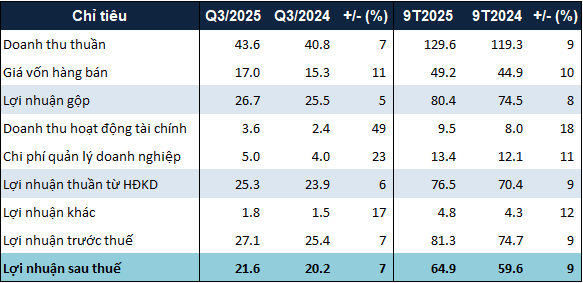

Specifically, WCS reported a net revenue of nearly VND 44 billion in Q3, a 7% increase year-over-year. Financial revenue surged by 49% to nearly VND 4 billion, primarily from deposit and lending interest.

On the cost side, the cost of goods sold and management expenses rose by 11% and 23%, reaching VND 17 billion and VND 5 billion, respectively.

After deducting expenses, WCS achieved a post-tax profit of nearly VND 22 billion, up 7% year-over-year. Combined with the first half results, the company’s nine-month post-tax profit reached nearly VND 65 billion, a 9% increase year-over-year.

|

WCS’s Business Results for the First Nine Months of 2025. Unit: Billion VND

Source: VietstockFinance

|

Compared to the 2025 target of over VND 77 billion in post-tax profit, WCS’s nine-month result represents more than 84% completion.

As of September 30, 2025, WCS’s total assets stood at over VND 375 billion, a 22% increase from the beginning of the year. This growth is primarily driven by a 23% rise in short-term cash holdings, reaching nearly VND 323 billion, the largest asset category.

Meanwhile, total liabilities reached approximately VND 95 billion, 2.3 times higher than at the start of the year, due to a VND 50 billion dividend payable to shareholders.

– 14:05 20/10/2025

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.

Record-Breaking Q3 for HDC: Nearly 550 Billion VND Profit After Selling Dai Duong Vung Tau Company

Despite a sharp decline in real estate revenue and shrinking profit margins, Hodeco achieved record-high profits, driven by a nearly 700 billion VND gain from the sale of its stake in Dai Duong Vung Tau Company.

VPBank Surpasses Annual Total Asset Plan in Just 9 Months, Driven by Ecosystem Synergy

Harnessing the unique power of its diverse and expansive ecosystem, Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) has built a robust foundation, setting the stage for significant growth and breakthrough advancements in the upcoming period.