Annual General Meeting 2024 of HSG on March 18, 2024 – Photo: Vu Hao

|

At the beginning of the meeting, Mr. Le Phuoc Vu – Chairman of the Board evaluated that 2023 was a year with rapid and complex changes in the economic and political situation, which posed many challenges not only to the steel industry but also to all manufacturing industries, significantly affecting the revenue and profit of most enterprises.

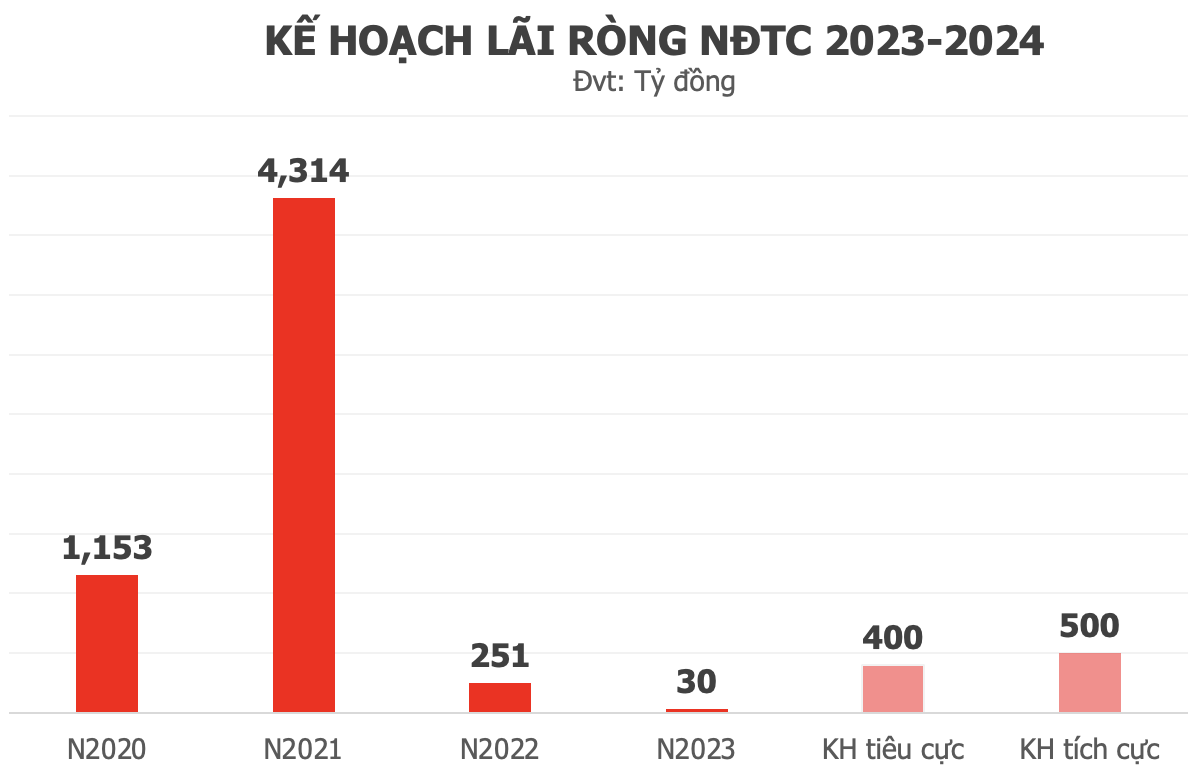

“In the face of challenges, it is encouraging that Hoa Sen achieved a profit of 30 billion VND in the 2022-2023 financial year,” Vu assessed. “The market in 2024 remains unpredictable and there are many potential fluctuations, however, challenges will open up many opportunities.”

In the 2023-2024 year, HSG will implement restructuring and specialization in its production and business fields, continue to expand the Hoa Sen Home system, and develop online business. It will effectively exploit export markets, increase operational efficiency and links in the corporation’s supply chain, ensuring sufficient goods.

Mr. Tran Thanh Nam, Deputy General Director of Hoa Sen Corporation, shared that in 2024, geopolitical tensions continue to be complex, especially the Russia-Ukraine war and tensions in the South China Sea. The Fed is forecasted to lower interest rates in 2024, but the timing is unknown. Regarding the steel industry, the HRC steel situation is still unpredictable, fluctuating around $600 per ton, while steel consumption has not yet recovered.

According to the documents of the General Meeting, the Corporation with the lotus symbol is actively considering expanding its operations into new areas and plans to issue 5 million ESOP shares to the leadership.

Entering new fields

In the current market context with volatility and challenges, Hoa Sen plans to allocate up to VND 5,000 billion to expand its scope of activities. The areas under consideration include finance, banking, securities, insurance, real estate, technology, tourism, and many other fields.

In addition, the Corporation is also planning to issue 5 million ESOP shares at a price of VND 10,000 per share to the leadership and key personnel.

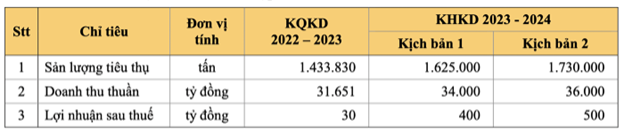

For the 2024 financial year, the steel industry tycoon has built two business scenarios. In the most positive scenario, the Corporation is expected to sell over 1.7 million tons of products, achieve a gross revenue of VND 36,000 billion, and a after-tax profit of VND 500 billion.

In the first quarter of the 2023-2024 National Financial-Tax Customs Conference, Hoa Sen recorded gross revenue of over VND 9,000 billion and net profit of over VND 103 billion, more promising than the heavy loss situation of the same period last year.

Continuing unfinished plans

In addition, the Corporation does not forget its plans to restructure and develop its current business fields. A typical example is the continuation of the IPO plan for its subsidiary companies, which have been announced in recent years, such as the plastics manufacturing and construction materials distribution-furniture business.

In the plastics manufacturing and business field, the subsidiary has received two more plastics plants and is in the process of researching and building an IPO plan and stock listing.

In the construction materials distribution-furniture business field, Hoa Sen Home, the building materials and furniture supermarket system, is developing and preparing to establish a Joint Stock Company of Hoa Sen Home to transfer this system. By the end of 2023, the Hoa Sen Home building materials and furniture supermarket system will have 114 stores nationwide.

In the steel pipe field, Hoa Sen is considering restructuring the steel pipe manufacturing and business field and proposing to transfer this entire field to a company specializing in steel pipes. Afterwards, HSG will consider an IPO for this new subsidiary.

According to the plan, Hoa Sen is considering changing the name of Hoa Sen Phu My Joint Stock Company to Hoa Sen Steel Pipe Joint Stock Company, in which Hoa Sen Group owns 99% of the charter capital. The entire steel pipe business will be transferred to Hoa Sen Steel Pipe Joint Stock Company.

Strong internal force will create value for shareholders in the future

Responding to shareholder opinions on dividend distribution, Chairman Le Phuoc Vu said that if the company made a profit of VND 1 billion in the 2023 financial year, it would be considered a success and worthy of rewarding the management board because it had a loss of VND 800 billion in the first quarter. This is completely objective.

According to him, Hoa Sen is both an importer, producer, distributor, and exporter, so inventory always has to be ensured for 4 months. “In the first quarter of 2023, the raw materials price dropped from $1,000 to $500 per ton, and with 4 months of inventory, having a loss of VND 800 billion is natural. Completely objective. In the last three quarters, prices are still volatile, the weakness of both the domestic and export markets, but Hoa Sen still made a profit of VND 30 billion, which is an exceptional effort of the management board,” Vu evaluated.

HSG no longer has medium and long-term debts. Cash flow has reached VND 1,100 billion, and financial capacity is very abundant. Short-term debts and inventory, if for any objective reason, HSG has the money to repay the banks. The financial situation has never been as good as it is now. Currently, HSG is borrowing from the top 5 global banks, lending in VND at 2.3% interest rate for a 4-month term. Without good cash flow, good financial situation, it is impossible to access cheap capital like this.

If HSG does not generate good cash flow, it will not be able to obtain such low-interest loans. The geopolitical situation is currently very complex, with warnings of the risk of World War III. There are conflicts between Israel and the Middle East, Russia and Ukraine, and many other conflicts.

“We should not be subjective, we should be more defensive. Shareholders’ money is over VND 4,000 billion and the profit is retained. If retained, it will create value for shareholders in the future, and a strong internal force will create value for shareholders in the future,” Vu added.

Expected debt is below VND 3,000 billion

Tran Ngoc Chu, Standing Deputy Chairman of the Board, said that the expected debt would be maintained below VND 3,000 billion. This year, HSG expects a profit of at least VND 400-500 billion. Depreciation is nearly VND 100 billion per month. Up to now, Hoa Sen has made a profit of VND 400 billion. Average monthly revenue is VND 3,000 billion.

Currently, debt has increased to VND 5,000 billion, but it is only temporary. Because orders arrive early, inventory is high. Normally, the debt is only VND 3,000 billion. The average profit is 2.1%/year.

“I affirm that no enterprise has access to such cheap capital. Every year, our cash flow is positive. Up to this month, the profit is below VND 400 billion. Our cash flow this year is positive VND 1,500 billion,” Chu shared.

Regarding the selling price of HRC, Formosa sells at $630 per ton, but now HSG is negotiating quality contracts equivalent to $530 per ton. Trends are currently unstable, not following any rules.

In this period, HSG must prioritize defense over offense. HSG is healthy, so why not take advantage to prepare for opportunities. HSG will not issue bonds.

The General Meeting ended with all agenda items approved.

Vu Hao