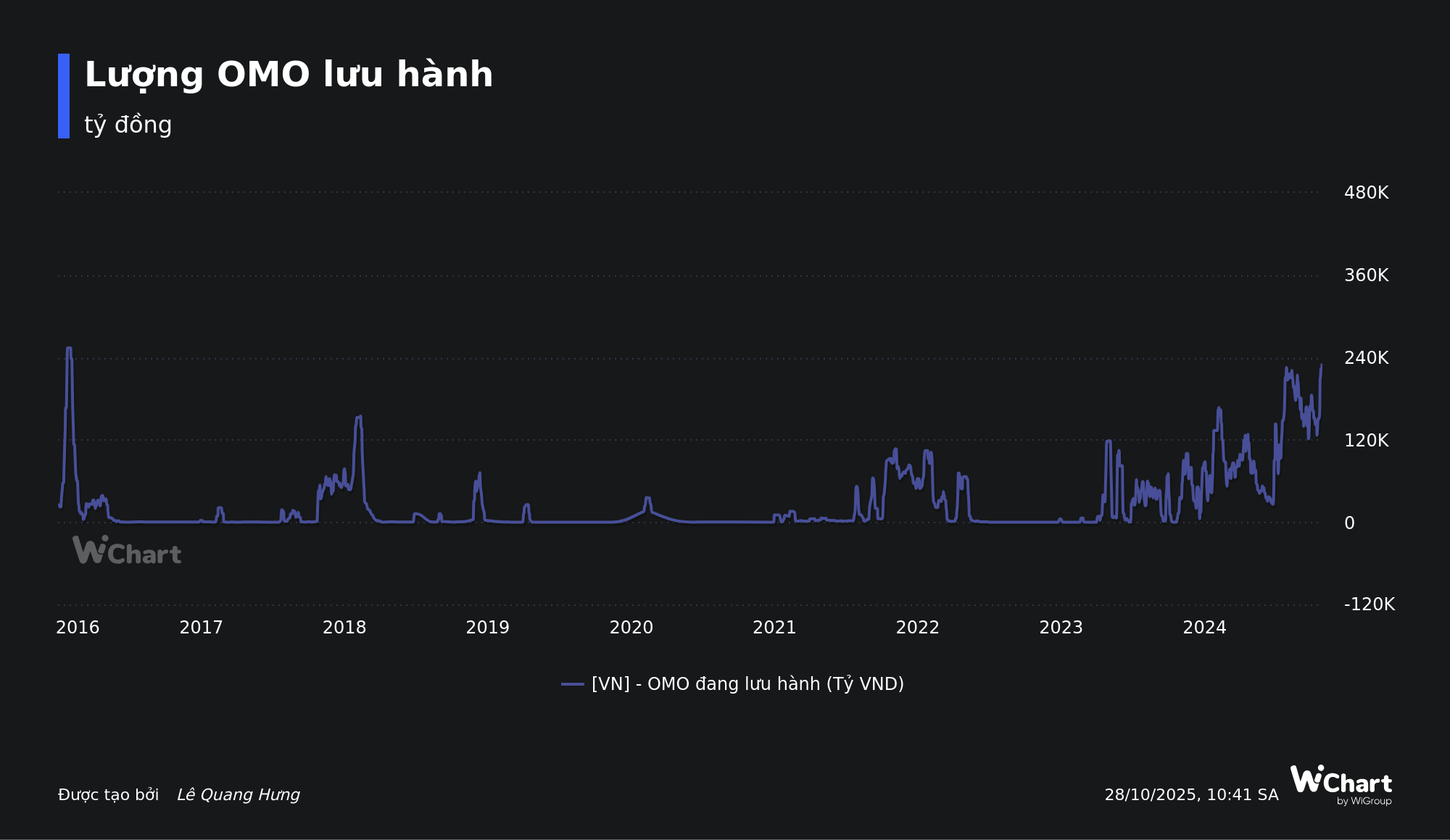

On October 27th, in the open market operations (OMO) channel, the State Bank of Vietnam (SBV) offered VND 1,000 billion for 7-day maturity, VND 3,000 billion for 14-day maturity, VND 8,000 billion for 28-day maturity, and VND 6,000 billion for 91-day maturity, all at a fixed interest rate of 4.0%. All short-term maturities were fully subscribed, with over VND 5,529 billion allocated for the 91-day term.

Meanwhile, VND 10,000 billion matured, and the SBV did not issue new treasury bills. As a result, the SBV net injected over VND 7,529 billion into the market through open market operations during the session. This brought the total outstanding OMO volume to over VND 231,012 billion—the highest level of VND liquidity support since January 2017.

Previously, the SBV net injected over VND 72,852 billion into the banking system via open market operations during the week of October 20th – 24th.

The SBV has consistently supported VND liquidity for the banking system since the beginning of 2025, with a significant expansion since late June.

According to the SBV, these open market operations aim to lower interbank interest rates, ensuring timely and sufficient liquidity for banks. This enables banks to access low-cost capital from the SBV, facilitating further reductions in lending rates in line with government directives.

Despite the SBV’s active liquidity support, the average VND interbank interest rates rose by 0.12–0.16 percentage points across all maturities of one month or less in the October 27th session compared to the previous week. Specifically, overnight rates increased to 6.00%/year; one-week rates to 6.00%/year; two-week rates to 6.02%/year; and one-month rates to 5.96%/year.

In contrast, average USD interbank interest rates decreased by 0.01–0.02 percentage points across all maturities, trading at: overnight 4.10%/year; one-week 4.13%/year; two-week 4.18%/year; and one-month 4.21%/year.

As a result, VND interbank rates are currently 1.5 times higher than USD rates. This indirectly supports the exchange rate by reducing the attractiveness of holding USD.

On October 27th, the SBV set the central exchange rate at VND 25,097 per USD, a slight decrease of 1 VND from the previous session. The buying spot rate was set at VND 23,893 per USD, 50 VND above the floor rate. The selling spot rate was set at VND 26,301 per USD, 50 VND below the ceiling rate.

In the interbank market, the exchange rate closed at VND 26,306 per USD, a minor increase of 3 VND compared to October 24th.

Latest Interest Rate Forecast: Savings and Loan Rates Poised to Rise in Q4

According to KB Securities, several banks have recorded credit growth exceeding 20% in the first nine months of the year, which could put upward pressure on deposit interest rates. Lending interest rates at many banks have stabilized in recent months, following a significant downward adjustment since the beginning of the year.

Is the Sharp Rise in Black Market USD Rates a Cause for Concern?

The black market USD price is nearing the 28,000 VND/USD mark, surpassing the official market rate by over 1,000 VND/USD. Experts suggest that while the unofficial market is rising, it’s unlikely to significantly impact the overall economy, as the State Bank continues to intervene and stabilize USD rates within the banking sector.

Central Bank Boosts Net Injection Scale in Open Market Operations

During the week of October 20-27, the State Bank of Vietnam (SBV) intensified its liquidity injection into the system through the open market channel. This move comes amid elevated overnight interbank interest rates, hovering around 5% per annum, coupled with a surge in transaction volumes.

Is the Sharp Rise in Black Market USD Rates a Cause for Concern?

The black market USD price is inching closer to 28,000 VND per USD, surpassing the official market rate by over 1,000 VND. Experts suggest that while the unofficial market is rising, it’s unlikely to significantly impact the broader economy, as the State Bank continues to intervene to stabilize USD rates within the banking sector.