The consolidated gross profit margin of the phone and pharmaceutical retailer reached 19.4% in Q3, up from 18.2% in the same period last year, primarily driven by the growth of its pharmacy chain.

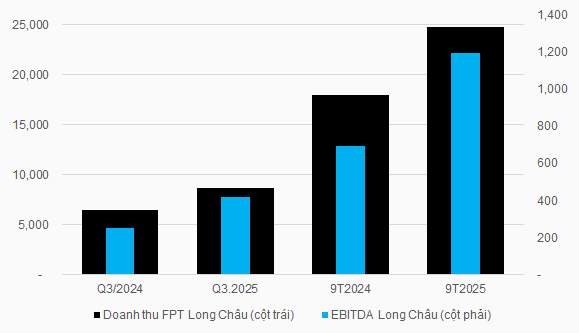

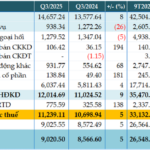

In Q3/2025, the revenue of the FPT Long Châu pharmacy and vaccination system hit 8.76 trillion VND, a 35% increase, with EBITDA profit reaching 420 billion VND, up 66%. This segment contributed 66% of total revenue and 79% of consolidated EBITDA profit for FPT Retail in the quarter.

|

Revenue and EBITDA of FPT Long Châu

Unit: Billion VND

Source: Consolidated FSC of FPT Retail

|

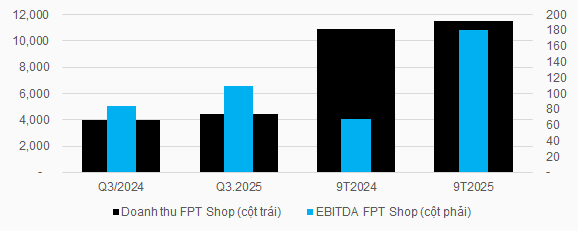

As for FPT Shop, the chain’s business efficiency improved, with Q3 revenue reaching 4.43 trillion VND, up 11%, and EBITDA profit at 109 billion VND, a 30% increase year-over-year.

The company attributed this growth to strong performance in electronics, services, and laptops, particularly gaming and AI laptops during the back-to-school season. Additionally, pre-orders for the iPhone 17 surged compared to the previous year, further bolstering revenue.

|

Revenue and EBITDA of FPT Shop

Unit: Billion VND

Source: Consolidated FSC of FPT Retail

|

Regarding FPT Retail’s balance sheet, the company reported term deposits of nearly 5.2 trillion VND at the end of Q3, a 5.3-fold increase from the beginning of the year. This surplus cash, deposited in banks, stems from increased capital utilization from suppliers like Apple and Digiworld, as well as additional equity raised from investors this year.

In the first nine months of 2025, FPT Retail invested nearly 401 billion VND in purchasing, constructing fixed assets, and long-term assets. As a result, 451 pharmacies and vaccination centers have been operational, surpassing the full-year expansion plan.

– 4:58 PM, 30/10/2025

Viettel Global Reports Record-Breaking Q3 2025 Profits, Revenue Surges Over 20% for 8 Consecutive Quarters

Viettel Global (stock code: VGI) has released its consolidated financial report for Q3/2025, showcasing remarkable growth in both revenue and profit, marking another quarter of exceptional business performance.

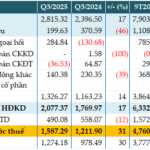

MSB’s Q3 Pre-Tax Profit Surges 31% on Strong Forex Gains

The Q3/2025 consolidated financial report reveals that Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) achieved pre-tax profits exceeding VND 1.587 trillion, marking a 31% year-on-year increase. This impressive growth is attributed to the bank’s robust core income expansion and successful foreign exchange operations.