Source: VietstockFinance

|

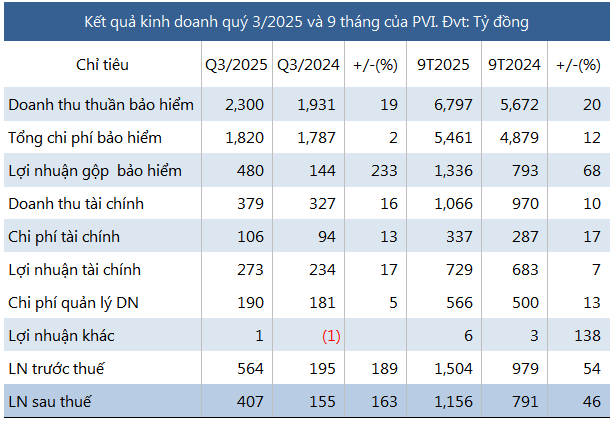

In Q3, PVI reported a net profit of VND 407 billion, 2.6 times higher than the same period last year. This impressive growth was driven by a 3.3-fold increase in gross insurance profits, reaching VND 480 billion, and a 17% rise in financial profits to VND 273 billion.

This performance was fueled by a 3.3-fold surge in reinsurance premium revenue, totaling nearly VND 2,793 billion, alongside a modest 4% growth in original insurance premiums to approximately VND 3,692 billion. In the financial segment, earnings from deposits, loans, bond investments, and dividends all saw year-over-year increases.

Over the first nine months, net insurance revenue outpaced costs, resulting in a 68% jump in insurance profits to VND 1,336 billion. Financial activities also contributed VND 729 billion, a 7% increase.

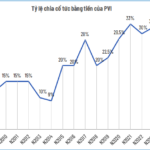

Despite a 13% rise in operating expenses to VND 566 billion, PVI achieved a 46% year-over-year growth in net profit. With a conservative 2025 pre-tax profit target of VND 1,090 billion—the lowest in five years—the company has already surpassed this goal by 38% after just nine months.

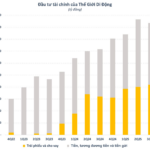

As of September 2025, PVI‘s total assets exceeded VND 42 trillion, a 32% increase from the beginning of the year. This growth was primarily driven by a 35% rise in short-term receivables from customers (totaling over VND 20.2 trillion) and a 24% increase in financial investments (nearly VND 17.7 trillion).

The short-term investment portfolio saw significant growth in trading securities (5.7 times higher than the start of the year) and deposits (up 30%), reaching VND 1.6 trillion and VND 10.8 trillion, respectively. Conversely, bonds (VND 583 billion) and certificates of deposit (VND 10 billion) decreased notably. In the long-term portfolio, bond values rose slightly by 5% to over VND 3.3 trillion, while deposits declined by 14% to VND 1.3 trillion.

By the end of Q3, PVI‘s total liabilities reached VND 32.6 trillion, a 38% increase year-to-date, primarily in short-term debt. Short-term provisions (VND 23 trillion) accounted for 71% of total liabilities, rising 30%, while short-term borrowings surged 8.3 times to VND 1.6 trillion. This increased reliance on short-term borrowing led to a 73% jump in interest expenses for the first nine months, totaling nearly VND 36 billion.

By Khang Di

– 10:58 AM, October 24, 2025

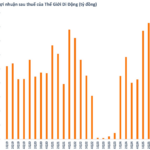

Mobile World Group (MWG) Reports Record-Breaking Q3 Profit of Nearly VND 1.8 Trillion, Surpassing Annual Plan in Just 9 Months

Over the first nine months, The Gioi Di Dong (Mobile World) achieved an accumulated after-tax profit of VND 4,989 billion, a remarkable 73% surge compared to the same period in 2024, surpassing its full-year target.

PVI Announces Dividend Payout: 3,150 VND per Share

PVI Holdings Corporation (HNX: PVI) has announced the closure of its shareholder registry for the 2024 cash dividend distribution. The ex-dividend date is set for October 1st.