|

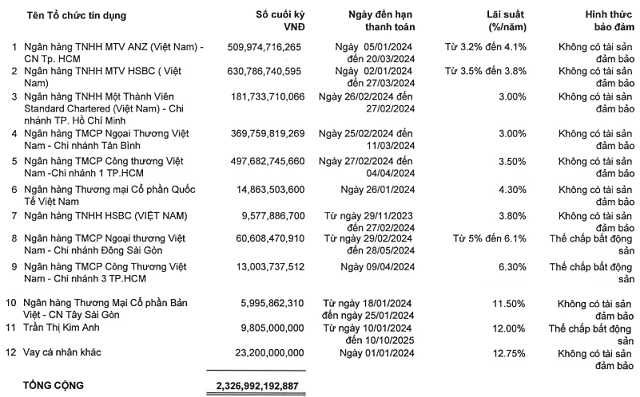

In Q3/2025, Nafoods recorded a revenue of nearly VND 628 billion, a 75% increase compared to the same period last year. Net profit reached VND 44 billion, up 56%. For the first nine months, revenue totaled nearly VND 1,658 billion, and net profit exceeded VND 115 billion, marking a 49% and 25% rise, respectively. These results signify that the company has achieved 84-85% of its annual revenue and profit targets.

This nine-month performance stands as the most successful in Nafoods’ history, with profits nearly matching the record set in 2024 (VND 116 billion) and surpassing all previous years.

| Nafoods’ Business Results from 2013 to 9M2025 |

In tandem with these robust business results, NAF shares on the HOSE have been on an upward trajectory, consistently reaching new highs. As of October 30th, the share price surged to nearly VND 35,000, an all-time high, reflecting a 16% increase over the past month and an 86% rise year-over-year. Since the accumulation phase in late 2022, the stock price has multiplied sevenfold. Average daily trading volume for the year stands at approximately 460,000 shares.

| NAF Share Price Performance Over the Past Year |

Financial Revenue and Exchange Rates Contribute Positively

Alongside improved core operations, Nafoods’ financial revenue in Q3 increased by 39% to over VND 12 billion, bringing the nine-month total to VND 31 billion, a 35% year-on-year increase. Over 60% of this revenue stems from realized exchange rate gains.

However, business expansion has led to higher costs, though still manageable. Nine-month financial expenses exceeded VND 60 billion, up 20%, with interest expenses accounting for over VND 50 billion. Administrative expenses also rose by 20% to VND 118 billion, primarily driven by management personnel costs (nearly VND 51 billion, 43%) and amortization of trade advantages (VND 31 billion, 26%). Conversely, selling expenses decreased slightly by 8% to under VND 93 billion, largely due to reduced external service costs.

Increased Deposits and Completion of IFC Preferred Share Buyback

As of September 2025, Nafoods held over VND 211 billion in bank deposits, a 41% increase from the beginning of the year. Notably, the company recorded a new receivable of nearly VND 131 billion related to the buyback of preferred shares from the International Finance Corporation (IFC).

According to the Board of Directors’ resolution dated August 19, 2025, Nafoods repurchased nearly 4.2 million preferred shares from the third issuance and completed payment to IFC, totaling nearly VND 131 billion. The company is currently finalizing the associated legal procedures.

Nafoods also maintains a provision of nearly VND 130 billion for overdue receivables, consistent with the beginning of the year, with the largest portion being nearly VND 77 billion from Profi Line Plus LLC.

Leverage Increases, International Capital Boosts Support

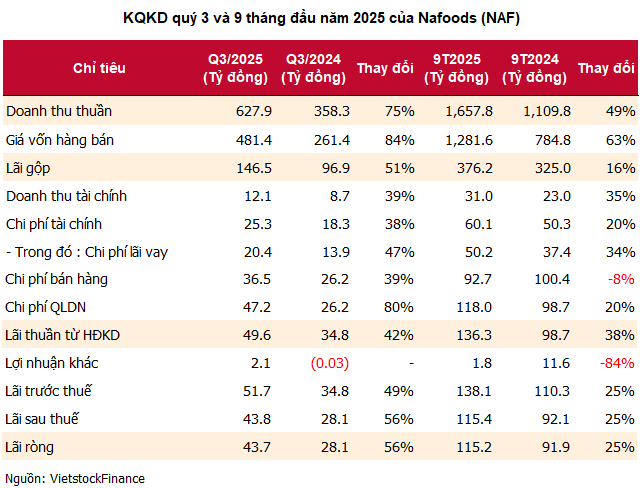

Inventory at the end of the quarter rose by 26% to nearly VND 268 billion, primarily consisting of finished goods (VND 225.5 billion, 84%). Total debt reached over VND 1,324 billion, a 56% increase year-to-date, with short-term debt accounting for 78% (over VND 1,029 billion).

In mid-August 2025, Nafoods signed a USD 20 million financing agreement with the Dutch Entrepreneurial Development Bank (FMO), 51% owned by the Dutch government. This funding is allocated as follows: USD 12.5 million for deep processing capacity expansion, USD 2.5 million for ESG programs and climate change adaptation, and USD 5 million for long-term working capital, aimed at advancing green and digital agriculture.

– 14:43 30/10/2025

GEG Reports Q3 Profit of VND 75 Billion, Attributing to Electricity Price Lock-In; 9-Month Net Profit Surges 7x Year-on-Year

With the official electricity prices set for the Tan Phu Dong 1 (TPD1) wind power plant and the A7 turbine of the VPL Wind Power Plant, Gia Lai Electricity Joint Stock Company (HOSE: GEG) reported a remarkable third-quarter performance compared to the same period last year, which saw losses. This has painted a bright cumulative picture for the company.

Phong Phú Reports 30% Surge in Q3 Profits, Driven by Improved Performance of Affiliated Companies

In Q3/2025, Phong Phu Corporation (UPCoM: PPH) reported a net profit of over 93 billion VND, marking a 30% increase. This growth was driven by reduced production costs and significant earnings from affiliated companies. After nine months, the company has achieved nearly 90% of its annual profit target.