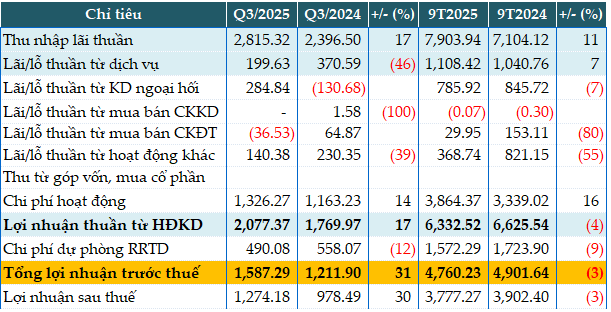

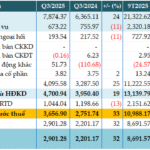

In Q3 alone, MSB’s net interest income surged by 17% year-over-year, reaching VND 2,815 billion.

Conversely, several non-interest income streams experienced declines, including service fees (-46%), other operating income (-39%), and trading securities, which reported a loss. Notably, foreign exchange operations turned a profit of nearly VND 285 billion, a stark contrast to the loss reported in the same period last year.

Operating expenses rose by 14% to VND 1,326 billion. As a result, net profit from operations increased by 17% to VND 2,077 billion.

MSB reduced its credit risk provisioning costs by 12%, allocating just over VND 490 billion in Q3. Consequently, pre-tax profit climbed by 31% to VND 1,587 billion.

For the first nine months of the year, MSB’s after-tax profit dipped by 3% compared to the same period last year, totaling VND 4,760 billion. Against the annual pre-tax profit target of VND 8,000 billion, MSB has achieved 60% of this goal in the first three quarters.

The net interest margin (NIM) for the last 12 months stood at 3.45%.

|

MSB’s Q3 and 9-month business results for 2025. Unit: Billion VND

Source: VietstockFinance

|

As of the end of Q3, the bank’s total assets grew by 11% year-to-date to VND 355,678 billion. Customer loans increased by 16% to VND 204,953 billion, while customer deposits rose by 19% to VND 183,397 billion. Of this, non-term deposits (CASA) exceeded VND 51,000 billion, a 25% increase, accounting for 28% of total deposits. Term deposits grew by 16% to nearly VND 132,360 billion, and the issuance of securities reached nearly VND 26,100 billion, up by 23%.

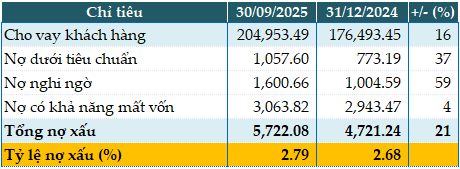

Total non-performing loans as of September 30, 2025, were recorded at VND 5,722 billion, a 21% increase. Consequently, the NPL ratio rose slightly from 2.68% at the beginning of the year to 2.79%. The individual NPL ratio stood at 1.9%.

|

MSB’s loan quality as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, MSB’s consolidated capital adequacy ratio (CAR) was 12.18%. The loan-to-deposit ratio (LDR) stood at 71.31%, and the ratio of short-term funding for medium to long-term loans (MTLT) was maintained at 27.03%.

– 4:43 PM, October 30, 2025

Vietcombank Reports 5% Surge in Pre-Tax Profit for Q3, Bolstered by Robust Reserves

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 11,239 billion in Q3/2025, marking a 5% year-on-year increase despite a significant rise in risk provisioning costs, as revealed in its recently released consolidated financial statement.

Sacombank Reports Pre-Tax Profit of Nearly VND 11 Trillion in 9 Months, Up 36%

Sacombank (HOSE: STB) reported a pre-tax profit of nearly VND 3.657 trillion in Q3/2025, marking a 33% year-on-year increase. This impressive growth is attributed to robust core revenue expansion and reduced risk provisioning costs. Consequently, the bank’s nine-month profit surged to VND 10.988 trillion, reflecting a 36% rise compared to the same period last year.

MSB Achieves ACCA Approved Employer Certification: Committed to Sustainable Talent Development

Maritime Bank (MSB) has been officially recognized as an ACCA Approved Employer by the Association of Chartered Certified Accountants (ACCA), marking a significant milestone in its strategic partnership with the global accounting body. This achievement underscores MSB’s commitment to human resource development, a cornerstone of its sustainable growth strategy.

Maritime Bank (MSB) has officially been recognized as an ACCA Approved Employer by the Association of Chartered Certified Accountants (ACCA), solidifying its strategic partnership with the organization. This milestone underscores MSB’s dedication to human resource development, a core pillar of its sustainable growth strategy.