As of October 20, 2025, third-quarter business results reveal that numerous listed companies have significantly surpassed their annual profit targets, with some achieving up to tens of times their planned figures in just the first three quarters.

Below is the list of the top 20 companies with the highest profit target exceedance rates to date.

Viglacera Hạ Long (VHL) stands out with a post-tax profit of VND 20.9 billion in the first nine months, surpassing its annual target of VND 1.2 billion by over 16 times, achieving a completion rate of 1,686%. This performance positions Viglacera Hạ Long as the top company in terms of target exceedance.

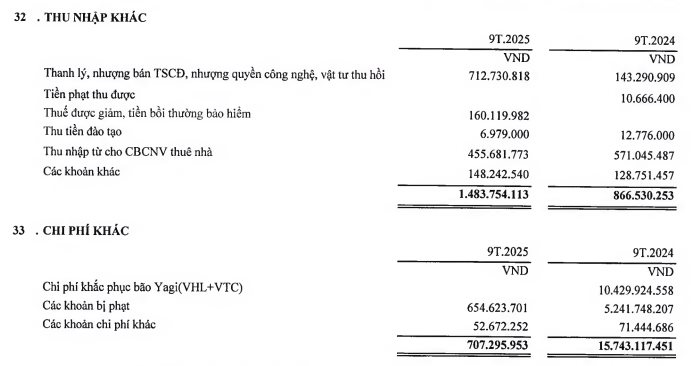

This remarkable achievement is attributed to the company’s conservative profit plan of only VND 1.2 billion, following two consecutive years of losses in 2024 due to a challenging construction materials market, resulting in a VND 61 billion deficit. Additionally, the company benefited from other income sources, including asset liquidation and sales, and avoided the costs associated with recovering from Typhoon Yagi, unlike the previous year.

Viglacera Hạ Long is 50.48% owned by Viglacera Corporation (VGC). GELEX Infrastructure JSC holds 50.21% of VGC, while GELEX Group (GEX) is the parent company, owning 91.62% of GELEX Infrastructure.

Another member of the GELEX ecosystem, Sông Đà Clean Water Investment JSC (VCW), achieved a 352.5% completion rate. Meanwhile, Electrical Equipment JSC (GEE) recorded a post-tax profit of VND 2,845 billion in nine months, exceeding its annual target by 219%.

However, Viglacera Đông Triều (DTC), in which Viglacera Hạ Long holds a 40% stake, presents a different scenario. The company reported a loss of VND 18.8 billion in the first nine months, surpassing its planned loss of VND 15 billion for 2025. Viglacera Đông Triều has been in the red for three consecutive years (2022–2024), and its shares were delisted to Upcom in late March 2025.

Following closely is Khánh Hòa Power (KHP), achieving a 309% completion rate.

DAP – Vinachem (DDV) posted a profit of nearly VND 496 billion in nine months, 2.9 times its annual target.

Nam Việt Corporation (ANV) and Ninh Bình Phosphate Fertilizer (NFC) also exceeded their annual goals by over 80%.

Long Hậu Industrial Park (LHG), BR-VT Housing Development (HDC), and Nam Hà Nội Urban Development (NHA) achieved completion rates ranging from 144% to 170%.

Other notable performers include Sông Đà 7.02 (S72), Thép Thủ Đức (TDS), and Superdong Kiên Giang (SKG), with exceedance rates between 150% and 160%.

Why Are Upcoming Hanoi Condos Priced at Just 18.4 Million VND/m² Amid the Market’s Price Surge?

Among the five social housing projects currently or soon to be launched in Hanoi, four have prices exceeding 20 million VND/m², with the highest reaching up to 29 million VND/m². However, one project maintains a price of 18.4 million VND/m², offering apartments starting from just 920 million VND.

Gelex Infrastructure Unveils IPO Plan: Targeting $28,000–$30,000 per Share, Aiming to Raise $300 Million, Potentially Valuing Company at $1 Billion

According to BVSC Securities, Gelex Infrastructure Corporation is poised to raise approximately VND 3,000 billion, a strategic move to bolster capital for its real estate segment and re-evaluate the market’s perception of the “engine” that currently constitutes two-thirds of the group’s total assets.

Hanoi to Welcome Its Largest Social Housing Project Ever, Accommodating Over 12,400 Residents

The Tiên Dương 1 Social Housing Project, with a projected investment of 8.690 trillion VND, spans 44.6 hectares and is set to deliver approximately 3,103 affordable housing units.