Quoc Cuong Gia Lai Joint Stock Company (symbol QCG, HoSE exchange) has announced its consolidated financial report for Q4/2023, with net revenue of nearly 155 billion VND, a decrease of 60% compared to the same period in 2022. After deducting the cost of goods sold, QCG achieved a gross profit of nearly 40 billion VND, an increase of 15% compared to the same period.

In terms of revenue structure, the real estate segment contributed the most with 71 billion VND, nearly 3.7 times higher. Electricity sales revenue remained almost flat, reaching 52 billion VND.

While business management expenses increased by more than 3 billion VND, the company received a refund of more than 400 million VND in sales expenses. At the same time, interest expenses were halved and QCG recorded a profit of 3.2 billion VND from its affiliated company.

As a result, Nguyen Thi Nhu Loan’s company reported a net profit of 13.7 billion VND in Q4/2023, a significant improvement compared to a loss of 9.7 billion VND in the same period.

The Q4/2023 profit made a significant contribution to the company’s net profit of 10.2 billion VND for the year 2023, a decrease of 68% compared to the previous year. Additionally, the revenue in 2023 also plummeted by a steep 3 times to only 432 billion VND.

By the end of December 2023, QCG’s total assets slightly decreased to 9,585 billion VND. After one year, the company’s cash balance sharply decreased to just over 28 billion VND, and no short-term financial investments were recognized.

Inventory reached 7,036 billion VND, accounting for 73% of total assets, a slight decrease compared to the beginning of the year. Of this, more than 6,531 billion VND is accounted for by compensation expenses, land use fees, and related project implementation costs.

Short-term receivables decreased by 15% to 442 billion VND. Out of nearly 159 billion VND of long-term receivables, QCG recorded an investment of 91.5 billion VND in the Tan Phong project in District 7, Ho Chi Minh City, and more than 67 billion VND investment in the Phuoc Kien residential project.

On the other side of the balance sheet, QCG recorded total liabilities of 5,236 billion VND, a decrease of nearly 7% compared to the beginning of the year. Of this, 4,292 billion VND is accounted for by other short-term liabilities, including 2,883 billion VND received from Sunny for the Phuoc Kien project, with the remainder being other projects.

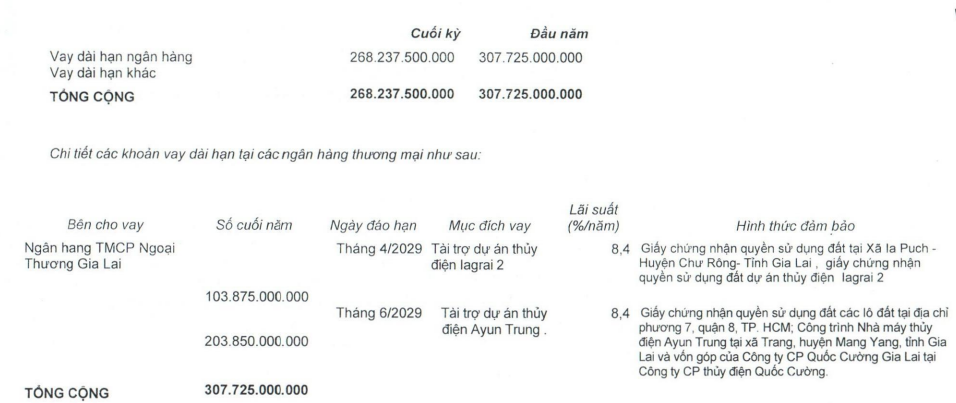

QCG’s long-term bank loans. Source: QCG

In terms of financial loans, QCG currently has over 300 billion VND of short-term debt and 268 billion VND of long-term debt. Of this, QCG has two loans worth 307 billion VND at Vietcombank, secured by two plots of land for building hydroelectric plants in Gia Lai.