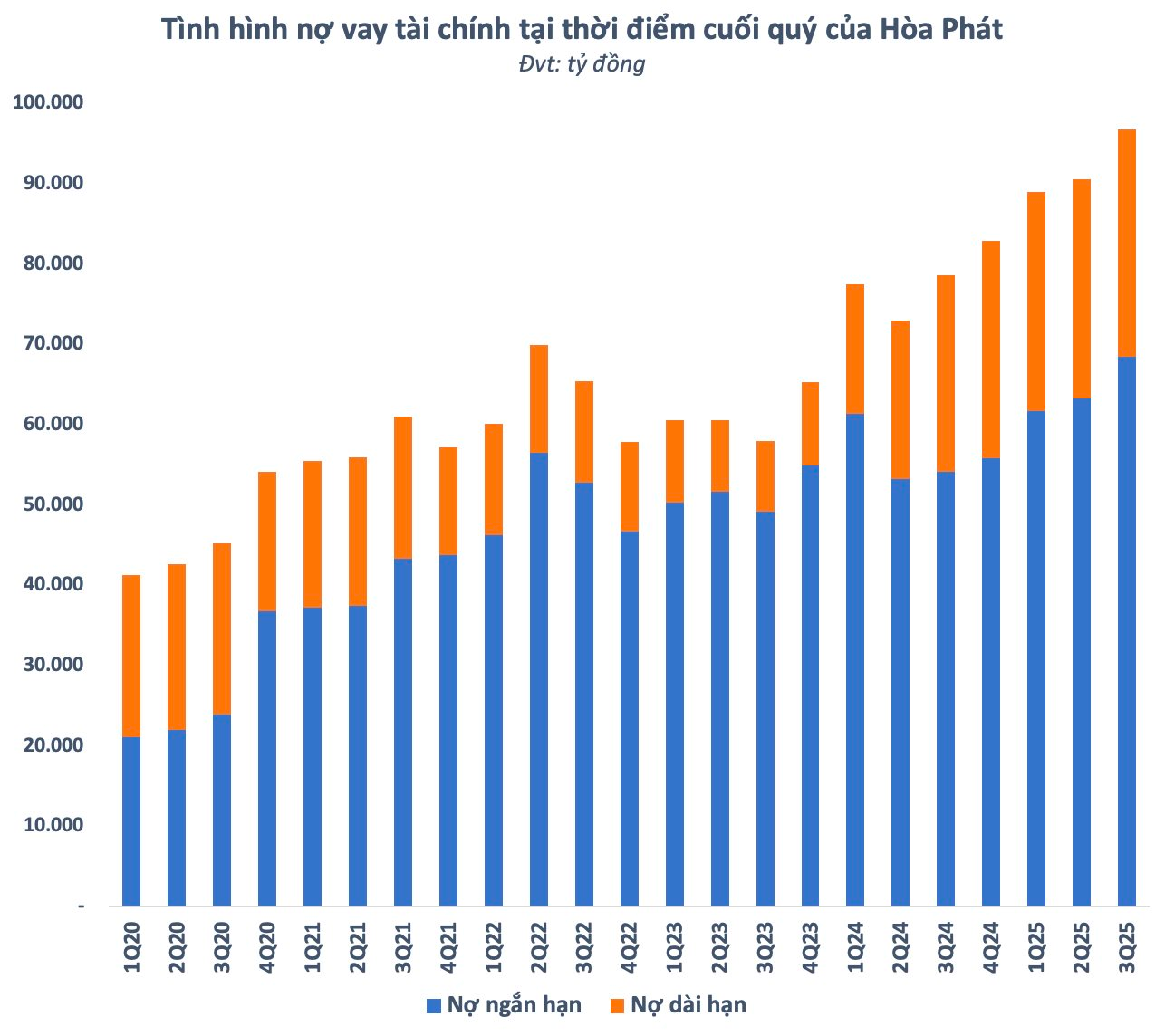

According to the consolidated financial report for Q3/2025, Hoa Phat Group’s (stock code: HPG) total financial debt reached VND 96,838 billion as of September 30th, marking a VND 13,875 billion increase since the beginning of the year and setting a new record high. Short-term debt accounted for VND 68,482 billion, while long-term debt stood at VND 28,356 billion, both reaching unprecedented levels.

Hoa Phat attributed the debt increase primarily to the disbursement of medium and long-term loans for ongoing investment projects, notably the Hoa Phat Dung Quat 2 Steel Complex. Additionally, working capital requirements rose to support production activities following the commencement of Phase 1 of the Dung Quat 2 project, necessitating additional raw materials and operational expenses during the initial phase.

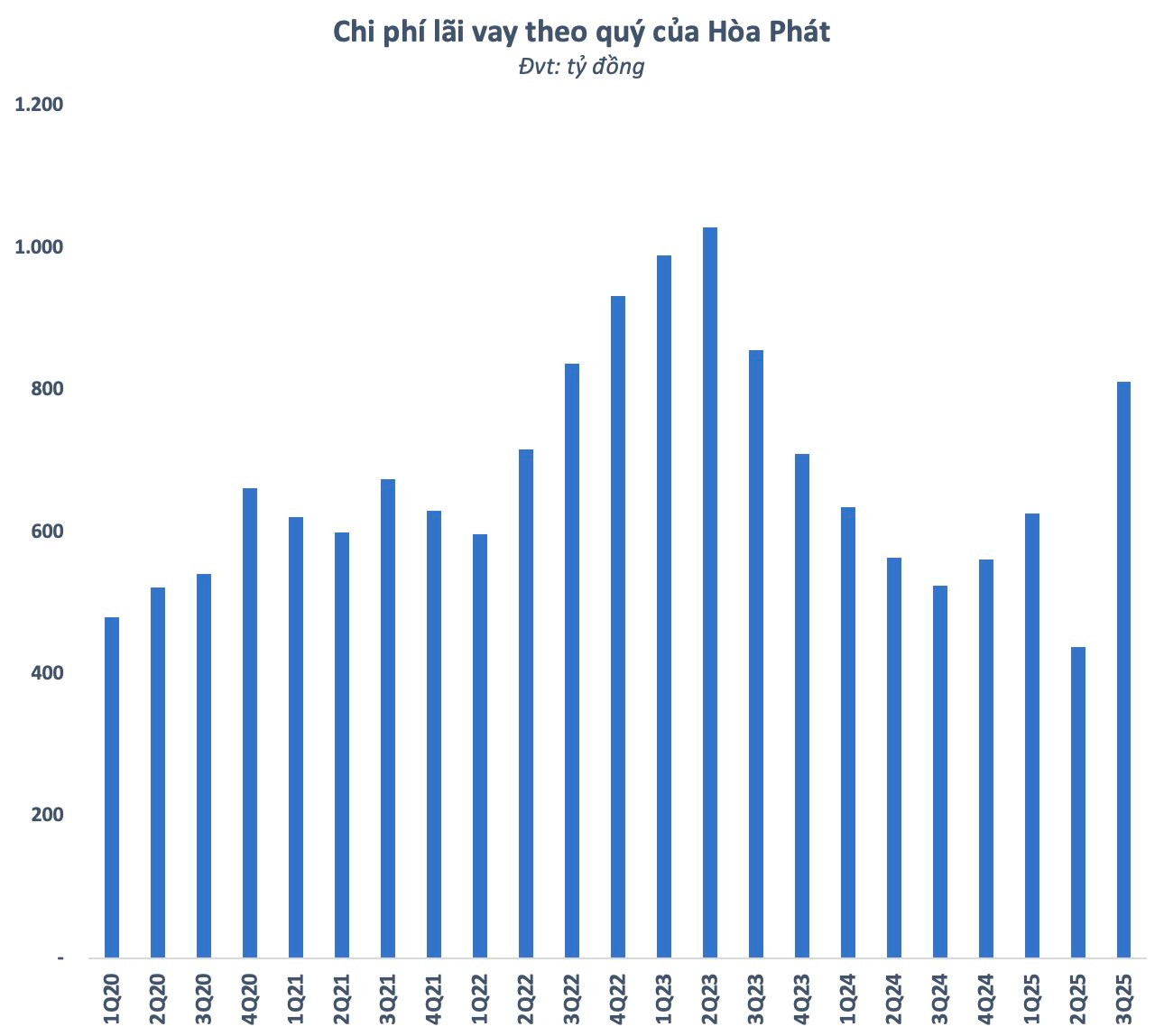

In Q3, Hoa Phat’s financial expenses rose slightly by nearly 10% quarter-on-quarter to approximately VND 1,100 billion, 29% higher than the same period in 2024. Interest expenses alone exceeded VND 800 billion, up 55% year-on-year and nearly double the previous quarter. The cost structure shifted significantly, with interest expenses increasing due to the cessation of capitalization after Phase 1 of Dung Quat 2 became operational.

Conversely, Hoa Phat’s foreign exchange losses decreased significantly compared to previous periods. In the first nine months of the year, the USD appreciated by approximately 900 points against the VND from the end of 2024, peaking in early September before easing slightly following the Fed’s rate cut cycle.

In Q3, Hoa Phat recorded realized foreign exchange gains and losses of VND 252 billion and VND 216 billion, respectively, from foreign currency transactions. Unrealized foreign exchange losses amounted to nearly VND 44 billion from the revaluation of foreign currency-denominated assets. The overall impact of exchange rate fluctuations in Q3 improved significantly compared to the same period in 2024, resulting in a loss of only VND 7.5 billion.

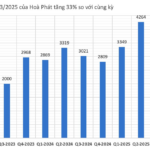

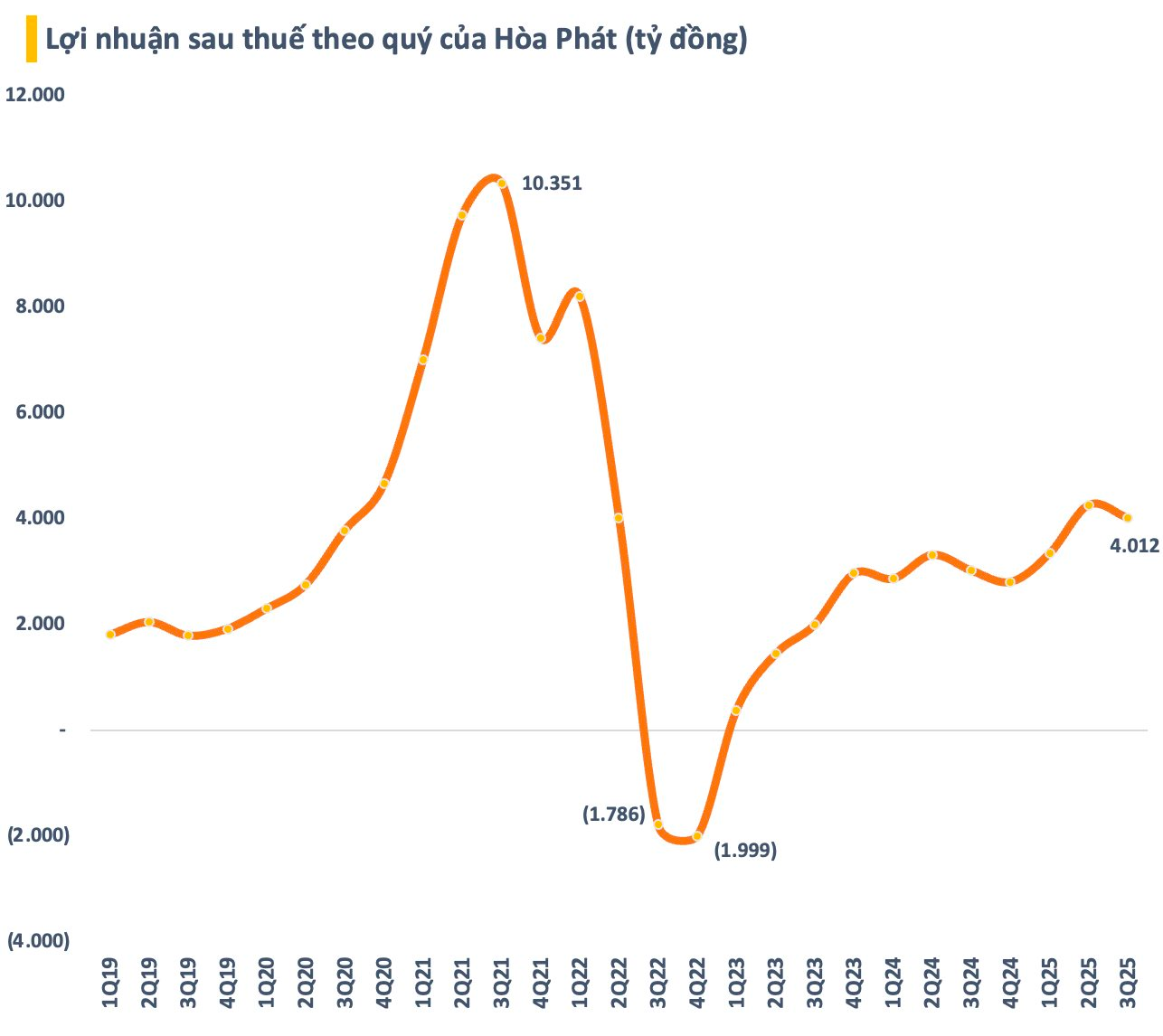

For Q3, Hoa Phat reported VND 36,794 billion in revenue and VND 4,012 billion in post-tax profit, up 7% and 33% year-on-year, respectively. During the quarter, the group produced 2.8 million tons of crude steel, a 14% increase from the previous quarter and 35% higher than the same period in 2024. Sales volume of hot-rolled coil (HRC), construction steel, high-quality steel, and billet reached 2.5 million tons, down 4% quarter-on-quarter but 21% higher year-on-year.

For the first nine months, Hoa Phat achieved VND 111,031 billion in revenue, a 5% increase, and VND 11,626 billion in post-tax profit, up 26% year-on-year. With these results, billionaire Tran Dinh Long’s steel company has fulfilled 65% of its annual revenue target (VND 170,000 billion) and 78% of its post-tax profit goal (VND 15,000 billion).

In Q3/2025, Phase 1 of the Hoa Phat Dung Quat 2 project completed testing and commenced operations. Thanks to this project, total HRC sales volume reached 3.4 million tons in the first nine months, a 51% increase year-on-year, with Q3 sales alone reaching 1.26 million tons, up 71% from the previous year.

Furthermore, since July 2025, the Vietnamese government has imposed anti-dumping duties on HRC imports from China, significantly improving the domestic competitive landscape. As a result, Hoa Phat not only accelerated domestic sales but also solidified its leading position in Vietnam’s hot-rolled coil market.

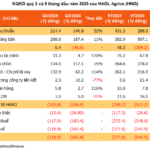

HAGL Agrico Reports Hundreds of Billions in Losses Despite Strong Rubber and Fruit Sales

Despite a resurgence in gross profit and a significant increase in revenue from rubber latex and fruit sales, billionaire Trần Bá Dương’s agricultural company has reported its 18th consecutive quarterly net loss. This persistent deficit is primarily attributed to escalating financial expenses, which continue to erode the company’s overall performance.

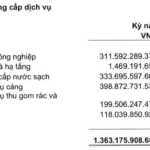

Sonadezi Surpasses Annual Plan with Over $1 Billion Profit in 9 Months

Following a record-breaking second quarter, Sonadezi’s net profit continued its upward trajectory in Q3 2025, driven by steady growth in port services, clean water, and improved gross margin. The company has already surpassed its full-year profit target after just three quarters.

Vietnamese-Made Containers by Hoa Phat Debut at World Expo, Securing Deals with US and European Partners On-Site

Hòa Phát proudly presents its container solutions, branded as “Made in Vietnam – Made for the World,” alongside a range of in-house produced auxiliary materials, including flooring panels and cast corners. These critical components significantly enhance localization rates and reduce reliance on imported supplies.

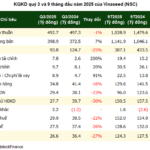

Vinaseed’s Gross Profit Hits Historic Low as Inventory Surges Past 1 Trillion VND

Amidst seasonal fluctuations and escalating financial costs, Vinaseed Group (HOSE: NSC) reported its weakest quarterly performance since 2020, with gross profit margins plummeting to a record low of 19%. Simultaneously, inventory levels surged past the 1,000 billion VND mark, exacerbating the company’s financial challenges.