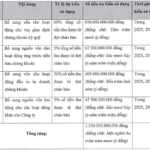

The company announced alternative plans regarding the issuance of shares to increase its charter capital. The Board of Directors will report to the upcoming Annual General Meeting about halting the registration process for the share offering to existing shareholders, as per the plan approved on October 15, 2025.

This plan involves offering shares to current shareholders to raise the charter capital to over 5.1 trillion VND, with an expected issuance of more than 365 million shares.

HD Securities aims to invest over 1 trillion VND in a cryptocurrency exchange platform

According to the plan presented to shareholders, HD Securities will offer shares at a ratio of 2:5 (shareholders holding 2 shares will be entitled to purchase 5 additional shares). The proposed selling price is 20,000 VND per share, equivalent to the book value on the semi-annual financial statements of 2025 (20,531 VND per share).

The total proceeds of over 7.3 trillion VND will primarily be allocated to investment activities, proprietary trading in securities, deposit certificates, and government bonds, with a projected capital of 4.6 trillion VND (63% allocation).

Notably, HD Securities will use 1.47 trillion VND to invest in a cryptocurrency exchange platform as it increases its capital to 10 trillion VND. This company is named HD Cryptocurrency Exchange JSC.

The remaining funds will be allocated to margin lending (25%), advance payment for securities sales (10%), and the acquisition of fixed assets, software, and operational expenses (2%).

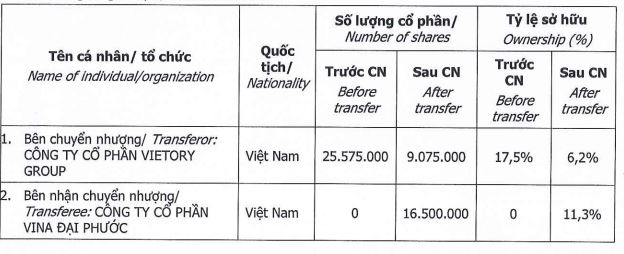

Recently, HD Securities witnessed a change in its shareholder structure. On October 20, the company recorded a transfer of over 10% of its charter capital. Vietory Group JSC transferred 16.5 million shares to Vina Dai Phuoc JSC. Following this transaction, Vietory Group’s ownership decreased to over 9 million shares, equivalent to 6.2% of the capital. Conversely, Vina Dai Phuoc JSC, previously a non-shareholder, became a major shareholder with 16.5 million shares, representing 11.3% of the capital.

|

Capital Transfer Transaction at HD Securities

Source: HD Securities

|

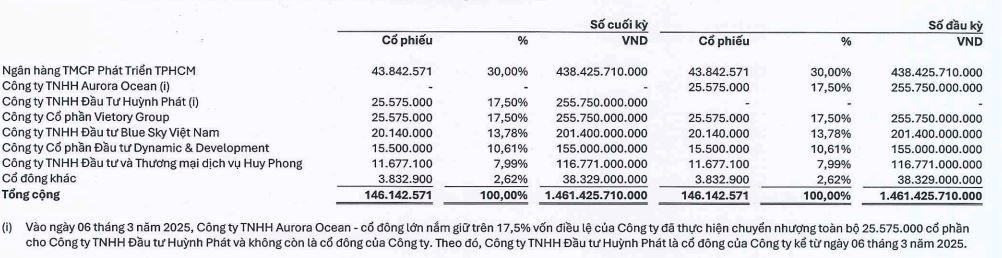

According to the reviewed financial report as of June 30, 2025, HD Securities has six major shareholders holding over 97% of the charter capital: HDBank (30%), Huynh Phat Investment LLC (17.5%), Vietory Group JSC (17.5%), Blue Sky Vietnam Investment LLC (13.78%), Dynamic & Development Investment JSC (10.61%), and Huy Phong Investment and Trading Services LLC (7.99%).

|

Shareholder Structure of HD Securities

Source: HD Securities Financial Report

|

Vina Dai Phuoc JSC, headquartered in Dong Nai, is a joint venture between DIG and VinaCapital (through two member funds), established in 2007 with a charter capital of nearly 1,654 billion VND, to develop the Hoa Sen Dai Phuoc project. As of August 2016, DIG held 28% of the capital, while two foreign shareholders, VinaCapital Pacific Limited – Singapore (54%) and Allright Assets Limited – Singapore (18%), held the remainder.

After more than 10 years of establishment, the founding shareholders of Vina Dai Phuoc gradually withdrew their investments: VinaCapital in 2017 and DIG in 2019. The recipient of VinaCapital’s shares was China Fortune Land Development (CFLD), a Chinese industrial real estate developer. The project was renamed from Hoa Sen Dai Phuoc to Swan Bay Dai Phuoc after the new investor took over.

By the end of 2021, Vina Dai Phuoc announced that SNC Investments 27 and SNC Investments 28, two subsidiaries of CFLD based in Singapore, were no longer part of the company’s shareholder structure. In 2023, the Chairman of the Board of Directors remained Mr. Lin, Yi Huang, a Taiwanese national, and an additional legal representative, a Vietnamese General Director, was appointed. By the end of 2023 and early 2024, market indications suggested that foreign investors were gradually exiting the Dai Phuoc project, though the new investors remained undisclosed.

The two new leaders of Vina Dai Phuoc hold managerial positions within a prominent real estate conglomerate within the ecosystem.

– 11:07 29/10/2025

Unveiling the Potential of Tuan Huy Phu Tho: The Visionary Developer Behind the 1.000 Billion VND Cam Khe Central Park Project

From a humble beginning as a construction company with a charter capital of 1 billion VND, Tuan Huy Phu Tho has consistently grown its capital to an impressive 200 billion VND. In 2024, the company further solidified its position by pledging assets related to the Cam Khe Central Park project as collateral at a bank.

HD Securities Welcomes New Major Shareholder

Vina Dai Phuc Corporation (CTCP Vina Đại Phước) has recently acquired 16.5 million shares, representing an 11.3% stake in HD Securities (Chứng khoán HD), solidifying its position as a major shareholder.