Vietnam’s stock market recently experienced significant volatility, with the VN-Index plunging over 94 points (-5.47%) on October 20th, only to recover to 1,683 points by the close of October 24th.

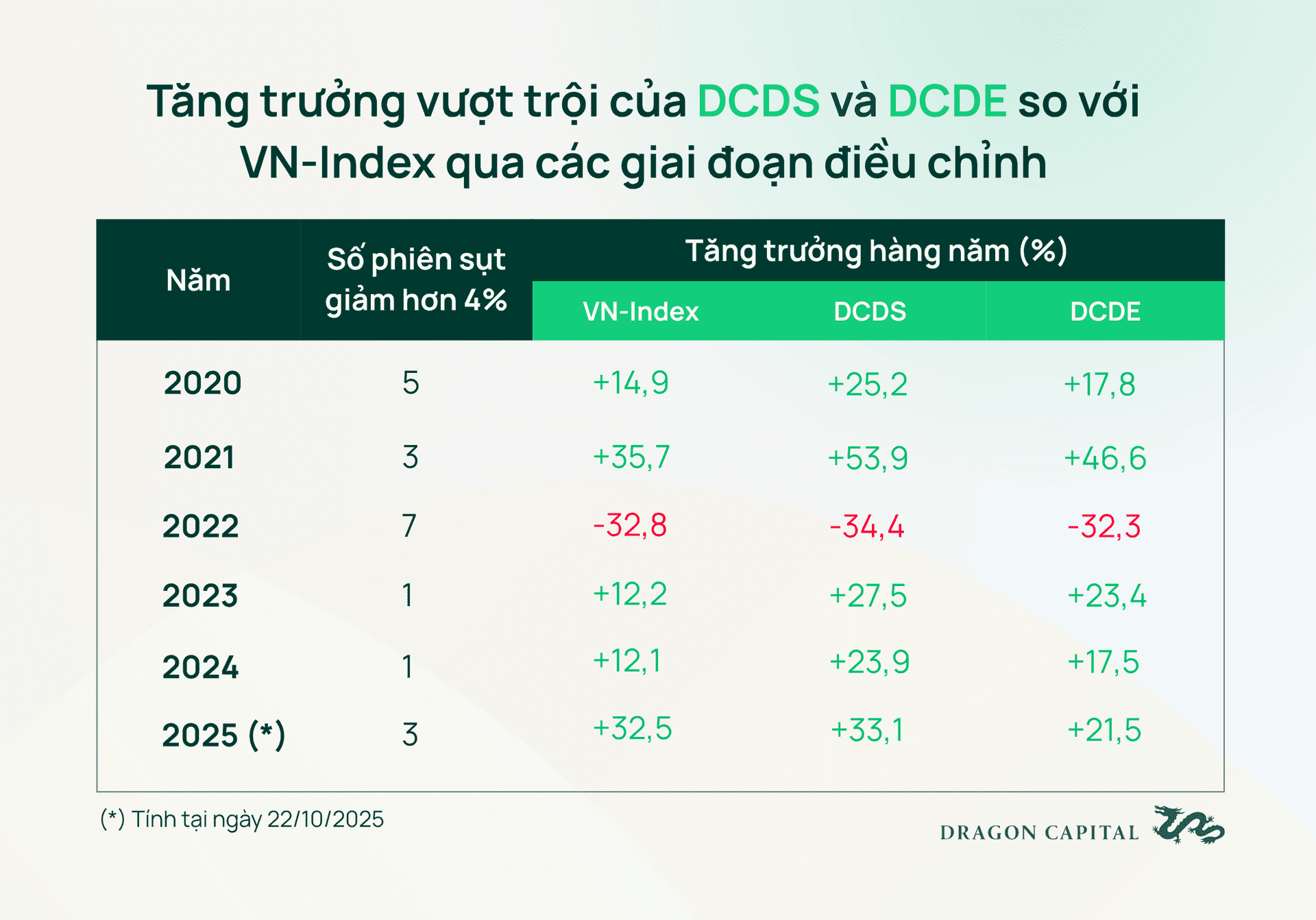

In its latest report, Dragon Capital notes that such sharp declines are not uncommon in the market. Since 2020, the VN-Index has dropped more than 4% in a single session 20 times. However, during this period, the market has also delivered four years of over 12% growth.

Despite three sessions with over 5% declines this year, the VN-Index is still up 32.5% year-to-date, demonstrating that short-term volatility doesn’t alter the long-term growth trend. Since 2020, the index has maintained its upward trajectory despite major disruptions like the COVID-19 pandemic, the Russia-Ukraine conflict, the Fed’s tightening cycle, and domestic bond market instability.

This period has also seen Dragon Capital’s DCDS and DCDE equity funds outperform the market. Data from the DCDS fund shows that investments held for over 24 months have yielded average annual returns of 18% to 34% since 2018 – comparable to many other investment channels.

Simulating a disciplined monthly investment strategy over a 10-year period ending June 2024, the average annual compound return (IRR) reached 14.8%. This result is nearly on par with a hypothetical “prophet investor” who perfectly times the market, buying only before upward movements.

These figures highlight that consistent, long-term investing can yield positive returns even in volatile markets. Conversely, panic selling during market corrections often causes investors to miss out on long-term wealth accumulation opportunities.

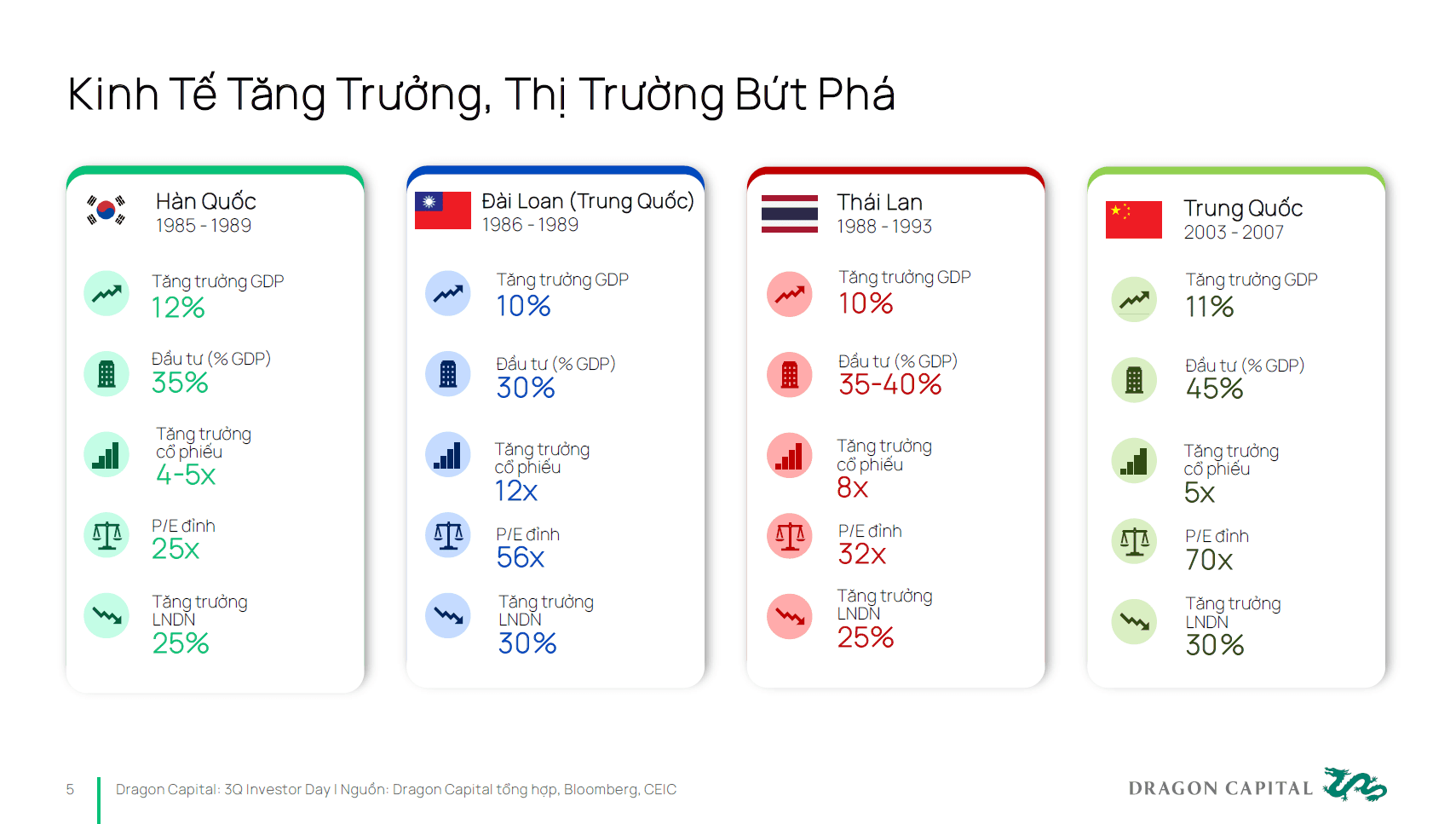

As emphasized at its Investor Day on October 9th, Dragon Capital believes Vietnam is entering a new growth phase with clear catalysts. The government is actively promoting economic policies aimed at double-digit growth. Historical examples from South Korea, Taiwan, and China show that when GDP growth reaches double digits for multiple years, stock markets often rise “by multiples” rather than just percentages.

Although the VN-Index has surpassed 1,700 points, market valuations remain attractive. The projected 2025 P/E ratio is only 12.5–13x, falling to 11x in 2026 – significantly lower than regional peers despite Vietnam’s impressive profit growth.

Historically, markets in countries with over 10% GDP growth have traded at P/E ratios of 20–25x, or even above 30x. Therefore, 5–10% corrections are considered normal before the market resumes its upward trend.

From this perspective, Dragon Capital maintains a positive outlook for long-term investment strategies, recommending that investors: (1) Hold positions long-term for superior returns; (2) Take advantage of market dips to accumulate stocks when opportunities arise; (3) Minimize short-term trading to avoid wasting time and effort without achieving better results than a long-term hold strategy.

VPBank Experts: Market Corrections Are Opportunities, Except for Overvaluation and Major Crashes

VPBankS experts assert that Vietnam’s stock market outlook remains robust in the medium term, with no significant concerns. This optimism is underpinned by the country’s sustained high economic growth rate, ranging between 8% and 10%, coupled with a manageable inflation rate of approximately 3%.