| Q3 Profits Offset Challenges from the First Half of the Year |

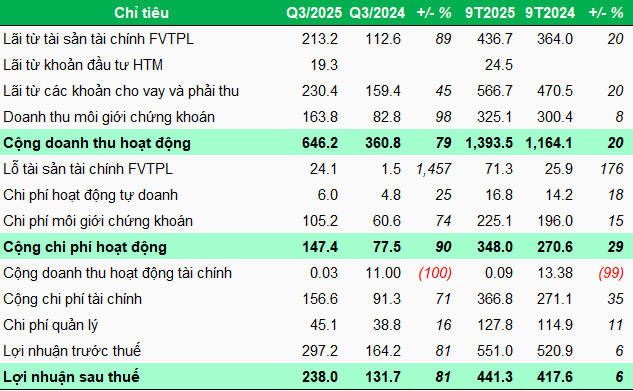

Specifically, the company’s proprietary trading profit exceeded 183 billion VND, a 72% increase year-over-year; brokerage profits reached nearly 59 billion VND, 2.6 times higher than the same period last year; and lending revenue surpassed 230 billion VND, up 45%.

Financial activities faced pressure, with costs rising 71% to nearly 157 billion VND. However, this was insufficient to overshadow the robust Q3 performance.

Notably, this quarter marked the highest profit in VCBS’s history, helping the company overcome challenges from the first half of the year. For the first nine months, the company’s net profit totaled over 441 billion VND, a modest 6% increase.

|

Q3 and 9-Month 2025 Financial Results of VCBS

Unit: Billion VND

Source: VietstockFinance

|

In 2025, VCBS set a revenue target of nearly 1.7 trillion VND. With approximately 1.4 trillion VND achieved in the first nine months, the company has completed 83% of its annual plan.

Beyond revenue, VCBS aims to secure a top-10 market share in equity brokerage among leading securities firms. As of Q3, VCBS achieved a 2.88% market share in base market brokerage on HOSE, ranking 9th. Additionally, the company holds a 3.08% share on HNX and 3.67% on UPCoM, both ranking 7th.

By the end of Q3, VCBS’s total assets reached approximately 19 trillion VND, a 47% increase from the beginning of the year, setting a new record. Financial assets at FVTPL and loans dominate the structure, accounting for 88% combined.

Loans totaled over 9.8 trillion VND, up 66%, primarily driven by margin lending and a smaller portion of advance lending. FVTPL financial assets were valued at nearly 6.9 trillion VND, a 5% increase year-to-date, mainly comprising term deposits, deposit certificates, and listed and unlisted bonds.

Regarding capital, without increasing equity, the company boosted borrowing to fund operations, raising debt from nearly 7.9 trillion VND at the start of the year to over 12.8 trillion VND by Q3’s end, a 62% increase. All borrowings are short-term, primarily from banks and financial institutions.

| VCBS Increases Borrowing to Fund Operations |

– 16:42 22/10/2025