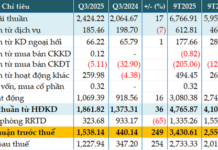

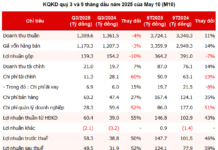

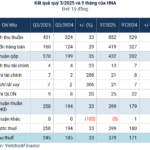

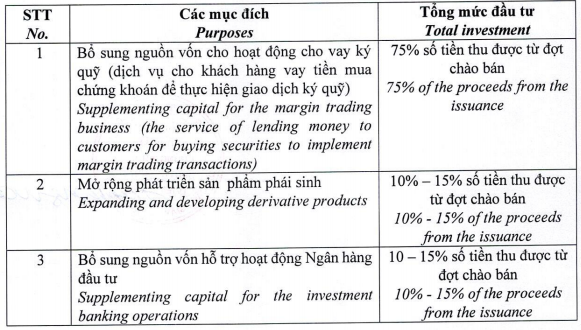

By the end of Q3, TDC reported a net revenue of VND 684 billion, a fourfold increase compared to the same period last year. However, due to rising production costs, gross profit reached nearly VND 115 billion, up by 10%. The gross profit margin narrowed from 60% to approximately 17%.

A highlight was the surge in financial revenue, which skyrocketed to nearly VND 38 billion, over 6,000 times higher than the previous year, thanks to profits from business partnerships.

Despite a 24% increase in financial, selling, and administrative expenses to VND 65 billion, TDC still achieved a net profit of nearly VND 89 billion, a 66% growth.

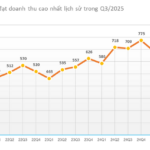

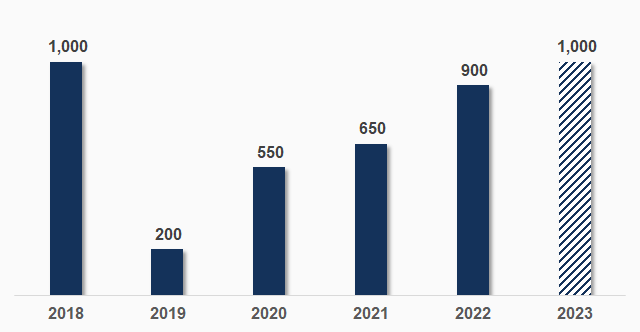

TDC Business Results from Q1/2022 – Q3/2025

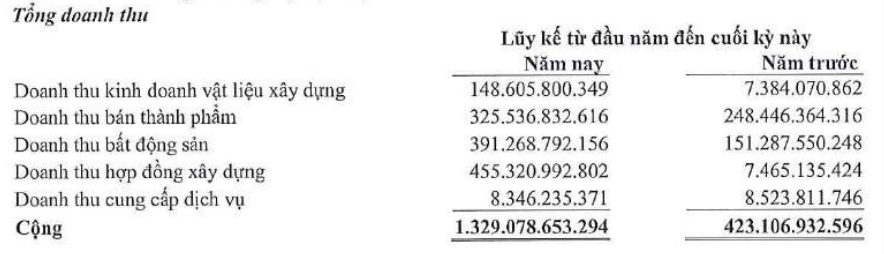

In the first nine months, cumulative net revenue exceeded VND 1,315 billion, 3.2 times higher than the previous year. Construction contracts saw the most significant growth, contributing over VND 455 billion, a 61-fold increase; real estate brought in more than VND 319 billion, 2.6 times higher; and building materials sales reached nearly VND 149 billion, over 20 times more. After-tax profit was nearly VND 156 billion, a 50% increase.

|

Revenue Structure for 9M/2025 of TDC

Source: TDC

|

Compared to the 2025 annual plan of VND 3,139 billion in total revenue and VND 254 billion in after-tax profit, TDC has achieved 47% and 62%, respectively.

Source: VietstockFinance

|

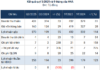

TDC‘s total assets at the end of Q3 were nearly VND 4,587 billion, a 4% increase from the beginning of the year. Cash on hand reached almost VND 56 billion, 3.9 times higher. Short-term receivables from customers also rose sharply by 63% to over VND 1,255 billion, including receivables from Becamex Industrial Development and Investment Corporation (HOSE: BCM) of more than VND 72 billion and from Binh Duong Construction and Transportation JSC (HOSE: BCE) of over VND 258 billion.

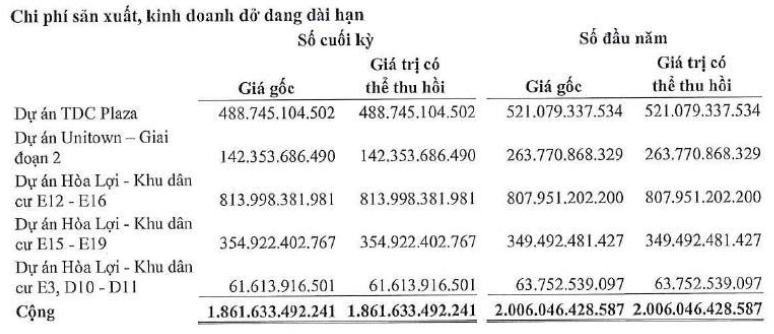

Long-term work-in-progress inventory stood at nearly VND 1,862 billion, down 7%, primarily concentrated in the Hoa Loi – E12 Residential Area project with VND 814 billion and the TDC Plaza Housing project with VND 489 billion.

Source: TDC

|

Total liabilities were over VND 2,991 billion, down 9%, with financial debt amounting to nearly VND 1,590 billion, accounting for 53% of total liabilities.

The TDC Board of Directors recently approved the use of credit services from Tien Phong Commercial Joint Stock Bank (HOSE: TPB) up to VND 1 trillion for loans and guarantees to execute the TDC Plaza Housing project, which the company is developing.

TDC Plaza is a high-end condominium project featuring 5 blocks of 21-story buildings, located within the Binh Duong New City planning area, part of the Binh Duong Industrial-Service-Urban Complex. TDC announced the project’s total value at nearly VND 567 billion.

– 11:41 29/10/2025

Nam Long Reports 23x Surge in 9-Month Profit, Sales Exceed VND 5 Trillion

Nam Long Investment Corporation (HOSE: NLG) has achieved remarkable business results in Q3 and the first nine months of the year, significantly outperforming the same periods last year. This exceptional growth is primarily driven by the successful handover of key projects.

Electric Light Escapes Losses Through Asset Liquidation

The proceeds from the liquidation of fixed assets enabled Dien Quang Lamp Joint Stock Company (HOSE: DQC) to turn a profit in Q3, partially mitigating the issues that had led to the stock being placed under special control.