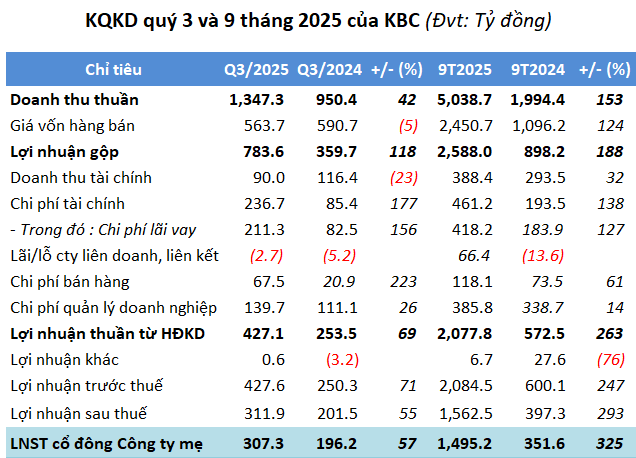

The Q3/2025 financial report of Kinh Bac Urban Development Shareholding Corporation (HOSE: KBC) reveals a remarkable performance, with net revenue surpassing 1.347 trillion VND and net profit exceeding 307 billion VND, marking a 42% and 57% increase year-on-year, respectively.

KBC attributes this growth primarily to the surge in revenue from industrial zones (IZs), real estate transfers, and factory sales compared to the same period last year.

Source: VietstockFinance

|

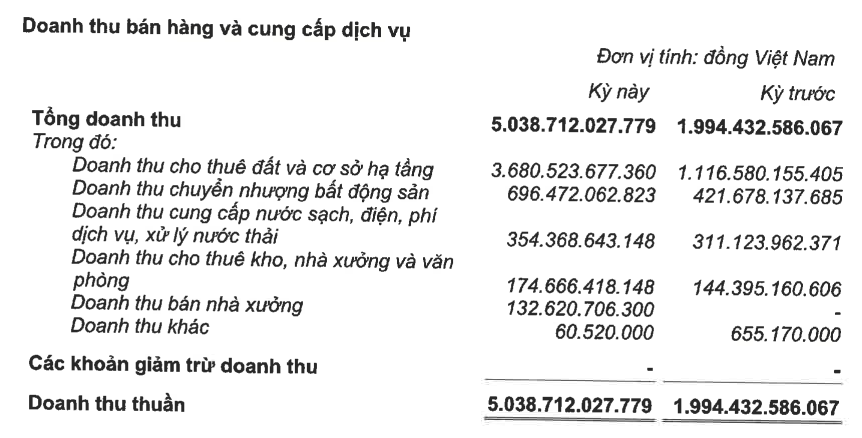

In the first nine months, cumulative net revenue reached nearly 5.039 trillion VND, and after-tax profit hit approximately 1.563 trillion VND, 2.5 and 3.9 times higher than the same period last year. This growth is driven by land leasing and IZ infrastructure services, generating over 3.680 trillion VND, a 3.3-fold increase; real estate transfers contributing more than 696 billion VND, up 65%; and factory sales adding nearly 133 billion VND.

|

Revenue Structure of KBC in 9M/2025

Source: KBC

|

For 2025, KBC aims for consolidated revenue of 10,000 billion VND and after-tax profit of 3,200 billion VND, 3 and 7 times higher than 2024’s results. After three quarters, the company has achieved 54% and 49% of these targets, respectively.

According to DSC Securities Corporation (HOSE: DSC), KBC plans to hand over 83 hectares in Nam Son – Hap Linh IZ and approximately 13 hectares in Tan Phu Trung IZ this year. Additionally, the company will continue developing IZs with completed investment policies (including Trang Due 3, Kim Thanh 2, and 4 others), expanding its leasable land fund to 3,000 hectares. DSC estimates KBC will lease an additional 130 hectares in 2025.

Financial Debt Surpasses 1 Billion USD

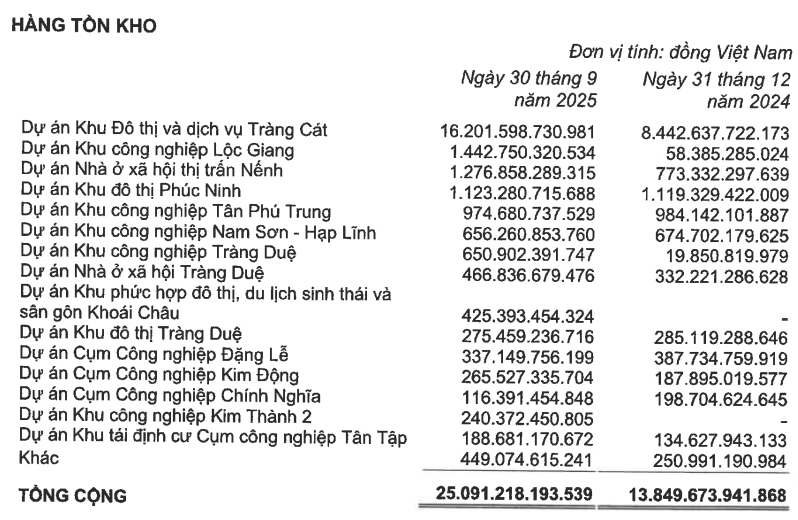

As of September 30, Kinh Bac’s total assets reached nearly 66.6 trillion VND, a 49% increase from the beginning of the year. Cash and cash equivalents rose by 43% to over 9.4 trillion VND. Inventory also surged by 81% to nearly 25.1 trillion VND, driven by the Trang Cat urban and service project, which increased by 92% to over 16.2 trillion VND, and Loc Giang IZ, which grew nearly 25-fold to over 1.4 trillion VND.

Source: KBC

|

Notably, KBC invested over 721 billion VND to acquire a 37.47% stake in Sai Gon – Hue Investment Corporation, the developer of the Sai Gon – Chan May IZ and duty-free zone, spanning nearly 322 hectares within the Chan May – Lang Co Economic Zone in Hue City. The total investment exceeds 100 million USD.

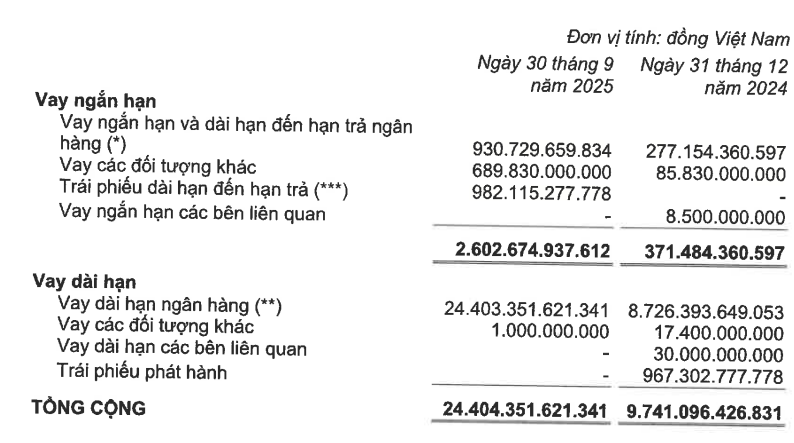

Total liabilities increased sharply by 68% to nearly 40.5 trillion VND. Financial debt alone reached 27 trillion VND (over 1 billion USD), primarily long-term bank loans, 2.7 times higher than the beginning of the year and accounting for 67% of total debt. Unearned revenue and customer deposits also rose by 86% to nearly 1.5 trillion VND, representing 4% of total debt.

Kinh Bac has consistently increased its debt since the start of 2025, primarily to fund the Trang Cat project and accelerate the construction of other developments.

Source: KBC

|

– 17:35 30/10/2025

Quy Nhơn Iconic Drives PDR’s Q3 Net Profit Up 67%

Despite the absence of investment liquidation proceeds compared to the same period last year, Phat Dat Real Estate Development Corporation (HOSE: PDR) reported a rise in net profit for Q3/2025, driven by a significant surge in net revenue.

“Proposed Tax Rate of 20% on Taxable Property Income”

The proposed introduction of a 20% tax rate on taxable real estate income has not been implemented. Instead, the current practice of levying a 2% tax on transaction values remains in place.