On the morning of October 23, 2025, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong, authorized by the Prime Minister, presented the Draft Law on Deposit Insurance (Amended) to the National Assembly.

The draft comprises 8 chapters and 42 articles, including 26 amended or supplemented articles, 7 newly added articles, 4 repealed articles, and 9 unchanged articles.

Three Cases for Deposit Insurance Payouts

According to SBV Governor Nguyen Thi Hong, one of the draft’s key updates is the definition of when the obligation to pay deposit insurance arises.

Specifically, this obligation arises in one of three scenarios. First, when a credit institution’s bankruptcy plan is approved, or the SBV confirms that a foreign bank branch is unable to pay deposits.

State Bank of Vietnam Governor Nguyen Thi Hong. |

Second, when the SBV suspends a specially controlled credit institution’s deposit-taking activities due to accumulated losses exceeding 100% of its chartered capital and reserves, as per the latest audited financial report.

Third, when payouts are necessary to ensure systemic safety and social order.

The government states that this addition aims to resolve challenges in using the Deposit Insurance Fund’s operational reserve, enabling regulators to better manage risks, protect depositors, and stabilize the financial and banking system.

The draft allows the SBV Governor, in exceptional cases, to set the maximum payout limit at the full insured deposit amount of a depositor within an insured institution.

For bankrupt or specially controlled credit institutions, payouts will follow the Law on Credit Institutions.

Regarding deposit insurance fees, the draft empowers the SBV Governor to set specific rates. Institutions under special control may defer payment of fees incurred before being placed under such control.

The government believes this provision gives institutions time to stabilize financially without immediate payment obligations. However, they must include a repayment plan for deferred amounts in their restructuring proposal.

Need for Strict, Transparent Regulations

Reviewing the draft, Chairman of the Economic and Financial Committee Phan Van Mai supported the fee and payout limit provisions but urged careful consideration to ensure financial system stability.

Mai suggested that fees to cover the operational reserve deficit should only apply in systemic cases, minimizing the Deposit Insurance Fund’s need for special SBV loans.

Chairman of the Economic and Financial Committee Phan Van Mai. |

For fee payment deferrals, the committee requested clear deferral periods and handling procedures if institutions cannot repay deferred amounts as planned.

“This policy must be integrated into the overall restructuring plan to ensure coherence and feasibility,” Mai stated.

On payout limits, the committee found the SBV Governor’s periodic adjustments appropriate but called for clear adjustment principles to protect depositors’ rights.

For payouts exceeding limits, the committee sought clearer “exceptional case” criteria and a transparent approval process involving the SBV, Ministry of Finance, and other agencies.

Additionally, the committee urged a thorough assessment of the policy allowing payouts for systemic safety and social order, considering its impact, feasibility, and necessity.

The Draft Law on Deposit Insurance (Amended) will be discussed by National Assembly delegates in groups on the morning of October 23, 2025.

REPORTING TEAM

– 10:48 23/10/2025

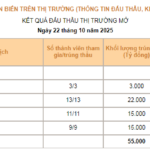

Cash Flow Monitoring: Revitalizing the Bond Market

The bond market thrives only when trust, knowledge, and discipline converge. When businesses treat transparency as a cornerstone, investors wield understanding as their greatest asset, and regulators harness data as a precision oversight tool, we create a market that is both secure and dynamic—one that fuels sustainable economic growth.

USD Freely Traded Rates Surge Unexpectedly on October 22nd Afternoon

The USD exchange rate in the open market has surged past the 27,000 VND mark, significantly outpacing the rates offered by commercial banks.