Source: VietstockFinance

|

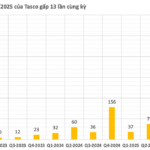

The Q3 2025 financial report reveals that AIC’s gross profit from insurance operations reached VND 85 billion, a remarkable 21.9-fold increase compared to the same period last year. This impressive result stems from a 34% surge in net revenue to VND 669 billion, driven by a 42% rise in original insurance premiums to over VND 929 billion. Meanwhile, expenses grew by only 18%, with claims expenses increasing slightly by 2% to VND 216 billion.

Financial activities also showed improvement, with gross profit rising by 11% to VND 41 billion. However, business management costs soared by 67%, primarily due to increased staff expenses, reaching VND 141 billion. This led to a net loss of VND 13 billion for DBV Insurance, though this loss is significantly narrower than the VND 39 billion loss recorded in the same period last year.

For the first nine months of the year, gross profit from insurance operations totaled VND 216 billion, 2.6 times higher than the same period last year, while financial profit remained stable at VND 107 billion. As a result, AIC shifted from a net loss of VND 21 billion in the same period last year to a net profit of VND 13 billion.

In 2025, AIC set a pre-tax profit target of VND 40 billion, 2.6 times higher than in 2024. After nine months, the company has achieved nearly 40% of this goal.

As of September 30, 2025, AIC’s total assets remained stable compared to the beginning of the year, at over VND 5.1 trillion. Term deposits decreased by 15% to more than VND 2.3 trillion, accounting for 45% of total assets.

Total liabilities exceeded VND 4 trillion, primarily short-term debt. Short-term provisions accounted for 70% of this, reaching over VND 2.8 trillion, a slight 3% increase from the start of the year.

|

DBV Insurance, formerly known as Aviation Insurance (VNI), was established in 2008 and officially rebranded on May 6, 2025, following a change in ownership over a year earlier. Since January 31, 2024, DB Insurance and Handicraft Import-Export Corporation have held 75% and 11.55% of DBV’s shares, respectively. DB Insurance is a non-life insurance company within the DB Group ecosystem, one of South Korea’s largest economic conglomerates. Founded in 1962, DB Group is now South Korea’s second-largest non-life insurer, with a global operational network. |

– 2:02 PM, October 28, 2025

FPT Under Trương Gia Bình’s Leadership Earns $190,000 Daily in Bank Interest

In the first nine months of the year, FPT’s financial activities generated nearly VND 2.424 trillion, with bank deposit interest alone contributing a substantial VND 1.235 trillion.