According to the recently released business report, PNJ recorded a net revenue of VND 8,136 billion in Q3 2025, marking a 14.1% increase compared to the same period last year. The post-tax profit reached VND 496 billion, a remarkable 129.7% surge year-over-year.

In the first nine months of 2025, despite weak market demand for jewelry due to rising gold prices, retail sales still achieved a positive growth of 5.1% compared to the same period in 2024. This impressive result can be attributed to several factors: i) an increased number of stores (429 compared to 418 in the same period of 2024); ii) effective marketing campaigns that successfully attracted new customers; iii) a flexible product strategy and inventory adjustments to align with evolving market trends and demands; and iv) continuous improvements in customer experience and service quality.

Additionally, wholesale jewelry revenue in the first nine months of 2025 grew by 5.3% year-over-year. As a reputable manufacturer with a structured operation and strict adherence to regulations, PNJ has solidified its market position and gained customer trust, especially in an era where transparency and product traceability are highly valued.

The average gross profit margin for the first nine months of 2025 reached 20.8%, up from 16.7% in the same period of 2024. This improvement is primarily due to shifts in revenue composition. Specifically, retail jewelry sales accounted for 65.6% of total revenue, an 11.1 percentage point increase from 54.5% in 2024. Furthermore, the recovery value from repurchased inventory increased amid rising gold prices, while PNJ maintained tight control over operational costs, optimizing business efficiency and enhancing profit margins.

PNJ’s Golden Leaf Jade Branch Collection (Photo: Sơn Tùng)

PNJ also launched several new collections and diversified its product portfolio, offering customized options tailored to various customer segments based on their needs, styles, and preferences. Notably, the company made a strong impression in the wedding season with the introduction of the Golden Leaf Jade Branch Wedding Jewelry Collection. Simultaneously, PNJ is focusing on a long-term strategy to diversify its investment portfolio, expanding into complementary sectors such as premium consumer goods and men’s fashion.

Ms. Trần Phương Ngọc Thảo, Vice Chairwoman of PNJ’s Board of Directors, receives an award from the event organizers (Photo: Tuấn Vũ)

Moreover, PNJ’s brand credibility has been further enhanced through its recognition in prestigious awards: the only jewelry and lifestyle retailer in the Top 50 Most Efficient Companies in Vietnam (published by Investment Bridge); the sole Vietnamese representative honored at the JWA 2025 Awards in the “Sustainability Leadership” category for its outstanding sustainable development strategy; and one of the Top 10 Strongest Vietnamese Brands in 2025, with a brand value of USD 523 million (according to Brand Finance).

Soaring Electricity Output Propels Song Ba Ha Hydropower Plant to Record Profits

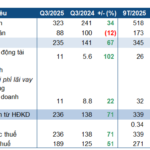

According to the Q3/2025 financial report, Song Ba Ha Hydropower Joint Stock Company (UPCoM: SBH) saw a 51% surge in post-tax profit compared to the same period last year. This remarkable growth is attributed to favorable hydrological conditions, which significantly boosted commercial electricity output.

Phan Thiet – Phu Quy Route Drives SKG’s Q3 Profit Turnaround

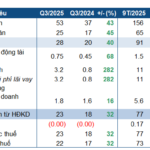

Superdong – Kien Giang JSC (HOSE: SKG) reported a Q3 profit of over VND 7.3 billion, a significant turnaround from the loss incurred in the same period last year. This impressive result was driven by a substantial increase in revenue across multiple routes, most notably the Phan Thiet – Phu Quy line.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

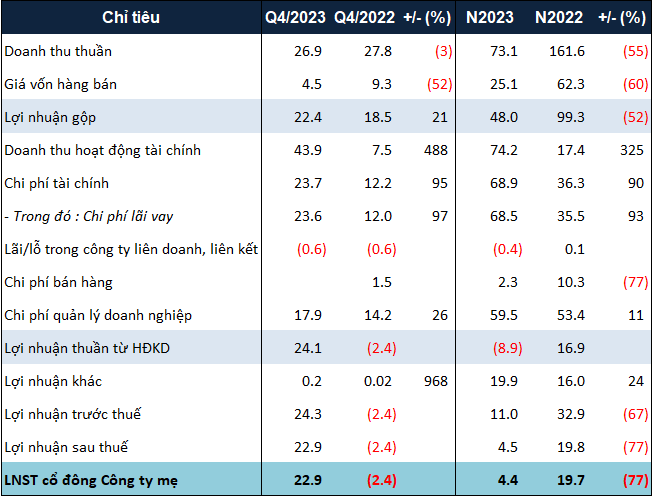

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.