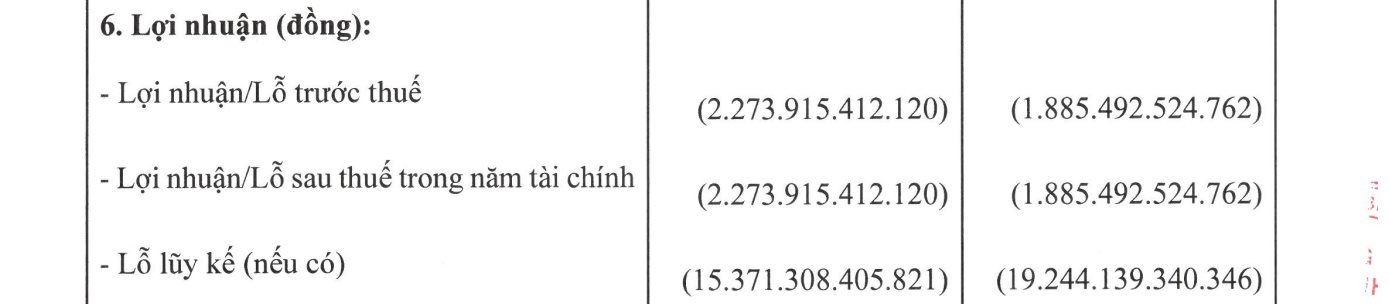

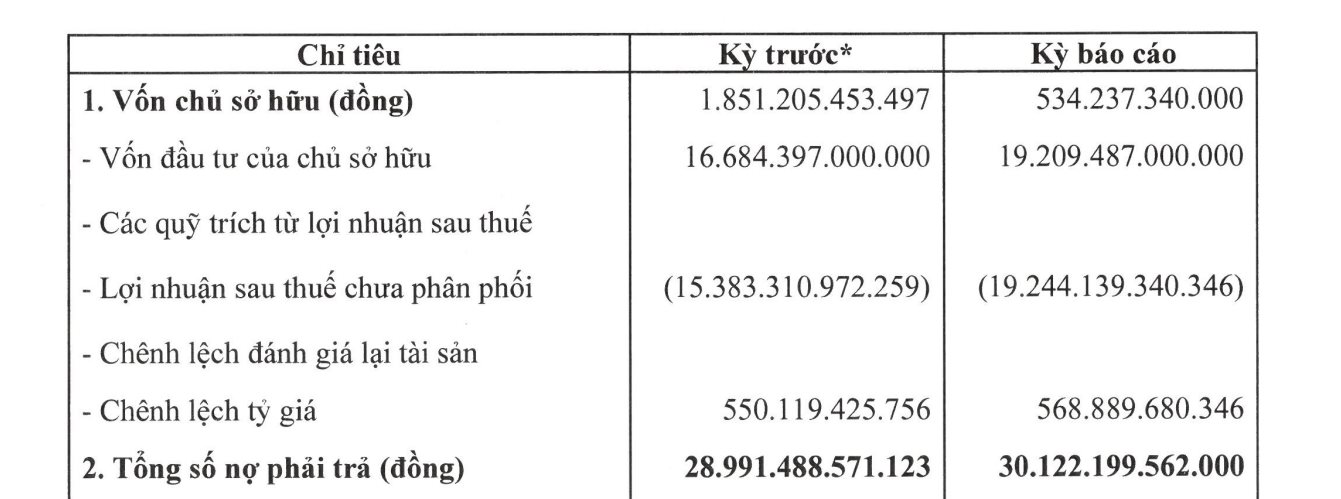

Hyosung Vina Chemicals, a wholly-owned subsidiary of South Korea’s Hyosung Chemical, established in May 2018, has released its financial report for the first half of this year. The company recorded a post-tax loss of VND 1,885 billion during this period alone.

This contributes to the cumulative loss of VND 19,244 billion for the South Korean enterprise.

Alongside this loss, the company’s total liabilities increased from VND 28,991 billion to VND 30,122 billion within a year.

According to the parent company Hyosung Chemical, 2018, the year Hyosung Vina Chemicals was founded, was the only year the company reported a profit, a modest KRW 207 million (VND 3.8 billion).

From 2019 to 2024, the results shifted from slight profits to increasing losses: KRW 5 billion in 2019, KRW 54.4 billion in 2020, KRW 72.5 billion in 2021, KRW 313.7 billion in 2022, KRW 259.4 billion in 2023, and KRW 232 billion in 2024.

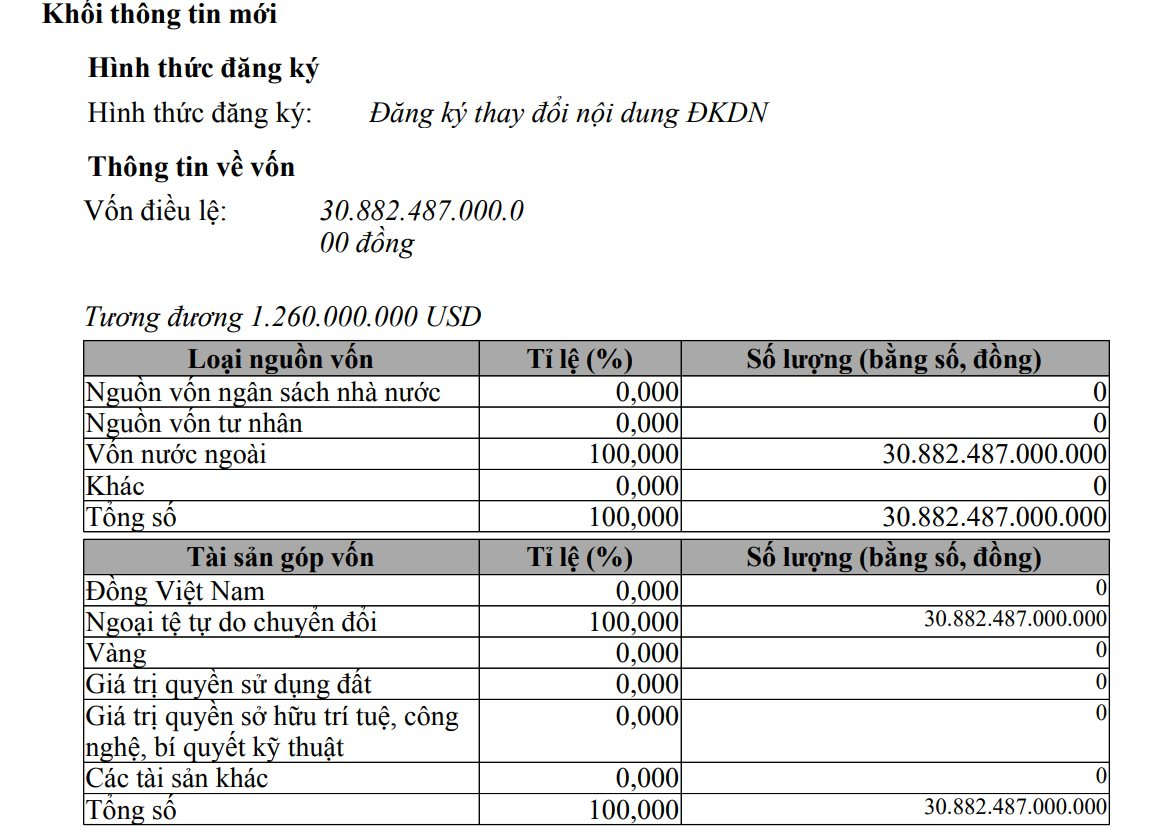

Following the report, Hyosung Vina Chemicals increased its charter capital from VND 19.2 trillion to VND 30.7 trillion in July this year.

Hyosung Chemical has not provided specific reasons for its subsidiary’s performance in Vietnam. Notably, in late September, Hyosung Chemical announced to the Korea Exchange (KRX) plans to sell its stake in Hyosung Vina Chemicals for financial restructuring, though no final decision has been made.

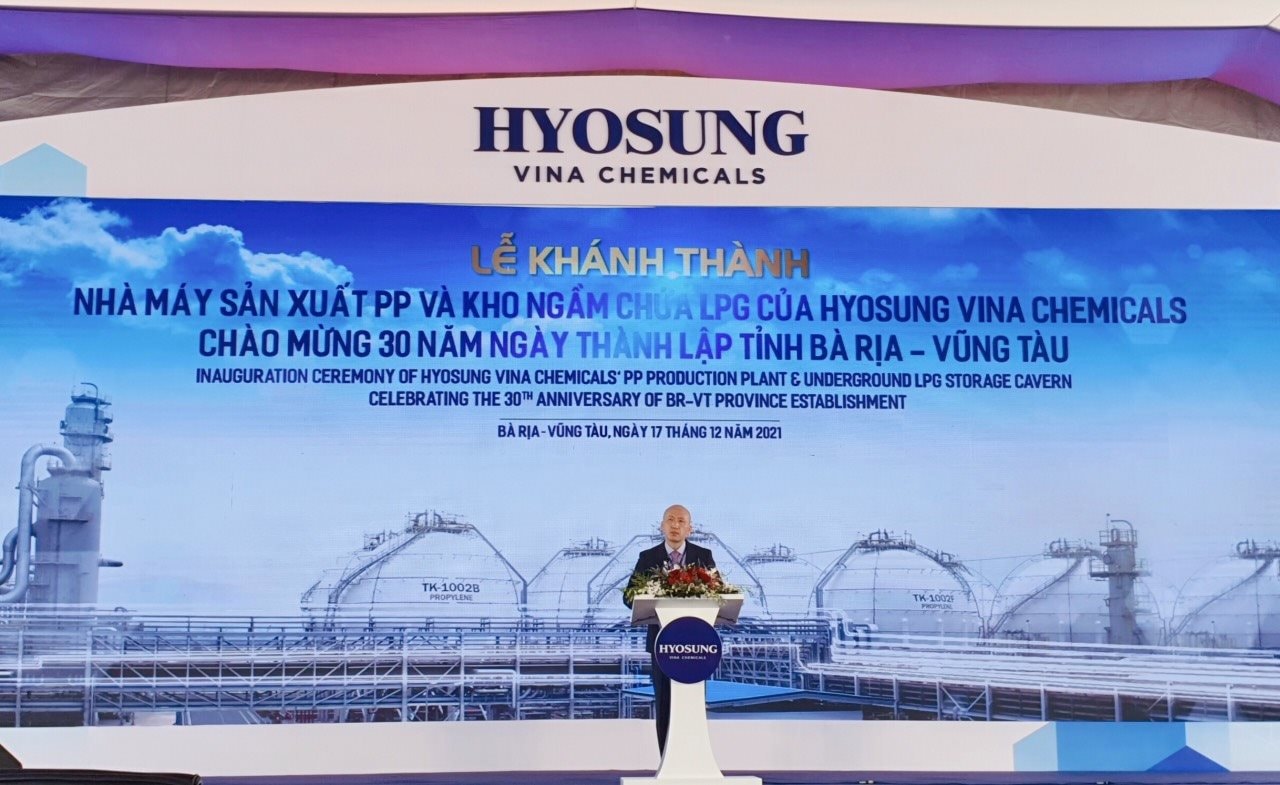

One of Hyosung Chemical’s notable projects in Vietnam is the Polypropylene (PP) plastic pellet production plant and underground LPG storage facility in Ba Ria-Vung Tau, now in Ho Chi Minh City. The project, with a total investment of USD 1.67 billion, began full operations in late 2021, producing approximately 550,000 tons of PP pellets annually.

One significant factor is the reliance on imported LPG (Propan, accounting for 67% of PP production costs). Global oil prices have surged due to the Russia-Ukraine war and Middle East instability, driving up PP costs. Meanwhile, Hyosung Vina Chemicals has been unable to raise PP prices domestically or for exports. Additionally, the company faces intense competition from cheaper, tax-free imported PP in Vietnam.

Despite these challenges, Hyosung, the parent company of Hyosung Chemical, remains committed to expanding its operations in Vietnam. Hyosung is South Korea’s third-largest FDI partner in Vietnam, with total investments of approximately USD 4.6 billion.

In March 2025, Mr. Bae In Han, General Director of Hyosung Dong Nai and Hyosung’s highest representative in Vietnam, announced plans to invest an additional USD 1.5 billion in Vietnam. This includes a biotechnology plant and a carbon fiber production facility in Ba Ria-Vung Tau.

He reiterated the group’s commitment to “building a future in Vietnam for the next 100 years,” citing Vietnam’s stable investment environment and favorable conditions for business growth.

Garmex Offloads 50,000m² of Land for $313 Billion to Offset Ongoing Losses

Garmex Saigon JSC (UPCoM: GMC) is offering its land and associated assets in Ba Ria – Vung Tau for sale at VND 313 billion, following unsuccessful auctions of other properties. This move underscores the company’s urgent need to recover capital and scale back investments as it continues to grapple with ongoing losses.

Phat Dat Corporation Reports Continued Losses in H1 2025, Debt Surpasses 11 Trillion VND

Real estate businesses continued to report losses in the first half of 2025, pushing accumulated deficits close to 115 billion VND. Meanwhile, their debt burden has ballooned, surpassing 11 trillion VND.