With over 29.8 million shares in circulation, SMB is set to distribute nearly VND 60 billion in dividends in November. The company previously paid an interim dividend on August 25, also at a 20% rate.

According to the 6-month 2025 financial report of SMB, the largest shareholder, Saigon Beer – Alcohol – Beverage Corporation (Sabeco, HOSE: SAB), holds 32.22% and stands to gain the most from the upcoming dividend, estimated at over VND 19 billion. Additionally, another major shareholder, Vietnam Real Estate Trading Corporation, with a 12.54% stake, could receive more than VND 7 billion.

At the 2025 Annual General Meeting, SMB shareholders approved a 40% dividend payout for the year, totaling over VND 119 billion. The November dividend payment will help the company fulfill its annual plan.

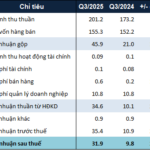

During the same meeting, the parent company’s 2025 business targets were approved, with total revenue exceeding VND 1.4 trillion, a modest 4% increase from 2024. However, profit expectations are more conservative, projected at nearly VND 155 billion, a 28% decrease. This may explain why the company reduced the dividend rate to 40% this year, down from 50% (VND 5,000 per share) in 2024, which totaled over VND 149 billion.

In the first half of 2025, SMB generated over VND 89 billion in pre-tax profit, a 5% decline compared to the same period last year, achieving 58% of the annual target. On a consolidated basis, the company’s net profit was nearly VND 81 billion, a slight 4% decrease.

In the stock market, SMB shares have consistently attempted to break the VND 40,000 per share threshold but have not succeeded. However, over a longer period, the stock has maintained an upward trend since 2013.

SMB shares maintain long-term upward trend – Source: VietstockFinance

|

– 18:50 21/10/2025

What Should Stock Investors Do After a Record-Breaking Market Decline?

According to the expert, this phase will serve as a necessary “reset” step before the market can return to its upward trajectory.

Vietstock Daily 21/10/2025: Panic Selling Surges, Short-Term Risks Escalate

The VN-Index plummeted sharply, marked by a long red candle accompanied by a surge in trading volume and a significantly higher number of declining stocks compared to advancing ones, reflecting overwhelming selling pressure across the board. The index breached the 1,700-point threshold, slicing through the Middle Bollinger Band and poised to retest the August 2025 lows (ranging between 1,605–1,630 points). Further compounding concerns, the MACD indicator triggered a sell signal as it crossed below the Signal line, signaling heightened short-term risks.