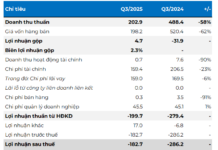

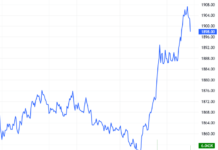

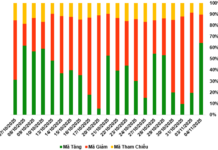

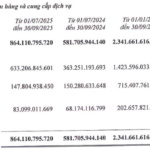

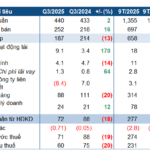

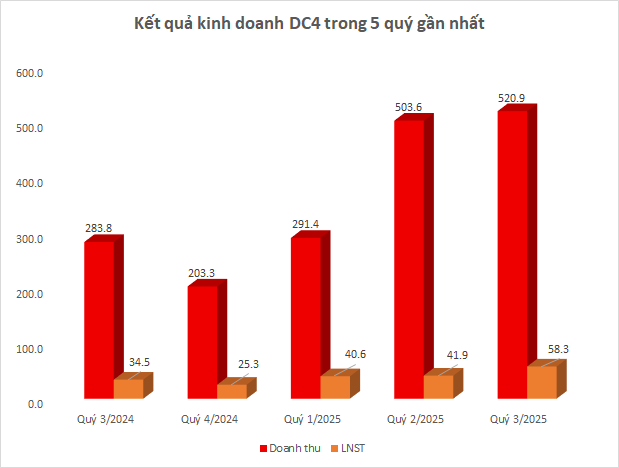

Specifically, in Q3/2025, DC4’s net revenue reached nearly VND 521 billion, an 83% increase compared to the same period last year, driven by the transfer of apartments in A2-1 Condominium (Vung Tau Centre Point). Consequently, Q3 net profit exceeded VND 58 billion, marking a 70% growth compared to Q3/2024 and the highest profit in the last five quarters.

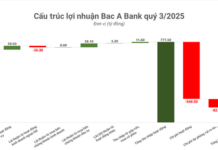

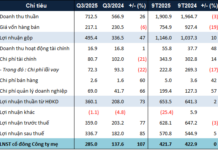

Source: VietstockFinance, Unit: Billion VND

|

In the first nine months of the year, DC4 achieved revenue of over VND 1,303 billion and a net profit of VND 141 billion, both up more than 45% year-on-year. This result also helped DC4 fulfill nearly 82% of its full-year 2025 profit target.

As of the end of Q3, DC4 increased its cash holdings to VND 356 billion, a 1.5-fold increase from the beginning of the year. Notably, the company reduced its debt to just VND 2.8 billion (long-term debt to zero) from over VND 490 billion at the start of the year.

Alongside improved business results, on October 31, 2025, DC4 and PetroVietnam Chemical and Services Corporation (HOSE: PVC) entered into a strategic partnership. Under this agreement, DC4 will explore and develop investment opportunities on land managed and owned by PVC. Through this collaboration, both parties aim to enhance project investment and development, diversifying their product portfolios.

Signing ceremony between DC4 and PVC

|

Mr. Lê Đình Thắng, Chairman of DC4’s Board of Directors, stated: “The combination of DC4’s project implementation expertise and diverse product-service ecosystem with PVC’s resource and land strengths will create high-quality projects, delivering sustainable value to the community and stakeholders.”

Mr. Trương Đại Nghĩa, Chairman of PVC’s Board of Directors, emphasized that the partnership reflects the spirit of cooperation and mutual development among Vietnamese enterprises during a period of significant economic transformation.

– 14:14 31/10/2025

REE Profits Surge 41%, Injects Hundreds of Billions into Stock Market Investments

According to the Q3/2025 financial report, Refrigeration Electrical Engineering Corporation (HOSE: REE) recorded a remarkable 41% surge in net profit, primarily driven by robust growth in its hydropower and refrigeration engineering segments.

DXS Q3 Profits Double Year-Over-Year, Secures Nearly 6 Trillion VND in Marketing and Project Distribution Deposits

Revised Introduction:

CTCP Dịch vụ Bất động sản Đất Xanh (HOSE: DXS) reported a remarkable surge in consolidated net profit for Q3, doubling year-over-year. Notably, short-term receivables reached approximately VND 10.5 trillion, with nearly VND 6 trillion attributed to deposits and advance payments for marketing and project distribution contracts.

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.