Masan Group Corporation (Masan, HOSE: MSN) has released its unaudited financial report for Q3 2025 and the first nine months of the year.

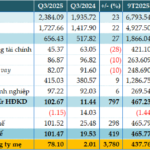

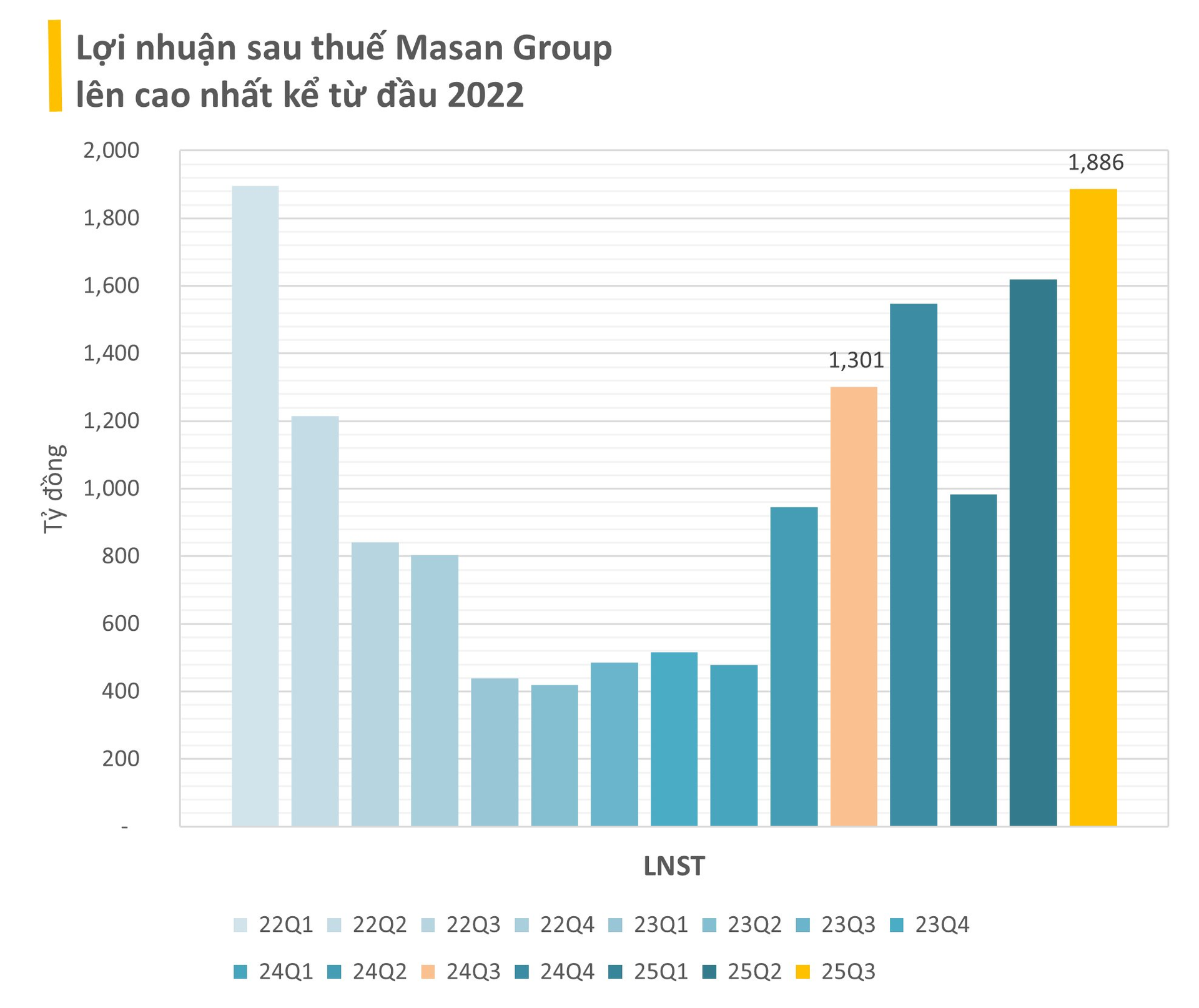

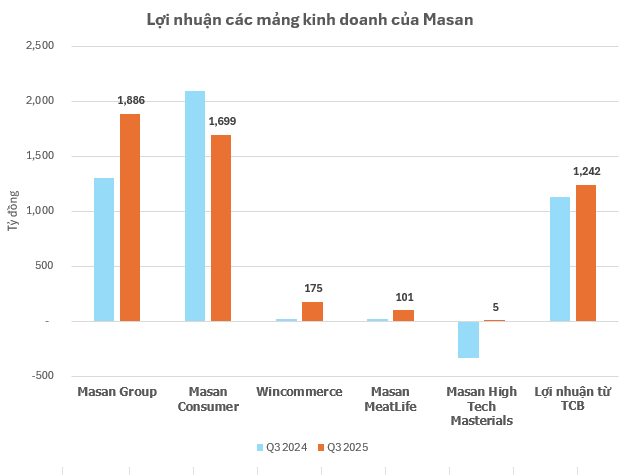

In Q3, the company achieved a revenue of VND 21,164 billion, a 9.7% increase year-on-year, with a post-tax profit of VND 1,866 billion, 1.4 times higher than the same period last year.

For the first nine months, revenue reached VND 58,376 billion, an 8% growth year-on-year, and post-tax profit hit VND 4,468 billion, a 64% surge, completing over 90% of the annual plan.

This growth was driven by strong profit performance from Wincommerce, Masan MeatLife, and Phúc Long, along with improved contributions from TCB and the deconsolidation of H.C. Starck (HCS), despite MCH’s early-stage distribution model refinement and a slight increase in net financial expenses.

WinCommerce (“WCM”): Q3 revenue reached VND 10,544 billion, up 22.6% year-on-year, with a post-tax profit of VND 175 billion, 8.7 times higher, resulting in a 1.7% profit margin. This was fueled by a 11% and 9.7% like-for-like (LFL) revenue growth in mini-supermarkets and supermarkets, respectively.

Nine-month revenue stood at VND 28,459 billion, a 16.6% increase, with a post-tax profit of VND 243 billion, up by VND 447 billion, driven by LFL growth and network expansion in Central Vietnam with WinMart+ stores.

Masan Consumer Corporation (UpCOM: “MCH”): MCH reported a Q3 revenue of VND 7,517 billion, down 6% year-on-year.

Nine-month revenue was VND 21,281 billion, a 3.1% decrease, with a post-tax profit of VND 4,660 billion, down 16%, impacted by the nationwide implementation of the “Direct Distribution” model in traditional trade channels. However, monthly and quarterly improvements were recorded, setting the stage for future growth.

Masan MEATLife (“MML”): Q3 revenue reached VND 2,384 billion, up 23%, with a post-tax profit of VND 101 billion, 5.2 times higher.

Nine-month revenue was VND 6,794 billion, a 24.7% increase, with EBIT at VND 310 billion, up 5.7 times, and post-tax profit at VND 466 billion, up by VND 526 billion, thanks to efficient operations, increased sales across all segments, and optimized pork value through enhanced MML-WCM collaboration.

Phúc Long Heritage (PLH) recorded a Q3 revenue of VND 516 billion, up 21.2%, with a net profit margin of 10.8%, 2.1 times higher.

Nine-month revenue reached VND 1,373 billion, a 14.1% increase, with a post-tax profit of VND 141 billion, up 80.1%.

Masan High-Tech Materials (“MHT”): Q3 revenue was VND 2,041 billion, with a post-tax profit of VND 5 billion, up by VND 279 billion.

Nine-month revenue stood at VND 5,048 billion, a 25.1% LFL increase, with a post-tax profit of -VND 211 billion, up by VND 1,159 billion, due to improved operational efficiency, higher commodity prices, reduced unit production costs, and the deconsolidation of H.C. Starck (HCS).

Techcombank (“TCB”): Masan’s share of TCB’s profit in Q3 2025 was VND 1,242 billion, up 9.4% year-on-year.

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.

MML Sustains Strong Profitability in Q3, Fueled by Masan Ecosystem Momentum

Masan MeatLife (UPCoM: MML) has reported impressive results in its Q3/2025 consolidated financial statements, with net revenue reaching VND 2,384 billion and post-tax profit exceeding VND 101 billion. This represents a 23% increase in revenue and a remarkable 5.2-fold growth in profit compared to the same period last year.

Masan Surges with 43% Q3 Profit Growth, Achieves Over 90% of Annual Target

Masan Group Corporation (HOSE: MSN) has announced its consolidated financial report for Q3/2025, revealing a remarkable post-tax profit of nearly VND 1,866 billion, marking a 43% surge compared to the same period last year. This outstanding performance positions Masan to achieve over 90% of its annual profit target within just nine months.

Vietnamese Businesses Accelerate Expansion, Driving Consumer Infrastructure Modernization

Vietnam’s retail market, valued at over $309 billion, is entering its fastest growth phase in the region, with modern retail channels projected to reach 35% by 2030. Amid fierce competition from global giants, WinMart stands out as a formidable domestic player, rapidly expanding to secure a strong foothold for Vietnamese businesses.