As of October 26th, the USD exchange rate in the free market was quoted at 27,550 VND/USD for buying and 27,700 VND/USD for selling, remaining stable compared to the previous day. The free market USD rate has plateaued after a rapid rise, now surpassing commercial bank rates by approximately 1,300 VND—a significant gap in recent times.

Commercial banks currently trade USD at around 26,112 VND/USD for buying and 26,352 VND/USD for selling, unchanged for several days. Compared to early October, bank USD rates have dropped by about 94 VND, while the free market rate has surged by 1,100 VND. This disparity widens the gap between official and unofficial USD/VND exchange rates.

Addressing this mismatch, Mr. Nguyễn Danh Thái, Macroeconomics Expert at CKG Vietnam, notes that free market rates reflect short-term supply-demand dynamics and market sentiment. Investors and individuals are increasingly hoarding USD amid high domestic and international gold prices, with some buying USD to smuggle gold, boosting foreign currency demand. This drives the free market rate higher than the official rate.

In the official channel, strict regulations govern foreign currency transactions at commercial banks, requiring legal needs and valid documents. Banks operate within a 5% band around the central rate under a “controlled peg” mechanism. Recently, the State Bank of Vietnam sold cancellable forward contracts to stabilize USD supply, maintaining the trade rate at around 26,320 VND/USD.

With interbank rates above 5% and the U.S. beginning rate cuts, downward pressure on the official rate has eased. Mr. Thái explains, “The free market rate rises due to real demand and defensive sentiment, while the official rate remains stable thanks to regulated supply and flexible policies. The current gap reflects short-term speculative expectations. Long-term, the State Bank must manage flexibly, ensuring strong USD inflows from trade surpluses, FDI, FII, and remittances to narrow the gap.”

Strengthening Detection of Illegal Foreign Currency Trading

In response, the State Bank of Vietnam has coordinated with the Ministry of Public Security, Ministry of Industry and Trade, and Government Inspectorate to manage foreign exchange activities.

The State Bank notes that global economic complexities have caused unofficial market rates to fluctuate, diverging from bank rates. To stabilize the forex market and minimize banking risks, the State Bank directs credit institutions to comply with forex regulations. It urges the ministries to inspect and supervise forex activities, detect illegal trading, and enforce penalties.

Bank USD rates remain stable, even declining since early October.

The State Bank requests these agencies to share information on violations to enhance market management and ensure banking safety.

Free market USD rates surge unexpectedly in recent weeks.

Ho Chi Minh City Credit Growth Estimated at 9.79% by End of October

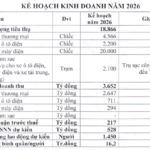

As of October 31, 2025, the total outstanding credit balance of credit institutions in Ho Chi Minh City is estimated to reach nearly VND 4,920 trillion, marking a 0.66% increase compared to the end of September and a 9.79% rise from the end of 2024.

Optimizing Depositor Protection and Ensuring Financial System Stability

Continuing the agenda of the 10th Session of the 15th National Assembly, on the morning of October 23rd at the National Assembly House, under the chairmanship of Vice Chairman of the National Assembly Vũ Hồng Thanh, the National Assembly heard the Presentation and Verification Report on the Draft Law on Deposit Insurance (amended).

Short-Term Stock Market Declines: What You Need to Know

The stock market’s growth prospects remain robust, fueled by strong domestic investor inflows and improving corporate earnings.