% to 42 billion VND in the first quarter, pre-tax profit still decreased by 24% to more than 116 billion VND. After Q1, PGB achieved 21% of its pre-tax profit target of 554 billion VND for the whole year.

PGBank explained that the decline in profit was mainly due to the payment of commissions to collaborators who introduced customers for loans in order to boost credit growth, resulting in an increase in service operating expenses. At the same time, the bank had to apply a preferential interest rate policy in the initial period for some customer loan products.

|

PGB’s business results in Q1/2024. Unit: billion VND

Source: VietstockFinance

|

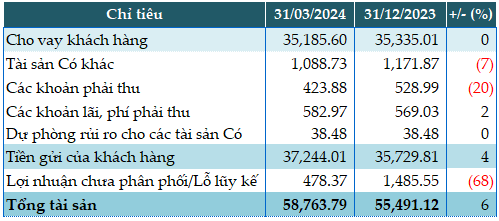

As of the end of Q1, PGB’s total assets increased by 6% compared to the beginning of the year, to 58,763 billion VND. Loans to customers remained unchanged at 35,186 billion VND, while customer deposits increased by 4% to 37,244 billion VND.

|

Some of PGB’s financial indicators as of March 31, 2024. Unit: billion VND

Source: VietstockFinance

|

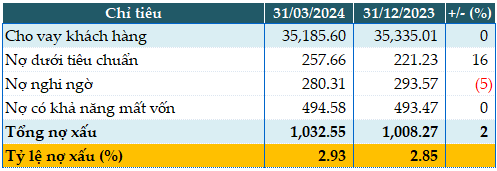

PGB’s total bad debt as of March 31, 2024 was 1,033 billion VND, a slight increase of 2% compared to the beginning of the year. The ratio of bad debt to outstanding loans increased from 2.85% to 2.93%.

|

PGB’s loan quality as of March 31, 2024. Unit: billion VND

Source: VietstockFinance

|