Globally, the reversal of globalization, sluggish economic growth, and ongoing geopolitical conflicts have disrupted global supply chains. Raw material prices fluctuate unpredictably, defying conventional patterns, while rising trade protectionism and stringent technical and tariff barriers from major markets, particularly the U.S., have intensified export pressures.

Domestically, steel consumption shows positive recovery signs, driven by increased public investment, infrastructure development, and a rebounding real estate market. However, the steel industry faces fierce competition due to excess production capacity within the country.

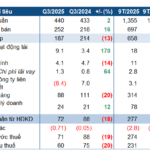

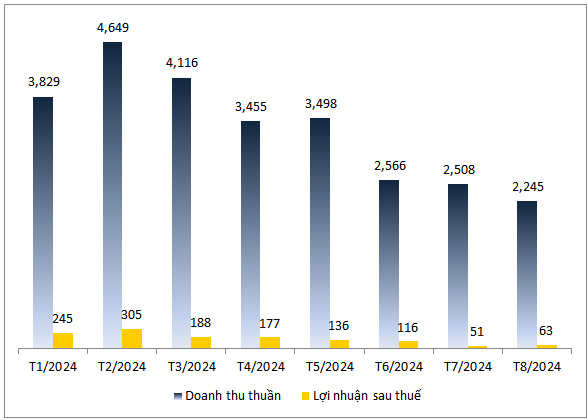

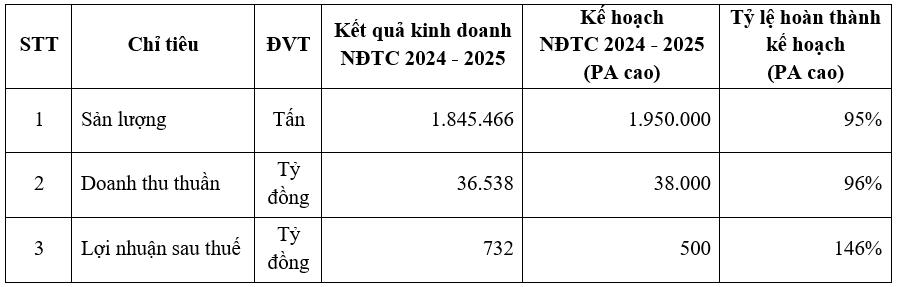

By closely monitoring market dynamics, proactively adapting to fluctuations, and implementing comprehensive strategies, Hoa Sen Group Joint Stock Company (HOSE: HSG) maximized opportunities to boost production and business efficiency. At the close of the 2024-2025 fiscal year (October 1, 2024 – September 30, 2025), HSG reported robust financial health, with a bank debt-to-equity ratio of just 0.39. The company’s performance highlights included consolidated output of 1,845,466 tons (95% of target), consolidated revenue of VND 36,538 billion (96% of target), and consolidated after-tax profit of VND 732 billion (146% of the high-scenario profit plan).

Consolidated Business Results of HSG for FY 2024-2025

Recently, Hoa Sen Group was honored by Forbes in the Top 50 Best Listed Companies in Vietnam for 2025. The Ho Chi Minh City Stock Exchange (HOSE) included HSG’s stock in the VN50 Growth Index, which tracks the performance of the 50 largest-cap companies on HOSE with strong business growth potential. The index will officially launch on November 3, 2025. This recognition underscores HSG’s stable growth, sustainable operations, and the appeal of its stock in the securities market.

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability, Dividends, and Bonus Shares Up to 30%

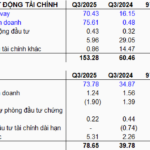

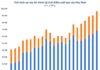

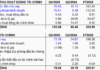

HDBank (HOSE: HDB) has reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% year-on-year growth. The bank continues to lead the industry in profitability metrics, boasting an impressive ROE of 25.2% and ROA of 2.1%, underscoring its operational efficiency and robust financial foundation.

Upcoming Dividend Payment: Thien Long Group to Issue Nearly 8.8 Million Shares for 2024 Dividends

Heavenly Dragon Group plans to issue nearly 8.8 million dividend shares for 2024, with a rights ratio of 10:1, scheduled for execution in Q4/2025.