SMC Investment and Trading JSC (Stock Code: SMC) has recently announced a decision dated October 24 by the Ho Chi Minh City Tax Department regarding administrative penalties for tax violations.

SMC Investment and Trading JSC was found to have misdeclared its tax filings, resulting in underpayment of taxes.

Based on the violation, the regulatory authority imposed a fine of nearly VND 3.8 billion for incorrect declarations leading to underpayment of VAT and corporate income tax. Additionally, SMC was required to pay over VND 18.8 billion in back taxes and more than VND 3.5 billion in late payment penalties.

The late payment penalties are calculated up to October 20, 2025. SMC is responsible for calculating and paying any additional late fees from October 21, 2025, until the actual payment date, as per regulations.

In total, the fines and back taxes amount to over VND 26 billion.

The regulatory authority has given SMC 10 days from the receipt of the penalty decision to comply. Failure to do so will result in forced execution of the administrative decision as per the law.

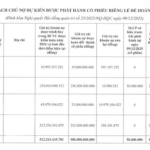

In related news, SMC recently approved the sale of various collateral assets to repay bank debts. These assets, pledged at Vietinbank – Ho Chi Minh City Branch, include over 10 million shares of Hoa Binh Construction Group JSC (Stock Code: HBC) and a deposit contract worth VND 10 billion.

Furthermore, SMC Investment and Trading JSC agreed to release collateral assets pledged at Vietinbank – Ho Chi Minh City Branch for SMC Steel Mechanics Co., Ltd. These assets, valued at VND 62 billion, include deposit contracts, real estate, and the entire machinery system and ice-melting production line invested in 2018.

SMC also approved the release of collateral assets for SMC Steel Co., Ltd., pledged at Vietinbank – Ho Chi Minh City Branch. These assets include deposit contracts worth VND 29.5 billion, real estate, and machinery in the steel pickling, pressing, and plating workshop.

All proceeds from the liquidation of these assets will be used to settle the outstanding debts of SMC group members with Vietinbank – Ho Chi Minh City Branch.

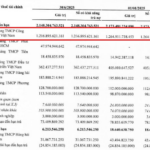

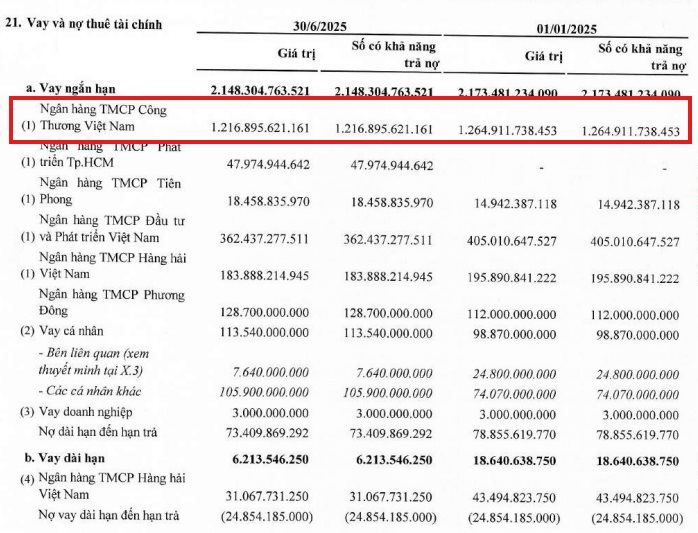

As of June 30, 2025, SMC Investment and Trading JSC had outstanding loans of over VND 2,300 billion, four times its equity. Short-term loans totaled nearly VND 2,150 billion, while long-term loans were close to VND 180 billion.

The largest debt, nearly VND 1,217 billion, is owed to the Joint Stock Commercial Bank for Industry and Trade of Vietnam.

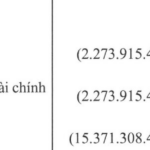

In the first half of 2025, the group incurred a loss of VND 102 billion, resulting in an accumulated loss of VND 242 billion. Net cash flow from operating activities was negative VND 129 billion. As of June 30, 2025, short-term liabilities exceeded short-term assets by VND 971 billion.

“These factors raise doubts about the group’s ability to continue operating in the future,” emphasized the auditor in the 2025 semi-annual financial review report.

SMC was once Vietnam’s leading steel trading company, achieving a record net revenue of VND 21,000 billion and after-tax profit of VND 901 billion in 2021. However, since 2022, its business results have declined due to falling steel prices and difficulties in recovering debts from customers in the construction and real estate sectors.

On the market, SMC shares are trading at around VND 10,600 per share.

South Korean Conglomerate Builds Billion-Dollar Plant in Ho Chi Minh City: Reports $188M Loss in H1 2025, Accumulated Losses Reach $850M, PwC Auditors Raise Concerns

PwC’s audit reveals that Hyosung Vina Chemicals’ accumulated losses and short-term liabilities have surpassed its current assets, raising concerns about the company’s ability to continue as a going concern.