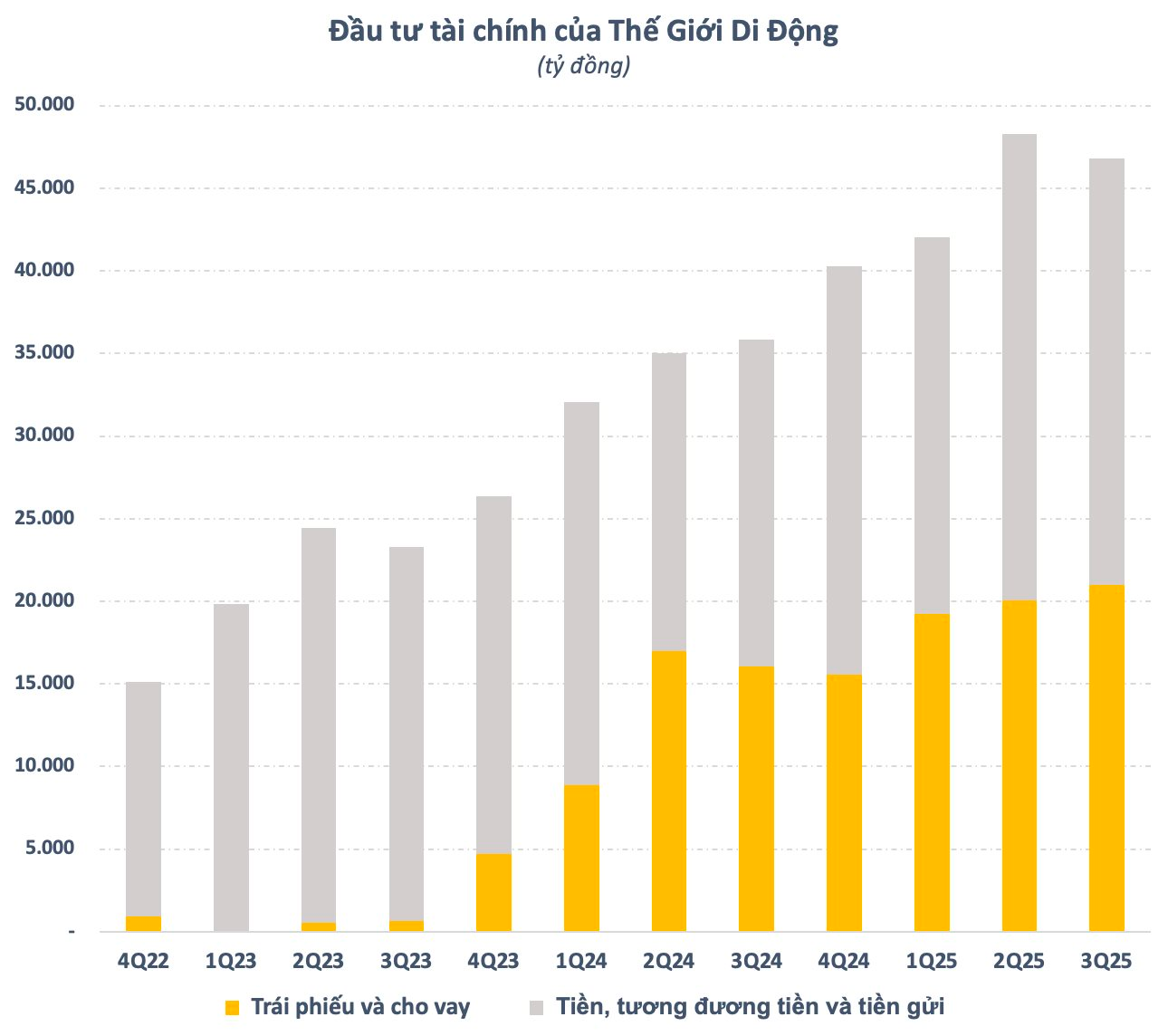

According to the Q3/2025 financial report, as of September 30, Mobile World Investment Corporation (stock code: MWG) recorded a cash balance (cash, cash equivalents, and short-term deposits) exceeding VND 25.8 trillion, a decrease of VND 2.4 trillion compared to the end of the previous quarter. Conversely, investments in bonds and loans continued to rise by nearly VND 1 trillion after one quarter, reaching over VND 21 trillion, the highest level since its operations began.

In a low-interest-rate environment, Mobile World Investment Corporation has optimized its cash flow by increasing high-risk, high-return financial investments. This strategy was initially explored by the retail enterprise of Mr. Nguyen Duc Tai in late 2022 but gained significant focus only in early 2024.

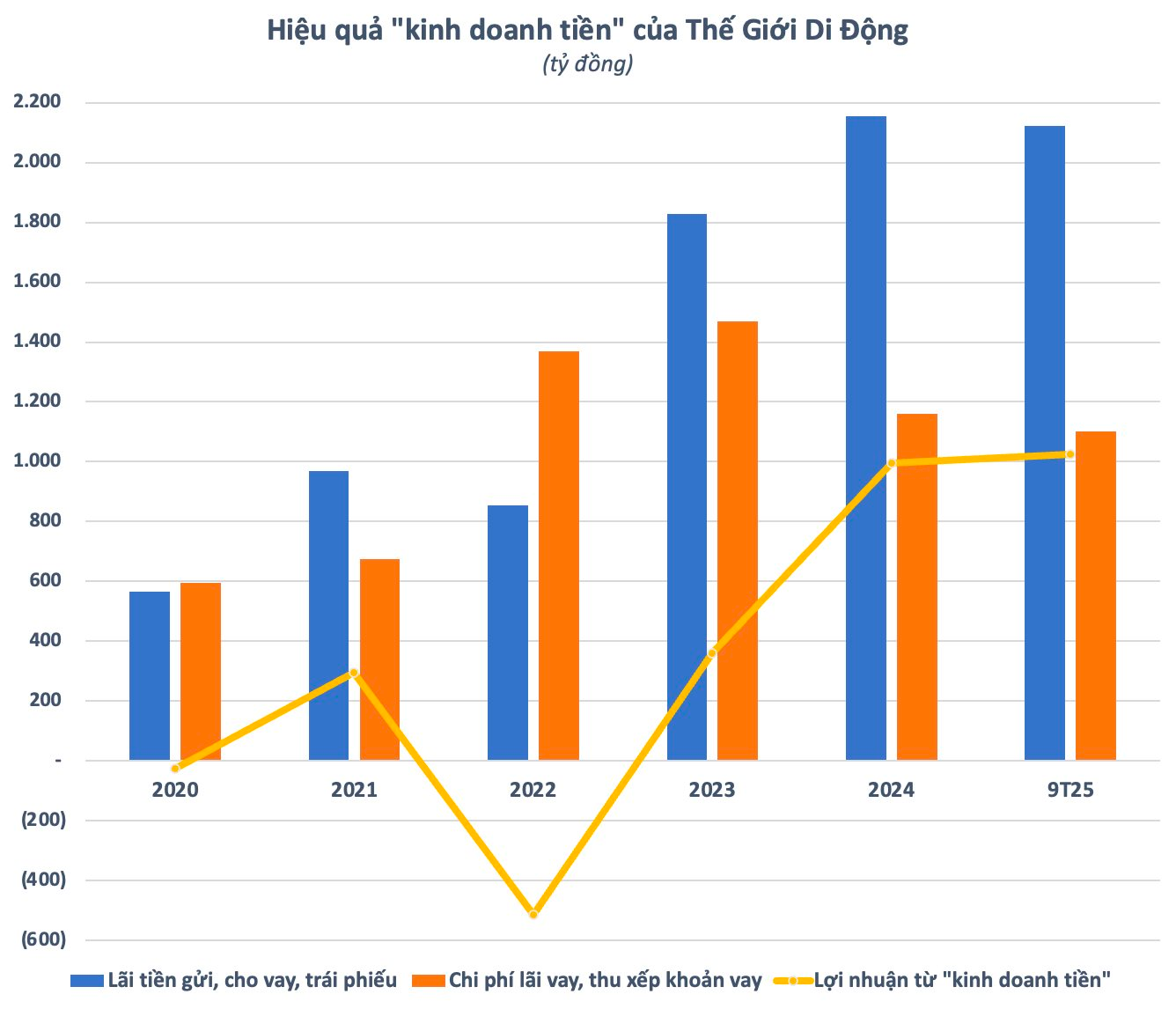

Notably, the effectiveness of financial investments has improved dramatically. In 2024, the company recorded a record-high profit of nearly VND 2.2 trillion from deposits, loans, and bonds. Meanwhile, borrowing costs and loan arrangement fees decreased significantly due to lower interest rates and a shift from long-term to short-term debt. By the end of 2024, the company had no long-term debt, reducing it by VND 6 trillion in a year.

As a result, the “money trading” activities generated nearly VND 1 trillion in profit for Mr. Nguyen Duc Tai’s enterprise in 2024, a significant increase from the previous year and a record high. This figure does not fully reflect the financial investment efficiency, as some borrowing costs were allocated to core business operations.

This strong performance continued in the first nine months of this year, with Mobile World Investment Corporation recording over VND 2.1 trillion in profits from deposits, loans, and bonds, nearly matching the previous year’s total. Profits from these activities in the first nine months even exceeded VND 1 trillion, surpassing the 2024 results. This significantly contributed to the company’s overall business performance.

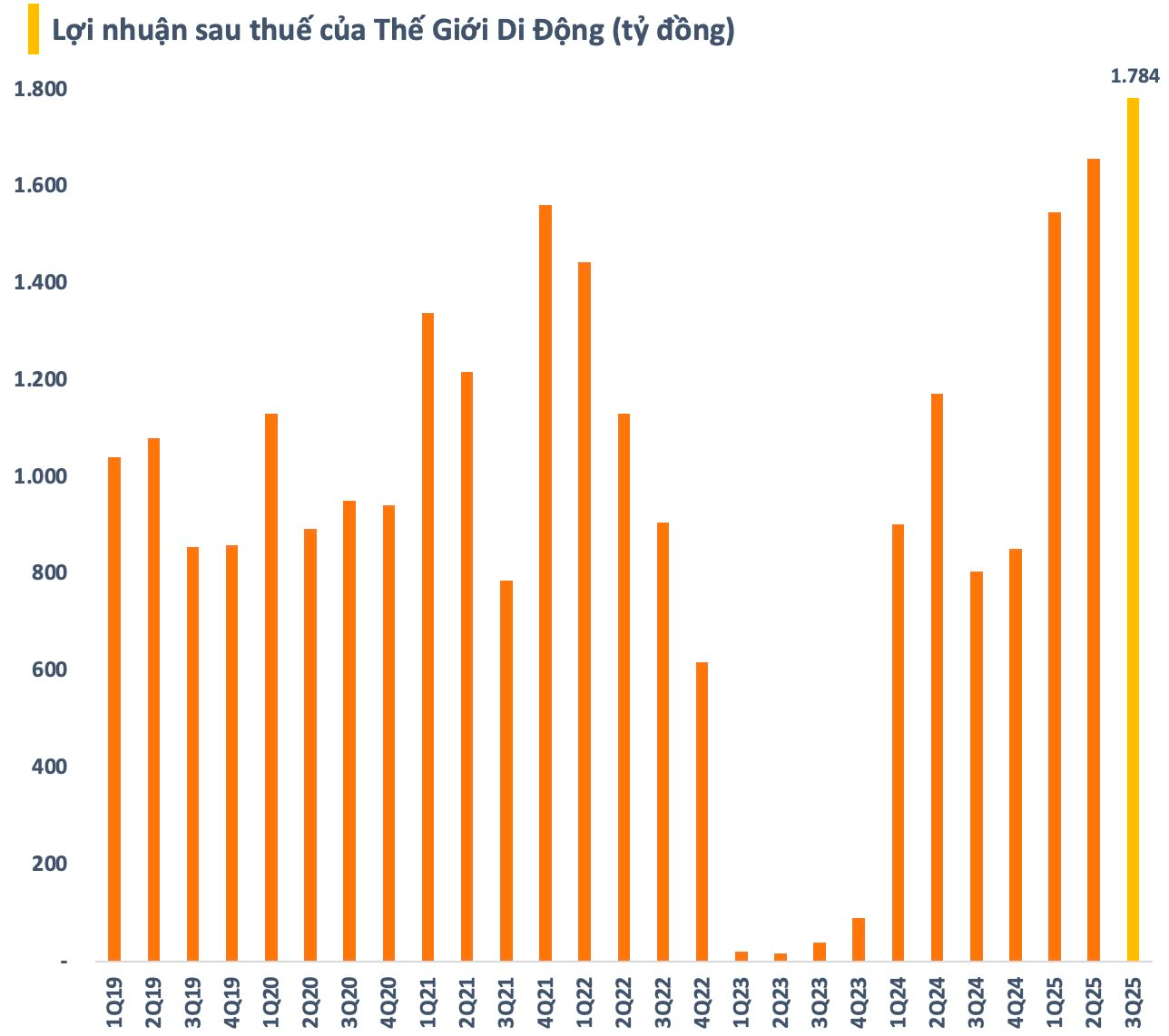

In Q3/2025, MWG reported a record after-tax profit of VND 1.784 trillion, up 121% year-on-year and 8% from the previous quarter. This marks the third consecutive quarter of profit growth for Mr. Nguyen Duc Tai’s retail company. The nine-month cumulative after-tax profit reached VND 4.989 trillion, up 73% year-on-year and exceeding the full-year plan.

Despite the success in financial investments, Mobile World Investment Corporation’s leadership emphasizes that this is only a “side business.” At the 2025 Annual General Meeting, CEO Vu Dang Linh stated that the company’s core business is retail, which provides a strong cash flow advantage. Leveraging this advantage, the company explores financial investments when cash flow is stable.

“We will be very cautious, such as depositing in banks and dealing with reputable partners. We will explore financial investments within our capabilities but will focus all resources on our core retail business,” emphasized the CEO of Mobile World Investment Corporation regarding financial investment activities.

Record-Breaking Q3: The Gioi Di Dong Posts Nearly VND 1.8 Trillion in Profit

Mobile World Investment Corporation (HOSE: MWG) has announced its consolidated Q3/2025 financial report, revealing a remarkable performance. The company achieved a net revenue surpassing 40 trillion VND, marking a 17% year-on-year growth. Even more impressively, its net profit soared to 1.77 trillion VND, a staggering 121% increase compared to the same period last year. This outstanding result sets a new record for the retail giant’s profitability.

World of Mobile’s CEO Announces Good News: Indonesian Electronics Retail Chain Surpasses Targets After 10 Months

With EraBlue’s early success, investors are now anticipating that The Gioi Di Dong will surpass its annual targets well ahead of schedule.

Thegioididong and Dien May Xanh Revenue Surges 21% in September

In September 2025, the mobile phone and electronics retail chains under the World Mobile Investment Corporation (HOSE: MWG) achieved a remarkable revenue of 9.4 trillion VND, marking a 21% year-on-year growth and the seventh consecutive month of expansion. These sectors now stand as the primary profit drivers for the diversified retail conglomerate.