Wall Street Securities Corporation (WSS, listed on HNX) has registered to sell its entire stake of 2.14 million shares in Hanoi Food Joint Stock Company (HAF), representing 14.76% of HAF’s charter capital, between October 29 and November 28, 2025.

Following the transaction, WSS’s ownership in HAF will drop to 0%, and it will no longer be a shareholder.

Notably, Mr. Nguyen Viet Thang, a member of HAF’s Supervisory Board and also Deputy General Director of WSS, currently holds no shares in HAF.

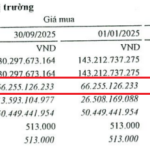

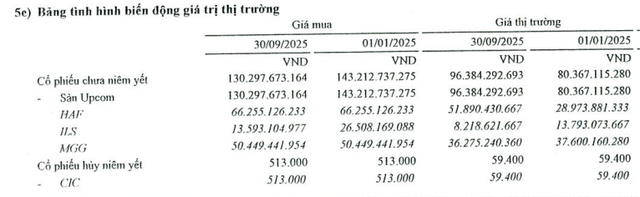

According to WSS’s Q3/2025 financial report, the investment in HAF as of September 30, 2025, had an original value of nearly VND 66.3 billion, with a temporary loss of approximately 22%. However, this loss has improved from the 79% deficit recorded earlier in the year.

Source: Wall Street Securities’ Q3/2025 Financial Report

WSS’s decision to divest comes as HAF’s shares remain under warning since April 2024 due to the auditor’s qualified opinion for three consecutive years, based on the 2023 audited financial statements.

As of June 30, 2025, HAF reported accumulated losses of nearly VND 91 billion, extending its five-year losing streak from 2020-2024, with an additional net loss of VND 4 billion in the first half of 2025.

In Q3/2025, Wall Street Securities generated over VND 17 billion in operating revenue, nearly triple the same period last year.

Meanwhile, operating expenses were reduced by nearly 58% to just over VND 5 billion. As a result, pre-tax profit reached more than VND 10 billion, compared to a loss of over VND 8 billion in the same period last year.