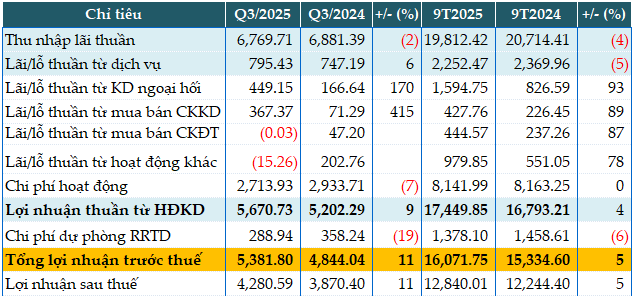

In Q3, ACB recorded VND 6,770 billion in net interest income, a slight 2% decrease compared to the same period last year.

Conversely, non-interest income streams saw robust growth. Service fees rose by 6% year-on-year, totaling over VND 795 billion.

Foreign exchange operations generated profits exceeding VND 449 billion, a 2.7-fold increase from the previous year. Securities trading activities yielded profits of more than VND 367 billion, a fivefold surge year-on-year.

Additionally, the bank reduced operating expenses by 7% during the quarter, to approximately VND 2,714 billion. The cost-to-income ratio (CIR) remained at 32%. Consequently, net operating profit rose by 9% to VND 5,671 billion.

ACB allocated VND 289 billion for credit risk provisions, a 19% decrease year-on-year. As a result, pre-tax profit for Q3 reached nearly VND 5,382 billion, an 11% increase.

For the first nine months of the year, ACB achieved pre-tax profits of nearly VND 16,072 billion, a 5% increase compared to the same period last year. Against the annual target of VND 23,000 billion in pre-tax profit, ACB has accomplished nearly 70% of its goal by the end of Q3.

|

Q3 and 9-month 2025 business results of ACB. Unit: Billion VND

Source: VietstockFinance

|

Not only the parent bank, but also subsidiaries within the ecosystem made significant contributions: ACBS achieved pre-tax profits of VND 895 billion, a 34% increase year-on-year, with margin lending growing by 87% since the beginning of the year, reaching over VND 16 trillion. ACBL, ACBA, and ACBC also showed positive growth, collectively accounting for approximately 6% of consolidated profits.

Mr. Tu Tien Phat, CEO of ACB, shared: “A bank can only achieve sustainable development by effectively managing risks while creating tangible value for society. For ACB, growth is not just about numbers, but about balancing efficiency, safety, and responsibility.”

As of the end of Q3, the bank’s total assets grew by 10% year-to-date, reaching VND 948,549 billion. Customer loans increased by 15% to VND 669,188 billion. Corporate lending remained the primary growth driver, rising by 20%, with a focus on key sectors such as trade and manufacturing.

Simultaneously, retail lending—a core component of ACB’s business strategy—showed signs of recovery, driven by flexible credit programs and tailored financial solutions for individual customers, small businesses, and traders.

As of September 30, 2025, customer deposits increased by 6% year-to-date to VND 571,028 billion. The CASA ratio reached 22.9%, up from 22.1% in Q1 and 22.6% in Q2, thanks to flexible mobilization policies and product diversification strategies.

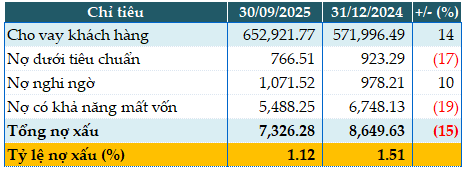

Excluding VND 16,266 billion in margin loans from ACB Securities (ACBS), as of September 30, 2025, ACB’s total non-performing loans (NPLs) stood at VND 7,326 billion, a 15% decrease year-to-date. The NPL ratio fell from 1.51% at the beginning of the year to 1.12%, with a further reduction to 1.09%. The ratio of short-term funds used for medium to long-term loans remained at 21.8%.

|

Loan quality of ACB as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 18:07 October 22, 2025

FPT Profits Soar: Earning $1.5 Million Daily

After the first nine months of 2025, FPT reported revenues of VND 49,887 billion and pre-tax profit of VND 9,540 billion, achieving 71% of the annual plan and marking a nearly 18% increase compared to the same period last year. This positive performance is driven by the growth of the Technology and Telecommunications segments, with overseas IT services and the Made-by-FPT ecosystem continuing to expand robustly.

Q3/2025 Financial Report Deadline on October 21: Real Estate Firms Double Profits Year-on-Year, Fertilizer Companies Report Nearly 100 Billion VND in Losses

Two leading securities firms, SSI and VNDirect, have reported remarkable third-quarter profits exceeding 1,000 billion VND. SSI recorded a pre-tax profit of 1,782 billion VND, a 90% surge, while VNDirect achieved a pre-tax profit of 1,165 billion VND, marking an 88% increase compared to the same period last year.

VNDIRECT’s Q3 Net Profit Surges 84% Amid Favorable Market Conditions

VNDIRECT Securities Corporation (HOSE: VND) has released its Q3/2025 financial report, revealing a remarkable post-tax profit of VND 929 billion, marking an 84% surge compared to the same period last year. The company’s core business segments, including proprietary trading, brokerage, and margin lending, all experienced significant growth amidst favorable market conditions.

Global Money Transfers: The Ultimate Financial Solution for World Citizens

ACB offers swift, secure, and cost-effective financial solutions for overseas money transfers from Vietnam, catering to diverse needs such as studying abroad, immigration, family support, and gifting. With competitive exchange rates and a trusted network spanning over 70 countries, we ensure your transactions are optimized and worry-free.